Despite Rapid Growth, Retail Clinic Use Remains Modest

HSC Research Brief No. 29

November 2013

Ha T. Tu, Ellyn R. Boukus

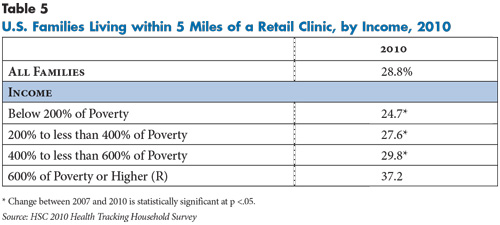

The proportion of American families who reported using a retail clinic in the previous year nearly tripled between 2007 and 2010, increasing from 1 percent of U.S. families in 2007 to 3 percent in 2010, according to a new national study by the Center for Studying Health System Change (HSC). In 2010, an estimated 4.1 million American families reported using retail clinics in the previous 12 months, compared to 1.7 million families in 2007.When asked why they chose retail clinics over other care settings, most clinic users cited convenience factors: extended operating hours, walk-in visits and a convenient location. However, uninsured and low-income families were much more likely to cite lower cost and lack of a usual source of care as reasons for choosing retail clinics. As retail clinics expand across the country, part of the uptick in use reflects consumers’ growing geographic access to clinics. In 2010, for example, nearly three in 10 U.S. families lived within five miles of a clinic—up from 23 percent in 2007. This increasing geographic access was somewhat skewed toward higher-income families. Thirty-seven percent of those with incomes at least six times the poverty level lived near a retail clinic in 2010 compared to 25 percent of those with incomes no more than twice the poverty level—presumably reflecting clinic operators’ decisions to locate in more-affluent communities. Higher-income families were nearly twice as likely as lower-income families to use retail clinics.

Looking forward, with insurance expansions under national health reform expected to pressure primary care capacity in many communities, retail clinics may play a larger role in providing basic preventive and primary care services. Some retail clinics also are expanding their scope to encompass services like chronic condition management. However, it remains unclear whether such strategies will succeed and, more broadly, whether retail clinics will grow beyond their current limited role in the health care delivery system and finally emerge as the widespread “disruptive innovation” that some have long predicted.

- Retail Clinic Use Low but Growing

- Demographic Variations in Retail Clinic Use

- Most Common Clinic Services

- Choosing Clinics over Other Care Settings

- Growing Geographic Access to Retail Clinics

- Expanded Role for Local Hospital Systems

- State Regulation and Retail Clinics

- Implications

- Notes

- Data Source

- Funding Acknowledgement

Retail Clinic Use Low but Growing

![]() etail clinics are walk-in health clinics commonly located inside pharmacies, supermarkets or “big-box” retailers that typically provide basic preventive services, such as vaccinations, and treat simple health ailments, such as strep throat and ear infections. Retail clinics usually offer extended hours on evenings and weekends, employ non-physician clinicians, charge relatively low, set prices for services, and display prices prominently so consumers are aware of the costs before receiving care.

etail clinics are walk-in health clinics commonly located inside pharmacies, supermarkets or “big-box” retailers that typically provide basic preventive services, such as vaccinations, and treat simple health ailments, such as strep throat and ear infections. Retail clinics usually offer extended hours on evenings and weekends, employ non-physician clinicians, charge relatively low, set prices for services, and display prices prominently so consumers are aware of the costs before receiving care.

When retail clinics first began operating in the early 2000s, few accepted health insurance, and most required cash payment upfront from patients. By 2008, the vast majority of clinics were accepting private insurance (97%) and Medicare (93%) and an increasing proportion (60%) were accepting Medicaid.1 For most privately insured patients, out-of-pocket cost sharing for retail clinic visits is usually the same as for primary care office visits; however, some employers encourage retail clinic use by reducing copayments for clinic visits compared with primary care office visits.

