HMOs Alive and Well in Orange County

Community Report No. 9

Summer 2003

Aaron Katz, Robert E. Hurley, Leslie Jackson Conwell, Bradley C. Strunk, Andrea Staiti, J. Lee Hargraves, Robert A. Berenson, Linda R. Brewster

![]() n March 2003, a team of researchers visited Orange County to study that community’s

health system, how it is changing and the effects of those changes on consumers.

The Center for Studying Health System Change (HSC), as part of the Community

Tracking Study, interviewed more than 110 leaders in the health care market.

Orange County is one of 12 communities tracked by HSC every two years through

site visits and every three years through surveys. Individual community reports

are published for each round of site visits. The first three site visits to

Orange County, in 1996, 1998 and 2001, provided baseline and initial trend information

against which changes are tracked. The Orange County market encompasses an area

of about 30 cities south of Los Angeles.

n March 2003, a team of researchers visited Orange County to study that community’s

health system, how it is changing and the effects of those changes on consumers.

The Center for Studying Health System Change (HSC), as part of the Community

Tracking Study, interviewed more than 110 leaders in the health care market.

Orange County is one of 12 communities tracked by HSC every two years through

site visits and every three years through surveys. Individual community reports

are published for each round of site visits. The first three site visits to

Orange County, in 1996, 1998 and 2001, provided baseline and initial trend information

against which changes are tracked. The Orange County market encompasses an area

of about 30 cities south of Los Angeles.

Bucking a national retreat from tightly managed care, Orange County continues to have extensive enrollment in health maintenance organizations (HMOs) that delegate financial risk for patients’ care to large medical groups. After surviving provider-network instability that threatened the market from 1996 to 2001, medical groups have grown stronger financially with the cooperation of health plans. Public insurance program expansions and grants from tobacco revenues have improved access for low-income residents and strengthened the safety net, but severe state budget woes threaten this progress.

Other important developments include:

- Health plans are exploring innovations in product design and quality improvement, such as tiered-provider networks and financial incentives for medical groups to improve quality.

- Hospitals’ financial health has improved, but they now face sharply rising operating costs and strained capacity.

- Fast-rising HMO premiums and a sluggish economy have led employers to shift more costs to workers and could increase interest in insurance products that accommodate more patient cost sharing, such as preferred provider organizations (PPOs).

- Plans and Physician Groups Revive HMO Model

- Now Stronger, Hospitals Face New Pressures

- Premium Hikes, Slow Economy Could Drive Change

- Access and Safety Net Make Modest Gains

- Issues to Track

- CalOPTIMA’s Initiative Draws Mostly Praise

- Orange County Consumers’ Access to Care, 2001

- Background and Observations

Plans and Physician Groups Revive HMO Model

![]() MO enrollment in Orange County remains strong, capturing more than 50 percent

of the private insurance market, as HMO premiums remain lower than those of

other options. Two years ago, many local observers expected less restrictive

insurance products to emerge, reflecting both the national trend away from tightly

managed products and the shaky financial footing of Orange County physician

organizations. Medical groups—ranging from the 900-physician Monarch independent

practice association (IPA) to Bristol Park Medical Group, now with fewer than

100 physicians—are central to the local delegated-HMO model in which health

plans largely delegate financial risk and care management activities to contracting

physician groups. A key feature of the delegated model is health plans’

use of fixed per-member, per-month payments, or capitation, which since the

mid-1980s has encouraged medical groups to invest in the financial and care

management systems needed to manage risk.

MO enrollment in Orange County remains strong, capturing more than 50 percent

of the private insurance market, as HMO premiums remain lower than those of

other options. Two years ago, many local observers expected less restrictive

insurance products to emerge, reflecting both the national trend away from tightly

managed products and the shaky financial footing of Orange County physician

organizations. Medical groups—ranging from the 900-physician Monarch independent

practice association (IPA) to Bristol Park Medical Group, now with fewer than

100 physicians—are central to the local delegated-HMO model in which health

plans largely delegate financial risk and care management activities to contracting

physician groups. A key feature of the delegated model is health plans’

use of fixed per-member, per-month payments, or capitation, which since the

mid-1980s has encouraged medical groups to invest in the financial and care

management systems needed to manage risk.

