Seattle Hospital Competition Heats Up, Raising Cost Concerns

Community Report No. 3

December 2010

Ian Hill, Robert A. Berenson, Jon B. Christianson, Marisa K. Dowling, Ralph C. Mayrell, Tracy Yee

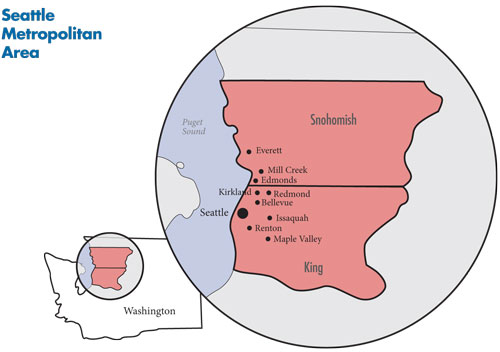

In April 2010, a team of researchers from the Center for Studying Health System Change (HSC), as part of the Community Tracking Study (CTS), visited the Seattle metropolitan area to study how health care is organized, financed, and delivered in that community. Researchers interviewed more than 50 health care leaders, including representatives of major hospital systems, physician groups, insurers, employers, benefits consultants, community health centers, state and local health agencies, and others. The Seattle metropolitan area encompasses King and Snohomish counties.

![]() nown as a “congenial” market where hospital systems focus on particular niches rather than head-to-head competition, Seattle now faces growing competition among hospital systems as they vie for market share in the city and seek new affiliations and growth in affluent suburbs. Seattle has a relatively unconcentrated hospital market with multiple hospital systems claiming between 5 percent and 20 percent of inpatient admissions. Market observers agreed that Swedish Medical Center, the area’s largest system, has ratcheted up the level of competition, for example, by affiliating with a hospital in Edmonds, north of Seattle.

nown as a “congenial” market where hospital systems focus on particular niches rather than head-to-head competition, Seattle now faces growing competition among hospital systems as they vie for market share in the city and seek new affiliations and growth in affluent suburbs. Seattle has a relatively unconcentrated hospital market with multiple hospital systems claiming between 5 percent and 20 percent of inpatient admissions. Market observers agreed that Swedish Medical Center, the area’s largest system, has ratcheted up the level of competition, for example, by affiliating with a hospital in Edmonds, north of Seattle.

Some viewed Swedish’s aggressive suburban growth partly as a defensive move to counteract efforts by suburban hospitals to expand specialized-care capabilities, such as robotic surgery, to keep patients in their communities rather than referring them to Seattle hospitals. Market observers disagreed about whether the more intense hospital competition was desirable or not. Critics worried that Swedish’s aggressive growth strategy would create excess capacity and increase system costs, while supporters believed additional capacity was needed in the face of continued population growth.

Key developments include:

- As hospital competition intensifies, physicians, who previously shunned hospital overtures, increasingly were seeking the security and stability of employment or other affiliations with hospitals.

- Health plans reportedly were competing more on price in light of larger-than-needed financial reserves, and employers were encouraging plans to develop new products, including plans with narrow- and tiered-provider networks that encourage consumers to consider cost when choosing providers.

- A robust safety net, with generous state public coverage programs and strong and growing community health centers, has maintained relatively good access to care for Seattle’s low-income residents. But, now the safety net faces significant pressure from growing state budget deficits, complicating the state’s preparation for coverage expansions enacted by national health reform.

- Recession Milder in Seattle

- Hospital Consolidation Ahead?

- Hospitals Court Physicians

- Providers Margins Strong Despite Recession

- Price Competition Among Health Plans

- No Critical Mass Yet for Quality Improvement

- Safety Net Meets Increased Demand

- State Coverage Efforts

- Preparing for Health Reform

- Issues to Track

- Background Data

Recession Milder in Seattle

![]() he population of the Seattle metropolitan area (see map below) now totals about 2.6 million and continues to grow rapidly—7.8 percent between 2004 and 2009—despite the economic downturn. Seattle-area residents are generally healthier and wealthier than residents in other U.S. metropolitan areas, and the area’s unemployment rate has been consistently lower than national rates (8.5% vs. 9.3 % in 2009). Likewise, the Seattle metropolitan area has much lower rates of uninsured people than the nation (11% vs. 15.1% in 2008) and more people with private insurance than the nation as a whole (78.6% vs. 69.6% in 2008). The area is home to such major employers as Amazon, Microsoft and Starbucks, and other large employers, including Boeing, have sizable workforces in the area. Despite the community’s overall prosperity, there are pockets in southern Seattle/King County and large parts of Snohomish County where poverty rates, uninsurance rates and health measures are much worse than in the rest of the metropolitan area.