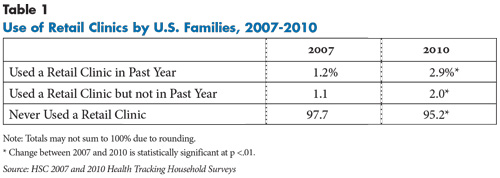

As the number of retail clinics has grown over the past decade, American families’ use of these clinics has increased. In 2010, 5 percent of U.S. families—or nearly 7 million families—reported ever using a retail clinic, and 3 percent—about 4.1 million families—reported doing so in the previous year, according to findings from the nationally representative 2010 HSC Health Tracking Household Survey (see Table 1 and Data Source).

Although the number of families using retail clinics remains modest, estimated use in 2010 nearly tripled from 2007, when only 2 percent of families reported ever using a retail clinic and only 1 percent used a clinic in the previous year. In part, the growth reflects the ever-increasing number of retail clinics across the United States—the count swelled from 818 clinics in 36 states in 2007 to 1,260 in 42 states in 2010.2 In turn, the growing number of clinics reflects operators’ assessments of increasing demand for retail clinic services.

Back to Top

Demographic Variations in Retail Clinic Use

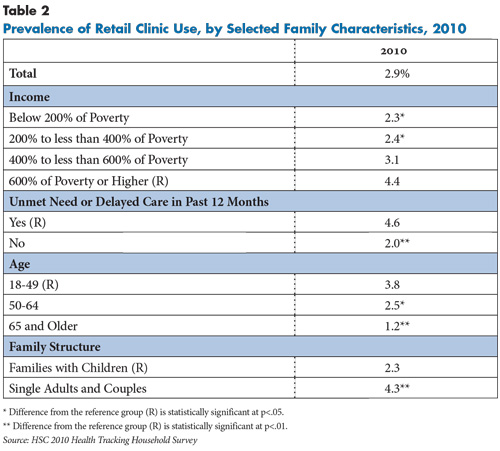

![]() amilies who reported not getting or delaying needed medical care in the past year were more than twice as likely to visit a retail clinic as families without such access problems (4.6% v. 2.0%, see Table 2). Younger families—those with a family respondent aged 18-49—also were more likely than older families to use retail clinics, and families with children were more likely to do so than single adults or childless couples.

amilies who reported not getting or delaying needed medical care in the past year were more than twice as likely to visit a retail clinic as families without such access problems (4.6% v. 2.0%, see Table 2). Younger families—those with a family respondent aged 18-49—also were more likely than older families to use retail clinics, and families with children were more likely to do so than single adults or childless couples.

Family income also was strongly associated with retail clinic use in 2010: Higher-income families—those earning at least 600 percent of the federal poverty level—were nearly twice as likely to have used a retail clinic as families with incomes less than 200 percent of poverty. Previous research suggests that retail clinic companies tend to locate facilities in more-affluent areas,3 so higher use among higher-income families partially reflects their greater geographic access to retail clinics.

In addition, higher-income families are more likely to use primary and preventive health care, even after accounting for differences in health status. Higher-income families also are more likely to have private insurance that covers clinic visits, and even when clinic services are not covered by insurance, paying out of pocket for these services typically does not represent a financial burden to higher-income families. In turn, these are factors likely to influence retail clinic companies’ decisions to locate in affluent areas in the first place.

Beyond these findings, there were no other statistically significant differences in retail clinic use across demographic subgroups.

Back to Top

Most Common Clinic Services

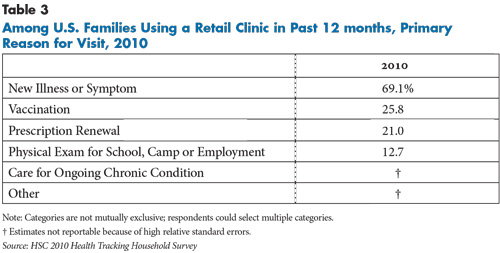

![]() early seven in 10 clinic users reported that the primary purpose of their most recent clinic visit was the diagnosis and treatment of a new illness or symptom (see Table 3).4 Other less common reasons cited by clinic users were vaccinations (26%) and prescription renewals (21%).

early seven in 10 clinic users reported that the primary purpose of their most recent clinic visit was the diagnosis and treatment of a new illness or symptom (see Table 3).4 Other less common reasons cited by clinic users were vaccinations (26%) and prescription renewals (21%).