In the late 1990s, flat payments from health plans—whose own premiums were rising slowly—and the financial collapse of national, physician practice management companies (PPMCs) threatened both the solvency of risk-bearing medical groups and the delegated-HMO model, itself. Between 1998 and 2000, several PPMCs declared bankruptcy, marking the end of a short-lived experiment that sought to organize physicians into very large networks to streamline practice management and negotiate with health plans. These failures disrupted patient care, threatened the viability of physician practices owned by the PPMCs and encouraged new state regulation of the finances of medical groups that accept risk from health plans.

The resurgence of HMO products in Orange County is due in large part to newfound stability among risk-bearing medical groups, which was no accident. Recognizing that the future of their HMO business depended on the medical groups, health plans increased payment rates—as much as 10 percent annually in recent years—and provided additional management support. Medical groups also improved their financial positions by focusing on managing risk for physicians’ fees and identifying and declining risk they believe is difficult to control—initially, prescription drug costs and, more recently, infusion therapy and injectable medications, including immunizations whose costs are unpredictable. In turn, the recovery of most risk-bearing medical groups in Orange County has helped to reduce contracting tensions between plans and physicians.

Continued support for delegating financial and care management responsibilities to physician groups, along with low HMO premiums compared to other insurance products, has slowed interest in and growth of PPOs. For example, both PacifiCare and Health Net have developed PPO products, but local enrollment in them remains low. Even Blue Cross of California, which dominates the California PPO market, continues to see HMO growth in Orange County. And neither purchasers nor health plans have shown much interest in consumer-driven benefit options, such as high-deductible products.

The delegated-HMO model also has fostered innovations in the Orange County market, such as increased use of hospitalists—general internists who specialize in inpatient care—and health plan-medical group efforts to create payment systems that reward better quality of care. Since they are at financial risk for HMO patients, large Orange County medical groups have moved to employ or contract with hospitalists, because they are potentially more efficient at providing care to hospitalized patients. Hospitalists were largely unknown in Orange County four years ago, but the rekindled commitment to physician risk contracting aligned the financial incentives of medical groups with the skills of this new type of medical specialist.More than half of the hospitalized patients in some plans are under the care of hospitalists at any given time.

Working with physician groups, health plans have been exploring payment systems to promote better medical care. PacifiCare’s Quality Index program is a prototype of such a program, in which consumers receive data to compare medical groups, and a group’s ratings are based on customer satisfaction, quality improvement indicators and adoption of certain information technologies. As part of the Pay for Performance initiative of the California-based Integrated Healthcare Association, plans and medical groups are collaborating on a uniform set of measures that each health plan would use for incentive payments. Support for this effort has been strong, and health plans contend they will put enough money at risk to make the incentives meaningful. The payment systems are being launched during 2003, with incentive payments, in the case of PacifiCare, beginning as early as summer 2003.

Now Stronger, Hospitals Face New Pressures

![]() he relative stability of the Orange County market also

reflects a strengthened hospital sector. Like physician groups, most hospitals

have obtained higher payment rates from health plans, but unlike physicians,

hospitals have mostly shed risk contracts, except where they are clearly advantageous,

such as in some Medicare+Choice plans. In contrast to medical groups, hospitals

have not viewed population health management as a core competency and, therefore,

have never developed the necessary skills or systems. This divergence between

physicians and hospitals was evident in the September 2001 ending of an affiliation

between Bristol Park Medical Group and St. Joseph Health System. Among other

management and organizational differences, the medical group wanted the hospital

system to aggressively capture capitated lives, but, instead, the hospital system

cut back on risk contracts.

he relative stability of the Orange County market also

reflects a strengthened hospital sector. Like physician groups, most hospitals

have obtained higher payment rates from health plans, but unlike physicians,

hospitals have mostly shed risk contracts, except where they are clearly advantageous,

such as in some Medicare+Choice plans. In contrast to medical groups, hospitals

have not viewed population health management as a core competency and, therefore,

have never developed the necessary skills or systems. This divergence between

physicians and hospitals was evident in the September 2001 ending of an affiliation

between Bristol Park Medical Group and St. Joseph Health System. Among other

management and organizational differences, the medical group wanted the hospital

system to aggressively capture capitated lives, but, instead, the hospital system

cut back on risk contracts.

The interests of physician specialists and hospitals do appear to be converging, however, especially in promoting specialized services. These services, such as outpatient surgery, are easier to develop and sustain with fee-for-service payments rather than capitated payments controlled by primary care-dominated medical groups and IPAs. Although some specialists have shown interest in developing their own ambulatory surgical facilities, hospitals mostly have succeeded in gaining specialists’ support for developing or expanding hospital-owned programs targeting special patient populations, such as those with cancer and women’s health issues.