he population of the Seattle metropolitan area (see map below) now totals about 2.6 million and continues to grow rapidly—7.8 percent between 2004 and 2009—despite the economic downturn. Seattle-area residents are generally healthier and wealthier than residents in other U.S. metropolitan areas, and the area’s unemployment rate has been consistently lower than national rates (8.5% vs. 9.3 % in 2009). Likewise, the Seattle metropolitan area has much lower rates of uninsured people than the nation (11% vs. 15.1% in 2008) and more people with private insurance than the nation as a whole (78.6% vs. 69.6% in 2008). The area is home to such major employers as Amazon, Microsoft and Starbucks, and other large employers, including Boeing, have sizable workforces in the area. Despite the community’s overall prosperity, there are pockets in southern Seattle/King County and large parts of Snohomish County where poverty rates, uninsurance rates and health measures are much worse than in the rest of the metropolitan area.

The Seattle area hospital market is less concentrated than markets elsewhere. The three largest systems are Swedish; UW Medicine, which is owned by the University of Washington; and Providence Health & Services, a multi-state Catholic system that operates Providence Regional Medical Center Everett in Snohomish County. Seattle has long been home to large physician groups, particularly multispecialty practices, most affiliated with specific hospital systems. The Seattle/King County-area has a robust safety net anchored by UW’s Harborview Medical Center and a network of federally qualified health centers (FQHCs). In Snohomish County, Providence Regional Medical Center Everett serves as the main safety net hospital, and several FQHCs provide access to primary care for low-income and uninsured people.

The commercial health plan market in Seattle has three nonprofit plans based in Washington—Premera Blue Cross, Regence Blue Shield and Group Health Cooperative, which also operates outpatient facilities and has an affiliated multispecialty physician practice, Group Health Permanente. Additionally, national for-profit health plans, including Aetna, UnitedHealth Group and CIGNA, operate in the Seattle market.

Hospital Consolidation Ahead?

![]() long with Swedish, UW Medicine and Providence, the Seattle area has multiple smaller hospitals, some part of larger systems that operate outside the study area. Important hospitals include Virginia Mason Medical Center in downtown Seattle; Seattle Children’s Hospital; Evergreen Hospital Medical Center, northeast of Seattle in Kirkland; Overlake Hospital Medical Center, east of Seattle in Bellevue; and Valley Medical Center, southeast of Seattle in Renton.

long with Swedish, UW Medicine and Providence, the Seattle area has multiple smaller hospitals, some part of larger systems that operate outside the study area. Important hospitals include Virginia Mason Medical Center in downtown Seattle; Seattle Children’s Hospital; Evergreen Hospital Medical Center, northeast of Seattle in Kirkland; Overlake Hospital Medical Center, east of Seattle in Bellevue; and Valley Medical Center, southeast of Seattle in Renton.

Competition among Seattle-area providers, particularly hospitals, has evolved from what respondents described as relatively “congenial” to a much more aggressive stance that threatens to produce new winners and losers and possibly increase costs to the system. While competition over specialty-service lines, such as cardiac, cancer and orthopedic care, continues, competition now includes new affiliations between hospitals, construction of new facilities in other systems’ backyards and increased hospital employment of physicians.

There was broad respondent agreement that Swedish is at the center of the change in the market’s competitive dynamic, although some viewed Swedish’s aggressive suburban growth north and east of Seattle partly as a defensive move. Swedish recently took over operation of Stevens Hospital in Edmonds, now known as Swedish Medical Center/Edmonds. And, Swedish established a freestanding emergency department (ED) in suburban Issaquah in 2005, also the site of a new Swedish hospital scheduled to open in 2012. Swedish plans to set up three more freestanding EDs—in Redmond, Mill Creek and Maple Valley—all high-growth areas outside of Seattle. Just before the Swedish Issaquah ED opened, Bellevue-based Overlake Hospital Medical Center opened a 24-7 urgent care clinic in Issaquah, while Kirkland-based Evergreen Hospital plans to open a freestanding ED in Redmond.