Although retail clinics historically have focused on providing basic preventive services and treating simple acute ailments, some clinics have expanded the scope of primary care services offered.5 For example, in early 2013, Walgreens’ Healthcare Clinics expanded clinical services to include diagnosis and treatment of common chronic conditions, such as asthma and diabetes.6 However, these developments were too recent to be captured by the 2010 Health Tracking Household Survey, which showed that care for ongoing chronic conditions accounted for only a small share of retail clinic visits.7 Other research also has found that chronic disease care comprises a small proportion of retail clinic visits.8

Back to Top

Choosing Clinics over Other Care Settings

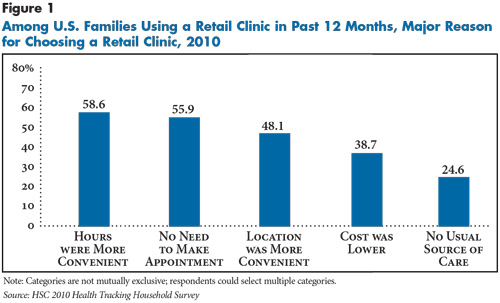

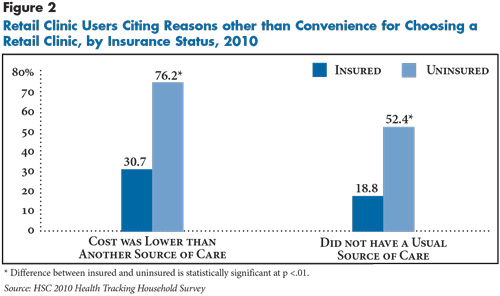

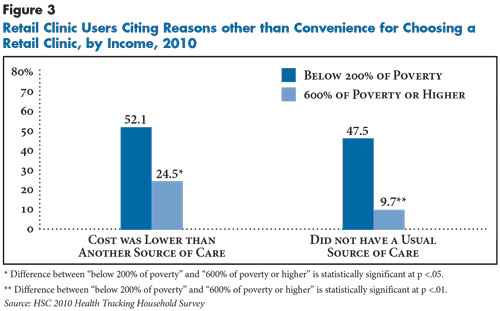

About two in five retail clinic users (39%) cited the low cost of a clinic visit relative to other care settings as a major reason for choosing a retail clinic, while one in four cited not having a usual source of medical care. While cost and lack of a usual source of care were less commonly cited overall than convenience reasons, they factored much more heavily into the decisions of uninsured and low-income families (see Figure 2 and Figure 3). Uninsured families—those with at least one member uninsured—were more than twice as likely as insured families to cite lower cost and almost three times more likely to cite not having a usual source of care as major reasons for choosing retail clinics. Similarly, lower-income families were more likely to cite lower cost and lack of a usual source of care as major factors for choosing retail clinics.