Hospitals’ ability to exit risk contracts and obtain more favorable payment rates comes in part from higher occupancy rates and the greater contracting leverage those bring. Also, unlike a few years ago, most hospitals are negotiating as multihospital systems that serve many parts of the county. Because health plans need broad geographic access for their enrollees, this strategy helps all hospitals within such systems to gain negotiating leverage. Hospitals no longer think they have to accept what they view as inadequate payment rates from health plans, and health plans, having obtained higher premiums, are willing in most cases to increase hospital payments to maintain network stability and access. This accommodation is a legacy of the St. Joseph system decision to terminate its HMO contract with PacifiCare in 2001. St. Joseph was able to retain most, but not all, of its patients as they switched enrollment from PacifiCare to other health plans, which sent a powerful message to both sides about the consequences of contract showdowns.

With health plan relations on a more even keel, hospitals have turned to a number of daunting operational challenges. Capacity constraints brought on by both a lack of available beds and an ongoing nursing shortage have hit most Orange County hospitals, especially in the affluent southern and Newport Beach areas. Diversion of patients from emergency departments is a common occurrence, and scheduling elective surgery can reportedly entail lengthy delays in some cases. In response, hospitals have embarked on major construction projects. For example, Tenet’s Fountain Valley Regional Medical Center is spending $76 million on a 156-bed patient tower, while the University of California-Irvine (UCI) Medical Center plans to construct a $370 million replacement hospital that will increase its bed capacity from 383 to 407. California’s seismic retrofitting standards, with deadlines in 2013 and 2030, also are driving large capital investments.

Orange County hospitals, like those in many other parts of the country, have faced a shortage of nurses for at least three years. Competition for nurses among hospitals has been fierce, with reports of signing bonuses and car allowances not uncommon. One hospital system reported staff nurse salaries approaching $80,000. The effects of the nursing shortage may be aggravated by a state-mandated nurse-staffing ratio of six patients to one nurse that takes effect Jan.1, 2004.

Premium Hikes, Slow Economy Could Drive Change

![]() MO premiums in Orange County have

increased at percentage rates in the mid-teens,

a rate of growth that some purchasers

reported is higher than for PPOs. Fast-rising

premiums are the price of the network

stability achieved in this market by funding

higher provider payments. In most other

markets, rising premiums, combined with

a sluggish economy, have led employers to

seek lower-cost insurance products than

HMOs with their comprehensive benefits

and low cost-sharing provisions. Although

this shift has not occurred in Orange County,

health plans anticipate that HMO price

increases eventually will drive purchasers

to seek alternative designs. As a result, and

despite a lack of employer interest, plans

continue to develop PPOs, which offer more

flexibility than HMOs to reduce purchaser

outlays by increasing patient cost sharing.

Even Kaiser Foundation Health Plan, whose

stock-in-trade has been a comprehensive

benefit and strictly limited provider network,

is exploring the feasibility of launching

such an alternative product.

MO premiums in Orange County have

increased at percentage rates in the mid-teens,

a rate of growth that some purchasers

reported is higher than for PPOs. Fast-rising

premiums are the price of the network

stability achieved in this market by funding

higher provider payments. In most other

markets, rising premiums, combined with

a sluggish economy, have led employers to

seek lower-cost insurance products than

HMOs with their comprehensive benefits

and low cost-sharing provisions. Although

this shift has not occurred in Orange County,

health plans anticipate that HMO price

increases eventually will drive purchasers

to seek alternative designs. As a result, and

despite a lack of employer interest, plans

continue to develop PPOs, which offer more

flexibility than HMOs to reduce purchaser

outlays by increasing patient cost sharing.

Even Kaiser Foundation Health Plan, whose

stock-in-trade has been a comprehensive

benefit and strictly limited provider network,

is exploring the feasibility of launching

such an alternative product.