At the heart of the debate over Swedish’s competitive strategy are different views about the ability of competition among providers to improve quality and restrain health care spending growth, with some expressing regret that the congenial, collaborative environment that has characterized Seattle health care seems to be changing.

In the wake of national health reform, which is likely to encourage greater alignment and integration of hospitals and physicians, Seattle hospital systems also were considering strategies to become so-called accountable care organizations (ACOs). The health reform law allows Medicare to contract with ACOs, which could include hospitals, physicians and other providers working together, to be responsible for the cost and quality of care of a defined patient population.

Given the competitive pressures inside the market, coupled with health reform, some observers expected stand-alone hospitals to consider joining larger systems, just as Seattle-based Northwest Hospital and Medical Center did in late-2009 by affiliating with UW Medicine. One hospital respondent said, “I would guess that most community hospitals are in serious conversations with consultants on whether they can make it on their own or if they should partner with someone.”

Hospitals Court Physicians

![]() he physician market, particularly in the cities of Seattle and Everett, is dominated by large, multispecialty physician groups: UW Physicians, the faculty practice of UW Medicine with more than 1,500 physicians and other providers; Swedish Physicians and Virginia Mason, both with approximately 500 physicians; and Providence Physician Group. Other significant groups include Group Health Permanente, which provides care for Group Health Cooperative members; The Everett Clinic; The PolyClinic; Pacific Medical Centers; Minor and James; and Proliance Surgeons, originally an orthopedic group that has added other surgical specialists, including general surgeons.

he physician market, particularly in the cities of Seattle and Everett, is dominated by large, multispecialty physician groups: UW Physicians, the faculty practice of UW Medicine with more than 1,500 physicians and other providers; Swedish Physicians and Virginia Mason, both with approximately 500 physicians; and Providence Physician Group. Other significant groups include Group Health Permanente, which provides care for Group Health Cooperative members; The Everett Clinic; The PolyClinic; Pacific Medical Centers; Minor and James; and Proliance Surgeons, originally an orthopedic group that has added other surgical specialists, including general surgeons.

Earlier in the decade, hospital efforts to employ physicians, especially to promote prestigious specialty-service lines, were often resisted by independent physicians. This was the case when Swedish physicians gave a vote of “no confidence” in 2004 to the then-CEO in response to his physician practice acquisition strategy. Today, however, such efforts do not seem to be meeting much resistance from physicians. Indeed, many physicians appeared to be seeking the security and higher compensation that larger organizations can provide them, and most major Seattle hospital systems were actively seeking to employ physicians to shore up their referral bases. In contrast, suburban hospitals have shown less interest in employing physicians and instead appeared to be focusing on adding capacity to care for more complex patients as a way to ensure their viability.

A number of factors appeared to be contributing to increased hospital employment of physicians. One factor that may be driving this trend is that younger physicians seem particularly interested in employment arrangements that offer more predictable and manageable time commitments. For their part, hospitals appeared to be driven by a desire to bolster and secure their referral bases—becoming larger can enable systems to gain leverage over health plans for favorable payment rates. Health reform also may accelerate this trend, as providers see larger and more integrated delivery systems having competitive advantages under reform.

Provider Margins Strong Despite Recession

![]() ncreased competition and the recession did not appear to have hurt providers’ financial status. Hospital and large medical group margins, with few exceptions, have been relatively strong in recent years, and patient volumes held up through 2009 despite the recession. According to state data, Washington hospital margins through September 2009 mostly clustered in the 2-percent to 5-percent range. Even UW Harborview Medical Center, Seattle’s leading inpatient safety net provider, had a positive margin of just less than 1 percent. However, most hospitals and physicians groups reported decreased patient volume in the winter and spring of 2010.

ncreased competition and the recession did not appear to have hurt providers’ financial status. Hospital and large medical group margins, with few exceptions, have been relatively strong in recent years, and patient volumes held up through 2009 despite the recession. According to state data, Washington hospital margins through September 2009 mostly clustered in the 2-percent to 5-percent range. Even UW Harborview Medical Center, Seattle’s leading inpatient safety net provider, had a positive margin of just less than 1 percent. However, most hospitals and physicians groups reported decreased patient volume in the winter and spring of 2010.