Back to Top

Back to Top

Growing Geographic Access to Retail Clinics

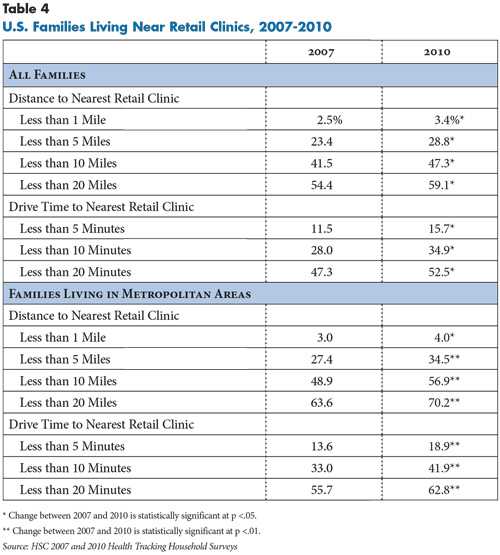

![]() hether defined in terms of mileage distance or approximate drive time, the proportion of families living in reasonable proximity to a retail clinic has increased significantly in recent years (see Table 4). For example, in 2010, 28.8 percent of all families lived within five miles of a clinic, and 47.3 percent lived within 10 miles, up from 23.4 percent and 41.5 percent, respectively, in 2007. Previous research has shown that the vast majority of retail clinics are located in metropolitan areas.9 When the analysis is restricted to metropolitan areas, the estimates of geographic access to retail clinics are considerably higher: 34.5 percent of families in metropolitan areas lived within five miles and 56.9 percent lived within 10 miles of a clinic in 2010.

hether defined in terms of mileage distance or approximate drive time, the proportion of families living in reasonable proximity to a retail clinic has increased significantly in recent years (see Table 4). For example, in 2010, 28.8 percent of all families lived within five miles of a clinic, and 47.3 percent lived within 10 miles, up from 23.4 percent and 41.5 percent, respectively, in 2007. Previous research has shown that the vast majority of retail clinics are located in metropolitan areas.9 When the analysis is restricted to metropolitan areas, the estimates of geographic access to retail clinics are considerably higher: 34.5 percent of families in metropolitan areas lived within five miles and 56.9 percent lived within 10 miles of a clinic in 2010.

Geographic access to retail clinics also increases with income (see Table 5). As noted earlier, this is consistent with previous research showing that clinics tend to locate in higher-income areas, in part to attract—or respond to demand from—a more-affluent patient mix.10

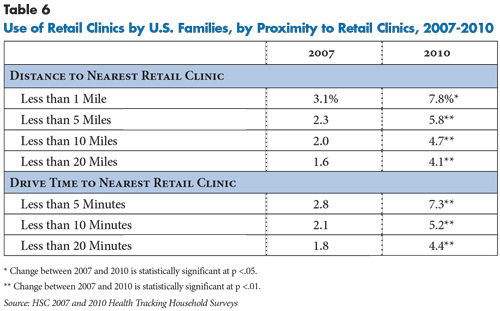

As previously discussed, convenience of a clinic’s location plays a major role in consumers’ decisions about where to seek medical care. Not surprisingly, consumers with greater geographic access to retail clinics are significantly more likely to use them (see Table 6). Yet, for any given measure of geographic proximity, the prevalence of retail clinic use has increased over time. This suggests that the growth in retail clinic use reflects a combination of factors beyond geographic convenience. For example, clinics increasingly accept more forms of insurance payment. Moreover, many local and regional hospital systems have entered the retail clinic market either by owning clinics outright or partnering with retail pharmacies. Consumers who are already familiar with these providers may be more inclined to trust and use their affiliated clinics.

Back to Top

Expanded Role for Local Hospital Systems

![]() he types of retail clinics in operation have changed in recent years, according to a national database of clinics compiled by the consulting firm Merchant Medicine. Between 2007 and 2010, the proportion of investor-owned retail clinics fell from 24 percent to 16 percent. This is consistent with a trend noted by industry experts: Investors impatient for positive returns have divested their stakes in some clinics—a trend exacerbated by the Great Recession, when investors struggled to obtain sufficient capital. As the share of investor-owned retail clinics has fallen, the proportion of clinics owned by hospital systems has doubled (from 9% to 18%). Prominent hospital systems owning and operating clinics include Minnesota-based Mayo Clinic, Pennsylvania-based Geisinger Health System and California-based Sutter Health.

he types of retail clinics in operation have changed in recent years, according to a national database of clinics compiled by the consulting firm Merchant Medicine. Between 2007 and 2010, the proportion of investor-owned retail clinics fell from 24 percent to 16 percent. This is consistent with a trend noted by industry experts: Investors impatient for positive returns have divested their stakes in some clinics—a trend exacerbated by the Great Recession, when investors struggled to obtain sufficient capital. As the share of investor-owned retail clinics has fallen, the proportion of clinics owned by hospital systems has doubled (from 9% to 18%). Prominent hospital systems owning and operating clinics include Minnesota-based Mayo Clinic, Pennsylvania-based Geisinger Health System and California-based Sutter Health.