In the meantime, health plans also have experimented with new provider network designs that can be used in their HMOs. Three of the area’s six largest health plans have launched some variation of tiered-networks—another plan has done so for a PPO—in which consumers pay more out of pocket to see higher-cost providers in the plans’ networks. For example, Blue Shield of California classified contracted hospitals as either choice (preferred) or affiliated (nonpreferred) based on prices, with enrollees facing higher copayments if they choose nonpreferred hospitals—$100 to $300 more per hospital day for HMO enrollees and about 10 percent higher coinsurance for PPO enrollees. The plans’ approach is partially an attempt to gain leverage to counter hospitals’ demands for higher payment rates. Hospitals initially resisted tiered networks when hospital prices were the exclusive basis of the tiers; in response, Blue Shield has now incorporated 14 quality measures into its tiering criteria and will take into account the illness severity of a hospital’s patient population. Other plans are considering similar approaches. The effect of tiered networks on providers and consumers remains to be seen, as plans are approaching this innovation cautiously. For example, at this point, Blue Shield includes all Orange County hospitals in its preferred choice tier.

The public sector is innovating as well in response to cost and revenue challenges. In particular, the Medi-Cal managed care program in Orange County is aggressively pursuing care management strategies targeting both high-cost patients and high-cost providers (see box on page 5).

Access and Safety Net Make Modest Gains

![]() hrough 2002, the health care safety net in

Orange County modestly improved access

to primary care due to an infusion of new

funding and eligibility and enrollment

expansions in Medi-Cal and Healthy

Families, the State Children’s Health

Insurance Program (SCHIP). The new

funding helped to bolster overall community

clinic capacity and expand specific services;

however, advocates expressed growing

concern that access would erode as the

state faced large budget deficits and the

economy continued to sputter.

hrough 2002, the health care safety net in

Orange County modestly improved access

to primary care due to an infusion of new

funding and eligibility and enrollment

expansions in Medi-Cal and Healthy

Families, the State Children’s Health

Insurance Program (SCHIP). The new

funding helped to bolster overall community

clinic capacity and expand specific services;

however, advocates expressed growing

concern that access would erode as the

state faced large budget deficits and the

economy continued to sputter.

Between 2000 and 2002, California aggressively expanded enrollment in Medi-Cal and Healthy Families. The state paid application assisters $50 per new application, and CalOPTIMA coordinated many outreach initiatives through subcontracts with local organizations. The state also expanded eligibility for some low-income residents—for example, earmarking $52 million from the state’s tobacco settlement to expand Healthy Families eligibility in 2001 from 201 percent to 250 percent of the federal poverty level. At the same time, Orange County voters dedicated considerable new tobacco settlement and tobacco tax revenues to the safety net, especially community clinics and emergency department care. During 2001-02, the area’s 19 community clinics used about $3.6 million in new funding to expand days and hours of service, helping to increase the number of people served by the clinics from 110,000 to 130,000. Dental care was targeted specifically. For example,Huntington Beach Community Clinic opened a six-chair dental care center in August 2002, and Laguna Beach Community Clinic started a new five-day-a-week dental program with two chairs and was studying the feasibility of a mobile dental van. Although some of the new funding has helped to build ties across safety net providers, the expectation of some safety net advocates in 2001 that this new funding would greatly strengthen and coalesce the safety net system—by creating strong linkages among organizations—has not yet been realized.

Progress in access and the safety net was threatened by state and local developments in early 2003.Most important, California was grappling with an 18-month state budget shortfall of about $35 billion. Gov. Gray Davis initially proposed $21 billion in budget cuts, including a 29 percent cut to Medi-Cal that would have meant a loss of coverage for about 40,000 Medi-Cal beneficiaries in Orange County, according to one estimate. The governor also sought to cut physician and hospital payment rates by 15 percent, eliminate some optional Medi-Cal benefits and delay expansion of Healthy Families coverage to parents, but he proposed maintaining current coverage expansions for children. Faced with bipartisan opposition from lawmakers, Davis released a new budget proposal in May 2003 that cut fewer health programs, but even that version ran into resistance. In June, Congress passed federal tax cut legislation allocating $20 billion to states, and California Democrats have proposed using the state’s approximately $2.4 billion share to fund health care programs previously slated for cuts. Nonetheless, local advocates fear the state’s budget woes will erase recent gains, especially in community clinic capacity. As of mid-July 2003, the state Legislature had not yet passed a fiscal year 2004 budget.

A second threat to access involved the county-run Medical Services for the Indigent (MSI) program, which pays for inpatient care for uninsured adult county residents. In late 2002, UCI Medical Center, the area’s main safety net hospital, instituted a policy to limit MSI care only to patients who live within five miles of the hospital; nonarea patients were to be referred to clinics closer to their residences. UCI also threatened to end its contract with the county program unless the burden of care was spread more evenly among area hospitals. In response, the Orange County Board of Supervisors restructured the MSI program, adding prior authorization for hospital stays as well as a case management component to refer patients to appropriate care through contracts with groups of hospitalists and specialists. The county also increased the annual MSI allocation to $47 million by adding $2 million to cover prescription drug costs.