Among physicians, large groups reported that margins were stable, but they were concerned about continued low public reimbursement rates—many of the mainstream medical groups typically don’t see many Medicaid or uninsured patients and increasingly limit the number of Medicare patients—and expected tightening of private reimbursement rates.

Also, health plans reportedly have not been very aggressive in price negotiations with hospitals or large physician groups, helping providers financially. In recent years, increases in hospital rates have been in the high single-digit range, continuing to increase employer premiums substantially even during the economic downturn. And, there was consensus that larger systems and their affiliated physicians have more leverage with health plans over payment rates than independent hospitals and practices.

A health plan respondent said relations between plans and hospitals have reached a “mature balance,” adding, “Health plans have great difficulty doing without most of the major hospitals without market disruption. The hospitals have major difficulty doing without the major health plans without major revenue disruption. You don’t see either one being able to push the others around that much.”

Price Competition Among Health Plans

![]() he Seattle market is unusual because it has two Blue plans, Premera Blue Cross and Regence Blue Shield, competing directly with one another across all market segments, primarily through preferred provider organization (PPO) product offerings.

he Seattle market is unusual because it has two Blue plans, Premera Blue Cross and Regence Blue Shield, competing directly with one another across all market segments, primarily through preferred provider organization (PPO) product offerings.

Another unusual facet of the Seattle commercial health plan market is the presence of Group Health Cooperative, which originated as a group-staff model health maintenance organization (HMO) but now offers PPOs and other insurance products. Most Group Health members’ care is provided by Group Health Permanente physicians, and the plan contracts for most hospital care through Virginia Mason Medical Center and Overlake Hospital Medical Center. Group Health is well known nationally for its innovations in chronic care delivery and, more recently, its experience with a medical-home model of primary care (see box below for more information on medical-home initiatives in the market). Group Health markets products in the individual and small group market, and its fully insured HMO product is frequently offered by large employers alongside PPO products of other plans.

In addition to the two Blue plans and Group Health, Aetna, UnitedHealth Group and CIGNA were identified by respondents as national plans operating in the Seattle market, with Aetna generally regarded as having the largest presence.

The key pressure faced by health plans in Seattle is the need to keep premiums at competitive levels. There was a consensus among health plan respondents that the Seattle market has grown more price competitive in recent years as some plans took action to reduce financial reserves by offering smaller premium increases in the group market. Nonetheless, all three major nonprofit plans have come under fire in the media recently for maintaining large reserves as they sought significant premium increases in the much-smaller individual insurance market.

Overwhelmingly, the PPO remains the dominant product in the Seattle area across all sizes of employers, though Group Health’s HMO product continues to be popular. The proportion of people enrolled in high-deductible plans linked to health savings accounts or health reimbursement accounts is low, reportedly in the single digits. In general, there were no significant new products introduced to the market in recent years, though some plans reported that they are developing narrow-network and high-performance network products, which they expected to introduce in the next year.

Plans have experimented with bundled payments—physician fees and hospital fees are combined into a single payment—in some hospital contracts. However, several providers reported being “burned” by risk contracts in the past, making them hesitant to negotiate new payment arrangements with health plans involving risk. Nevertheless, one respondent observed, “I think providers and plans think we need a fundamental change in how we pay.”

Supporting this view, health plan and provider respondents reported exploring incentive-based payment arrangements, such as bundled payments for defined specialty services. One plan described physician contract incentives to reduce high-end imaging and foster generic prescribing. Some hospital contracts reward for lower rates of hospital admissions, ED visits and intensive care unit days. Premera was experimenting with bundled payments for congestive heart failure and has developed what one provider characterized as “. essentially a capitated, bundled payment for the medical-home model,” a development that other plans were reportedly exploring.