More common than outright hospital ownership of retail clinics are partnerships between retail pharmacy chains—which own two-thirds of all retail clinics nationwide—and local hospital systems to staff and operate pharmacy-based retail clinics. Among large pharmacies, CVS has most aggressively pursued partnerships with hospital systems. The Cleveland Clinic, the University of California-Los Angeles Health System, San Diego-based Sharp Healthcare and Minneapolis-based Allina Health are among the many prominent hospital systems partnering with the pharmacy giant to run MinuteClinics inside CVS stores. For retail pharmacies like CVS, partnering with a prominent local/regional provider often lends prestige and brand-name recognition to a retail clinic. For hospital systems, operating retail clinics is often viewed as part of a multi-pronged strategy to drive referrals to a system’s facilities.

Back to Top

State Regulation and Retail Clinics

![]() ince many retail clinics are staffed by nurse practitioners (NPs), state scope-of-practice laws can be a factor in retail clinic operations. Seventeen states and the District of Columbia allow NPs to diagnose, treat and prescribe medications to patients without physician involvement, while the remaining states require varying degrees of physician collaboration or oversight.11

ince many retail clinics are staffed by nurse practitioners (NPs), state scope-of-practice laws can be a factor in retail clinic operations. Seventeen states and the District of Columbia allow NPs to diagnose, treat and prescribe medications to patients without physician involvement, while the remaining states require varying degrees of physician collaboration or oversight.11

One might expect that the states allowing NPs the most autonomy would be the states with the greatest retail-clinic penetration, but this is not the case. Of the three states with the most retail clinics per capita in 2010—Tennessee, Nevada and Wisconsin—none were among states that allow the highest degree of NP autonomy. In Tennessee, NPs can diagnose and treat independently but must have physician collaboration or supervision for prescribing. Wisconsin and Nevada ranked among the most restrictive states, requiring physician oversight of all three activities.12 Previous research indicates that while scope-of-practice laws vary widely across states, they tend not to restrict the services NPs can provide.13 Instead, the regulations address the degree of physician collaboration or oversight required, which can, in turn, affect clinics’ operating costs. But, if demand for clinic services is sufficiently high in a given market, clinic operators are likely to find additional operating costs justifiable, making scope-of-practice regulation only one concern among many when deciding whether to enter a market.

Several other factors influence where companies locate clinics. States’ licensure and ownership requirements for clinics vary. In some states, clinics are licensed as physician practices and are regulated by state medical boards. Some states require that clinic owners be physicians and/or state residents, thus limiting opportunities for outside investors. A few states require each clinic location to obtain a separate license, instead of issuing a single license to a clinic corporation.

The complex interaction of state regulations helps determine the start-up and operating costs of retail clinics. Balanced against these cost considerations are assessments by clinic companies about the potential demand for clinic services in particular markets. Population density is a key consideration, along with demographic composition—particularly household income and insurance coverage. In addition, communities with primary care shortages tend to be attractive targets, as consumers lacking ready access to routine care may be more willing to turn to a clinic as an alternative care provider. Ultimately, experts suggest that these assessments of market demand play a more significant role than state regulations in decisions about where to locate retail clinics.14

Back to Top

Implications

![]() hile the number of retail clinics has increased in recent years, the overall use of retail clinics remains quite low. To date, retail clinics have yet to become the “disruptive innovation” in health care that some observers predicted when the first clinics appeared more than a decade ago. Looking forward, it is possible that the role of retail clinics may expand substantially as a result of the Patient Protection and Affordable Care Act (ACA) of 2010. With the ACA’s insurance expansions likely to put further stress on existing primary care capacity constraints in many communities, more and more consumers may turn to alternative sources of care, especially for simple, routine preventive and primary care needs.

hile the number of retail clinics has increased in recent years, the overall use of retail clinics remains quite low. To date, retail clinics have yet to become the “disruptive innovation” in health care that some observers predicted when the first clinics appeared more than a decade ago. Looking forward, it is possible that the role of retail clinics may expand substantially as a result of the Patient Protection and Affordable Care Act (ACA) of 2010. With the ACA’s insurance expansions likely to put further stress on existing primary care capacity constraints in many communities, more and more consumers may turn to alternative sources of care, especially for simple, routine preventive and primary care needs.