Issues to Track

![]() he Orange County health care market has

stabilized over the past two years. Insured

local residents have benefited as contract

negotiations between health plans and

providers, though still contentious, no

longer threaten to unravel provider networks

and disrupt patient care. In addition, the

easing of tensions has allowed plans and

providers to explore care delivery innovations

that could benefit patients by

providing incentives to improve quality.

Health plans and large medical groups

have renewed their mutual interest in the

market’s tightly managed HMO model

and have worked together to strengthen

the medical groups’ financial health. On

the other hand, hospitals and specialists

have moved away from the capitation

environment, finding shared interests in

nonrisk relationships with health plans

and each other.

he Orange County health care market has

stabilized over the past two years. Insured

local residents have benefited as contract

negotiations between health plans and

providers, though still contentious, no

longer threaten to unravel provider networks

and disrupt patient care. In addition, the

easing of tensions has allowed plans and

providers to explore care delivery innovations

that could benefit patients by

providing incentives to improve quality.

Health plans and large medical groups

have renewed their mutual interest in the

market’s tightly managed HMO model

and have worked together to strengthen

the medical groups’ financial health. On

the other hand, hospitals and specialists

have moved away from the capitation

environment, finding shared interests in

nonrisk relationships with health plans

and each other.

In the next few years, the following issues facing this market will be important to track:

- Will the state make significant cuts in Medi-Cal and Healthy Families, and, if so, will such cuts reduce access and undermine the financial viability of provider organizations, not just those in the safety net?

- Will hospitals be able to comply with state-mandated nursing ratios, and with what effect on hospital capacity, patient care and financial bottom lines?

- Will rising premiums spark local purchaser interest in tiered networks such as PPOs or other more flexible product options?

- How will changes in the county’s Medical Services for the Indigent program affect access to inpatient and specialty services for uninsured individuals?

CalOPTIMA’s Initiative Draws Mostly Praise

CalOPTIMA, the quasi-governmental agency that manages the Medi-Cal managed care program in Orange County, has established itself as a leader in promoting public sector coverage and access while developing creative strategies to control the use and costs of services. The agency’s efforts to coordinate outreach efforts were noted as an important reason why the number of Medi-Cal enrollees in Orange County increased from 271,000 in April 2001 to 302,000 in January 2002. But like many payers, CalOPTIMA also has focused considerable energy on slowing steeply rising costs by, for example:

- requiring that provider networks participating in Medi-Cal share the financial risks of rapidly rising prescription drug costs;

- limiting for most members the number of prescriptions to 10 per month and considering dropping the limit to seven; and

- requiring prior authorization for some outlier physicians whose prescription drug costs are significantly higher than their peers’.

The agency has ventured into innovative care management areas as well, such as a wheelchair-fitting clinic, using a physiologist to ensure appropriate matching of patient to chair.

By and large, CalOPTIMA’s aggressive strategies have garnered praise throughout the local market. However, some health plans viewed some requirements as onerous, and Blue Cross of California decided to withdraw from CalOPTIMA, which required about 30,000 Medi-Cal beneficiaries to enroll in a new plan. Though not perceived as a major threat to the program, this change represented the loss of a highly visible, mainstream health plan.