Amid numerous uncertainties, health plans were assessing the potential impact of health care reform and appeared to be altering their competitive strategies, at least in part, to better position themselves for the new environment. For instance, one leading plan believed health reform would encourage more employers to self-insure, creating growth opportunities in the third-party administrator (TPA) market, where plans process claims and conduct medical management but do not assume insurance risk for employer clients. This plan had begun pricing its administrative fees as much as 25 percent lower in hopes of achieving a larger self-insured base before the health reform insurance regulations take effect in 2014. Indeed, a plan respondent reported that self-insurance has grown over the last few years and was being adopted by employers with as few as 100 employees. Plan respondents expected reform to drive the employer-size threshold even lower for self-insurance, perhaps to as low as 50 employees.

Medical Homes Gain Prominence Both public- and private-sector initiatives have invested in the development of medical-home models, several of which have gained national attention for their potential to improve coordination of care and reduce costs. Group Health Cooperative has achieved national recognition for its medical-home demonstration. The model involves heavy electronic medical record use, increasing staffing ratios, decreasing physician panel size, improving chronic care management, using pre- and post-visit follow ups, and team-based approaches. The demonstration cut emergency department visits by 29 percent and hospitalizations by 6 percent, decreased clinician “burnout,” and improved patient satisfaction and clinical quality. Group Health receives capitated payments, or fixed monthly payments for each member. Under the demonstration, cost of patient care did not increase, and preliminary results suggested that the model may even lead to lower costs. These findings were compelling enough for Group Health to roll out the medical-home model to all of its 26 clinics across Washington and Idaho. Similarly, under the initiative of Boeing, Regence has worked with Virginia Mason, The Everett Clinic and Valley Medical Center Independent Practice Association to test the plan’s Intensive Outpatient Care Program, a medical-home variant with particular emphasis on care of patients with multiple, severe chronic conditions. This program, which pays providers an additional monthly fee for each enrolled patient, reportedly has achieved a significant reduction in hospital days and ED use. Regence recently announced plans to expand the program. Moreover, the state’s Health Care Authority and the Puget Sound Health Alliance are cosponsoring the development, implementation and evaluation of the Patient Centered Medical Home Multi-Payer Reimbursement Model, which is targeted to reduce avoidable ED and hospital use while maintaining quality and patient experience of care. Slated for launch in early 2011, health plans in the program will pay primary care practices for care management activities not normally reimbursed. This project builds on the state’s Patient Centered Medical Homes Collaborative, which was launched in 2009 to improve quality, access and affordability; the collaborative already includes 33 participating primary care practices. Another example includes Qliance, a form of low-cost concierge practice that collects a monthly subscription fee from patients in lieu of accepting insurance payments. Qliance has developed a national reputation for what it calls a medical-home approach, in this case relying on the monthly fees to permit physicians to care for a much smaller number of patients than typical primary care physicians, allowing longer visits and more communication via phone and e-mail. |

No Critical Mass Yet for Quality Improvement

![]() he Seattle market has important pockets of activity related to quality improvement, yet none so far appear sufficient in scope to exert significant pressure on care delivery. The Puget Sound Health Alliance, a local coalition of purchasers and providers, performs an important convening function while also objectively measuring, monitoring and publicly reporting on the quality of health plans and providers. At least two of the Alliance’s large employer members have required health plans responding to requests for proposals to submit results of the National Business Coalition on Health’s eValue8 quality survey. The data collected allow employers to compare plans across a uniform set of measures related to price, quality and services. The eValue8 effort to “level the playing field” appeared to be fostering competition among health plans, notwithstanding that the market’s largest plan, Premera, declined to participate in the most recent survey.

he Seattle market has important pockets of activity related to quality improvement, yet none so far appear sufficient in scope to exert significant pressure on care delivery. The Puget Sound Health Alliance, a local coalition of purchasers and providers, performs an important convening function while also objectively measuring, monitoring and publicly reporting on the quality of health plans and providers. At least two of the Alliance’s large employer members have required health plans responding to requests for proposals to submit results of the National Business Coalition on Health’s eValue8 quality survey. The data collected allow employers to compare plans across a uniform set of measures related to price, quality and services. The eValue8 effort to “level the playing field” appeared to be fostering competition among health plans, notwithstanding that the market’s largest plan, Premera, declined to participate in the most recent survey.