In addition, as noted previously, consumers soon may gain access to a broader set of services beyond simple, routine preventive and primary care at retail clinics, as companies such as Walgreens expand their clinics’ scope of services into chronic condition management. This development may help ease access problems in communities with serious capacity constraints in traditional primary care settings. However, the broadened scope of practice for retail clinics is facing pushback from medical societies, including the American Academy of Family Physicians, which cites concerns involving coordination and continuity of care. Also, the extent to which consumers will accept a larger primary care role on the part of retail clinics remains uncertain.

The question of whether retail clinics generate cost savings for the health system overall is a long-debated issue. When comparing the same services provided across different care settings, previous research has found that retail clinics are moderately less costly than urgent care centers and physician offices and much less costly than emergency departments.15 But more broadly, the cost-saving potential of retail clinics may be overstated if clinics duplicate services provided in other settings or if clinics simply serve as feeder systems for hospitals that either own or operate the clinics.

Going forward, how clinics are likely to evolve will depend largely on whether they are included in accountable care organizations (ACOs)—provider-based entities that assume responsibility for the overall cost and quality of care of a defined population. If ACOs include retail clinics, there would be incentives to use clinics as part of a coordinated and efficient system of care without duplicating services or making needless referrals. Under the accountable care model, clinics are likely to continue expanding only to the extent that their efficiency and cost-savings performance can be convincingly demonstrated. However, if hospitals reject ACO approaches and persist in maintaining the fee-for-service status quo, then the growth trajectory for retail clinics is likely to remain largely independent of their cost-savings potential to the overall health system.

Back to Top

Notes

Back to Top

Data Source

This Research Brief presents findings from the Center for Studying Health System Change (HSC) 2007 and 2010 Health Tracking Household Surveys (HTHS). Both surveys were funded by the Robert Wood Johnson Foundation and use nationally representative samples of the civilian, noninstitutionalized population. For the first time, the 2010 survey included a cell phone sample because of declining percentages of households with landline phones. Sample sizes included about 18,000 people for the 2007 survey and about 17,000 people for the 2010 survey. Response rates for the surveys were 43 percent in 2007 and 46 percent and 29 percent, respectively, for the landline and cell phone samples in 2010. Population weights adjust for probability of selection and differences in nonresponse based on age, sex, race or ethnicity, and education. The weights also adjust for the increased probability of selection in cases of households using both landline and cell phones. The 2007 and 2010 surveys were based on a stratified random sample of the nation. Standard errors account for the complex sample design of the surveys. Questionnaire design, survey administration and the question wording of all measures in this study were similar across surveys.

For each surveyed family, the primary family respondent was asked: “An in-store clinic is a medical clinic that is located inside a retail store like CVS, Walgreens, Target or Wal-Mart. Have you (or [names of other family members]) ever had a medical visit at an in-store health clinic? Do not include pharmacies that only offer flu vaccinations once a year or eye care.” Respondents who answered yes were then asked: “Have you (or [names of other family members]) used an in-store health clinic in a retail chain during the past 12 months?” Respondents who answered yes to this question were then asked about services obtained during clinic visits and reasons for choosing clinics. All estimates reported in this study are family-level, not person-level, estimates, because respondents were not asked which family members received retail clinic services. For the analysis on geographic access, HTHS data were merged with a dataset on retail clinic locations provided by Merchant Medicine, LLC, to develop proximity measures using ArcGIS software.

Funding Acknowledgement

This Research Brief was funded by the Robert Wood Johnson Foundation. As the nation's largest philanthropy devoted exclusively to health and health care, RWJF works with a diverse group of organizations and individuals to identify solutions and achieve comprehensive, measurable and timely change.