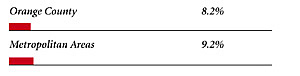

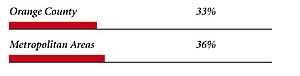

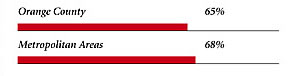

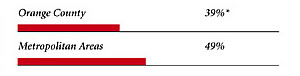

Orange County Consumers’ Access to Care, 2001

Orange County compared to metropolitan areas with over 200,000 population

| Unmet Need |

| PERSONS WHO DID NOT GET NEEDED MEDICAL CARE DURING THE LAST 12 MONTHS |

|

| Delayed Care |

| PERSONS WHO DELAYED GETTING NEEDED MEDICAL CARE DURING THE LAST 12 MONTHS |

|

| Out-of-Pocket Costs |

| PRIVATELY INSURED PEOPLE IN FAMILIES WITH ANNUAL OUT-OF-POCKET COSTS OF $500 OR MORE |

|

| Access to Physicians |

| PHYSICIANS WILLING TO ACCEPT ALL NEW PATIENTS WITH PRIVATE INSURANCE |

|

| PHYSICIANS WILLING TO ACCEPT ALL NEW MEDICARE PATIENTS |

|

| PHYSICIANS WILLING TO ACCEPT ALL NEW MEDICAID PATIENTS |

|

| PHYSICIANS PROVIDING CHARITY CARE |

|

| * Site value is significantly different from the mean for large metropolitan

areas over 200,000 population at p<.05. Source: HSC Community Tracking Study Household and Physician Surveys, 2000-01 Note: If a person reported both an unmet need and delayed care, that person is counted as having an unmet need only. Based on follow-up questions asking for reasons for unmet needs or delayed care, data include only responses where at least one of the reasons was related to the health care system. Responses related only to personal reasons were not considered as unmet need or delayed care. |

Background and Observations

| Orange County Demographics | |

| Orange County | Metropolitan Areas 200,000+ Population |

| Population1 2,890,444 |

|

| Persons Age 65 or Older2 | |

| 9.8% | 11% |

| Median Family Income2 | |

| $37,463 | $31,883 |

| Unemployment Rate3 | |

| 4.1% | 5.8%* |

| Persons Living in Poverty2 | |

| 11% | 12% |

| Persons Without Health Insurance2 | |

| 16% | 13% |

| Age-Adjusted Mortality Rate per 1,000 Population4 | |

| 7.3 | 8.8* |

* National average. Sources: |

|

| Health Care Utilization | |

| Orange County | Metropolitan Areas 200,000+ Population |

| Adjusted Inpatient Admissions per 1,000 Population 1 | |

| 132 | 180 |

| Persons with Any Emergency Room Visit in Past Year 2 | |

| 14% | 19% |

| Persons with Any Doctor Visit in Past Year 2 | |

| 74% | 78% |

| Average Number of Surgeries in Past Year per 100 Persons 2 | |

| 15 | 17 |

| Sources: 1. American Hospital Association, 2000 2. HSC Community Tracking Study Household Survey, 2000-01 |

|

| Health System Characteristics | |

| Orange County | Metropolitan Areas 200,000+ Population |

| Staffed Hospital Beds per 1,000 Population1 | |

| 2.0 | 2.5 |

| Physicians per 1,000 Population2 | |

| 2.0 | 1.9 |

| HMO Penetration, 19993 | |

| 46% | 38% |

| HMO Penetration, 20014 | |

| 44% | 37% |

| Medicare-Adjusted Average per Capita Cost (AAPCC) Rate, 20025 | |

| $640 | $575 |

| Sources: 1. American Hospital Association, 2000 2. Area Resource File, 2002 (includes nonfederal, patient care physicians, except radiologists, pathologists and anesthesiologists) 3. InterStudy Competitive Edge, 10.1 4. InterStudy Competitive Edge, 11.2 5. Centers for Medicare and Medicaid Services. Site estimate is payment rate for largest county in site; national estimate is national per capita spending on Medicare enrollees in Coordinated Care Plans in December 2002. |

|

The Community Tracking Study, the major effort of the Center for Studying Health System Change (HSC), tracks changes in the health system in 60 sites that are representative of the nation. HSC conducts surveys in all 60 communities every three years and site visits in 12 communities every two years. This Community Report series documents the findings from the fourth round of site visits. Analyses based on site visit and survey data from the Community Tracking Study are published by HSC in Issue Briefs, Tracking Reports, Data Bulletins and peer-reviewed journals. These publications are available at www.hschange.org.

Authors of the Orange County Community Report:

Aaron Katz, University of Washington; Robert E. Hurley,

Virginia Commonwealth University; Leslie Jackson Conwell, HSC;

Bradley C. Strunk, HSC; Andrea B. Staiti, HSC; J. Lee Hargraves, HSC;

Robert A. Berenson, AcademyHealth; Linda R. Brewster, HSC

Community Reports are published by HSC:

President: Paul B. Ginsburg

Director of Site Visits: Cara S. Lesser

Editor: The Stein Group

For additional copies or to be added to the mailing list, contact HSC at:

600 Maryland Avenue SW, Suite 550, Washington, DC 20024-2512

Tel: (202) 554-7549 (for publication information)

Tel: (202) 484-5261 (for general HSC information)

Fax: (202) 484-9258

www.hschange.org