Even as respondents mostly agreed that the Alliance has carved out an important niche as an unbiased convener of stakeholders and holder of data, several also suggested that it has not had a significant effect on care delivery and market dynamics to this point. Some members have questioned whether paying the Alliance’s large dues is justifiable. To have greater impact, some members believed the organization would have to include more cost and efficiency data in provider reports—which the Alliance is already working on—and, perhaps, expand its purchaser base to include mid-sized—not just the largest—employers in Seattle.

Safety Net Meets Increased Demand

![]() he Seattle area has a strong array of safety net providers for low-income people. In Seattle/King County, UW Harborview Medical Center remains by far the largest institutional provider of care to Medicaid and uninsured patients, who comprise approximately half of its patients. In recent years, Swedish has stepped up its safety net role, and Seattle Children’s Hospital plays a key role in the safety net for children. Six federally qualified health center (FQHC) organizations, such as Neighborcare Health and Healthpoint Community Health Center, provide comprehensive primary care and a broad range of medical, dental, behavioral, and social services, often under one roof. The King County health department also operates an FQHC. In Snohomish County, Providence Regional Medical Center Everett is the main safety net hospital and Snohomish County Community Health Center is the main FQHC serving Everett and Lynnwood.

he Seattle area has a strong array of safety net providers for low-income people. In Seattle/King County, UW Harborview Medical Center remains by far the largest institutional provider of care to Medicaid and uninsured patients, who comprise approximately half of its patients. In recent years, Swedish has stepped up its safety net role, and Seattle Children’s Hospital plays a key role in the safety net for children. Six federally qualified health center (FQHC) organizations, such as Neighborcare Health and Healthpoint Community Health Center, provide comprehensive primary care and a broad range of medical, dental, behavioral, and social services, often under one roof. The King County health department also operates an FQHC. In Snohomish County, Providence Regional Medical Center Everett is the main safety net hospital and Snohomish County Community Health Center is the main FQHC serving Everett and Lynnwood.

Thanks in large part to the market’s far-reaching FQHC network, access to primary care appeared to be quite strong for both publicly insured and uninsured residents. Access to dental care, by comparison, remained much more challenging, especially for adults, both because of shortages of private dentists willing to participate in Medicaid and other public programs and state budget cuts.

The recession led to increased demand for care from growing numbers of Medicaid and uninsured patients, though more markedly for FQHCs than hospitals. According to county data, between 2007 and 2008, volume at most Seattle/King County FQHCs remained flat and the percentage of uninsured people decreased because of increases in public coverage. However, from 2008 to 2009, the volume, as well as the proportion, of uninsured patients increased at all but two of the market’s FQHCs, with volume increasing in some cases as much as 20 percent.

FQHCs were able to meet the increased demand, in part because of recent capacity expansions. FQHCs’ strong financial positions and ability to expand capacity have resulted from a combination of generous and consistent federal funding, including stimulus funding through the American Recovery and Reinvestment Act (ARRA), and large reserves earned and redistributed to centers by the Community Health Plan, a statewide Medicaid managed care plan formed and operated by the FQHCs.

One particularly notable outgrowth of the FQHCs’ healthy financial status has been their ability to invest in health information technology. Indeed, FQHCs and the Community Health Plan network have been leaders in implementing a comprehensive electronic medical record (EMR). Six FQHCs joined forces and reinvested savings from improved care management to select, implement and maintain a NextGen EMR system. While citing sometimes challenging and costly transition periods—which saw marked temporary decreases in productivity—most FQHC officials reported they were already seeing benefits of health information technology in terms of improved efficiency and quality of patient care.

In King County, FQHCs have worked to improve access to specialty care through Project Access. Based on similar programs across the country, Project Access was started by the Community Health Council—a consortium of FQHCs, the King County health department and major area hospitals—and the King County Medical Society in 2005. Project Access attempts to increase access to specialists for uninsured and underinsured people with incomes up to 200 percent of poverty, or $44,100 for a family of four in 2010. The program serves as a referral center for FQHCs and volunteer physician specialists who have agreed to accept patients on a rotating basis, ensuring that no individual physician is overloaded. Project Access also makes sure that the referring FQHC has done all necessary pre-referral work, such as verifying that the referral is necessary, arranging transportation to assist patients in keeping their appointments, and making interpreters available as needed. The model, though limited, was widely described as helpful in addressing the challenge of specialty care access.

State Coverage Efforts

![]() he state of Washington offers a variety of health care programs for more than 1.2 million lower-income residents, including Medicaid, Apple Health for Kids and Washington Basic Health (BH), a state-funded program that provides comprehensive health coverage and sliding-scale subsidies to about 59,000 people. Another state-funded program, General Assistance-Unemployable—recently renamed Disability Lifeline—covers about 15,000 people with physical and/or mental disabilities that prevent them from working for at least 90 days.

he state of Washington offers a variety of health care programs for more than 1.2 million lower-income residents, including Medicaid, Apple Health for Kids and Washington Basic Health (BH), a state-funded program that provides comprehensive health coverage and sliding-scale subsidies to about 59,000 people. Another state-funded program, General Assistance-Unemployable—recently renamed Disability Lifeline—covers about 15,000 people with physical and/or mental disabilities that prevent them from working for at least 90 days.

Medicaid, Apple Health for Kids and Disability Lifeline are administered by the Department of Social and Health Services (DSHS), while Basic Health is managed by the Washington Health Care Authority (HCA), an agency that also runs the state employee benefits board. The state is moving to consolidate administration of all health programs within a single agency.

Just more than half of the state’s 1.2 million residents enrolled in Medicaid or other public coverage are in managed care programs. The state contracts with multiple health plans but enrollment in the Seattle/King County market is concentrated in two distinctly different health plans that offer consumers alternative care models—the smaller FQHC-owned Community Health Plan (CHP) and the much larger, multi-state Molina Healthcare Medicaid plan, which has a network primarily composed of private physicians.

The recession has placed significant pressure on Washington’s state budget. While the state enjoyed large surpluses as recently as 2007 and was expanding health coverage, Washington in 2009 faced a $9-billion deficit at the beginning of its biennial budget cycle (2009-11) and an additional $2.6 billion shortfall heading into 2010. While dramatic cuts to public coverage programs were widely discussed, by spring 2010, most cuts had been averted thanks to the influx of federal stimulus funding through ARRA, such as a higher federal match for Medicaid. The state also shored up its budget through a combination of narrow tax increases—for example, on soda, candy and bottled water—and other financial moves to draw down additional federal matching funds.

However, the state’s budget has suffered several significant revenue setbacks since then. First, voters handed the state a $281 million reversal of fortune in the November election, approving an initiative repealing the tax on soda, candy and other items. Second, the state has had two revenue forecasts that collectively put the state’s current budget in the red and bumped the 2011-13 budget shortfall to $5.7 billion, about half of the state’s total discretionary budget for the biennium. The severity of the budget crisis forced Gov. Christine Gregoire to call for a 6.3 percent across-the-board cut in September 2010, resulting in almost $112 million in cuts to state health programs. The planned cuts include elimination of the Disability Lifeline program and elimination of many adult Medicaid services, including dental and vision care and the outpatient pharmacy benefit. Since then, the state has announced a second round of budget cuts to trim another 4.6 percent in spending.

Previous cuts, along with the threatened new reductions, have left some worried about the fallout on the state’s ability manage health programs effectively and serve vulnerable residents. For example, a reduction of 160 full-time staff at DSHS, amounting to more than 20 percent of agency personnel, was described as potentially undermining the state’s ability to process applications in a timely manner and reducing its capacity to administer managed care contracts efficiently. The state also has made significant cuts to Basic Health, leading to a waiting list larger than the program’s enrollment—almost 130,000 people were on the waiting list as of November 2010.

Preparing for Health Reform

![]() hen asked about the state’s readiness for health reform, one official said, “Washington is ahead of the curve compared to other states, especially in terms of leadership.” In fact, many respondents remarked that Washington has long been an innovator in public coverage programs and delivery system reform, and thus was well positioned to take advantage of the opportunities presented by the Patient Protection and Affordable Care Act.

hen asked about the state’s readiness for health reform, one official said, “Washington is ahead of the curve compared to other states, especially in terms of leadership.” In fact, many respondents remarked that Washington has long been an innovator in public coverage programs and delivery system reform, and thus was well positioned to take advantage of the opportunities presented by the Patient Protection and Affordable Care Act.

Still, with passage of federal health reform barely a month old at the time of the site visit, respondents commonly reported that formal planning efforts were in their infancy and that most officials were attempting to grasp the full implications of reform for Washington’s programs and systems. Several efforts were already underway, however, including Gov. Gregoire’s appointment of a subcabinet on health care reform. Respondents also pointed to a change in leadership at the Health Care Authority, which will now be directed by the same individual who heads Medicaid, a move that suggested the state wants to combine the purchasing power of its two largest health agencies.

Perhaps the most important reform taking shape was Washington’s application to the federal Centers for Medicare and Medicaid Services (CMS) for a Medicaid waiver to create a “bridge” between existing state-funded programs and creation of the health insurance exchange and mandatory Medicaid eligibility expansion to 133 percent of poverty in 2014. Washington officials outlined their proposal to CMS in January 2010, which would enroll Basic Health and Disability Lifeline recipients (most of whom are adults with incomes below 133% of poverty or who are disabled and living below poverty, respectively) into Medicaid so that the state can draw federal matching funds at the normal level of 50 percent. The waiver would provide the two state-funded programs a financial “lifeline,” as one state official said, by moving large groups into federally matched coverage ahead of the federal reform timetable.

As well positioned as Washington may be for reform, public-sector officials were not without concerns looking ahead. The most often-cited challenge was a shortage of primary care providers to serve the newly insured. As one official said, “It will be very interesting to see what happens when we have 350,000 to 400,000 new members added to the rolls in 2014. we don’t want a whole lot of people with insurance but without access to primary care.” Several respondents also noted the need for ongoing state financial support of the safety net to continue serving undocumented immigrants who will not be helped by federal reform.

Issues to Track

Will the intensified competition among hospitals continue and lead to consolidation of the hospital market? If so, how will the new market dynamics and increased leverage among a smaller group of providers affect rates paid by private payers and health care costs and utilization?- Will employers and health plans be able to implement innovative benefit designs and payment arrangements that help keep coverage affordable?

- Will medical-home models and other quality improvement advances begin to exert greater influence over care delivery in the market more generally? And what ongoing role will the Puget Sound Health Alliance play as health care reform, which emphasizes quality reporting, is implemented over time?

- Will Seattle’s relatively rich health system resources, including its safety net providers, be able to absorb tens of thousands of newly insured individuals post reform and provide adequate access to primary, specialty, dental and behavioral health care?

- Will safety net providers receive adequate funding to serve people who will be left behind by health reform, such as undocumented immigrants?

- How will continued state budget deficits and the end of federal stimulus funding affect the state’s and safety net’s ability to prepare for health reform?

Background Data

| Seattle Demographics | ||

|---|---|---|

| Seattle Metropolitan Area | Metropolitan Areas 400,000+ Population | |

| Population, 20091 | 2,611,012 | |

| Population Growth, 5-Year, 2004-20092 | 7.8% | 5.5% |

| Age3 | ||

| Under 18 | 22.5% | 24.8% |

| 18-64 | 67.0%* | 63.3% |

| 65+ | 10.5%# | 11.9% |

| Education3 | ||

| High School or Higher | 91.8% | 85.4% |

| Bachelor’s Degree or Higher | 40.4% | 31.0% |

| Race/Ethnicity4 | ||

| White | 71.1% | 59.9% |

| Black | 4.9% | 13.3% |

| Latino | 7.6% | 18.6% |

| Asian | 11.9% | 5.7% |

| Other Races or Multiple Races | 4.5%* | 4.2% |

| Other3 | ||

| Limited/No English | 9.8% | 10.8% |

|

* Indicates a 12-site largest decrease. Sources: 1 U.S. Census Bureau, Annual Population Estimate, 2009 2 U.S. Census Bureau, Annual Population Estimate, 2004 and 2009 2 U.S. Census Bureau, American Community Survey, 2008 3 U.S. Census Bureau, American Community Survey, 2008, weighted by U.S. Census Bureau, Annual Population Estimate, 2008 |

||

| Economic Indicators | ||

|---|---|---|

| Seattle Metropolitan Area | Metropolitan Areas 400,000+ Population | |

| Individual Income less than 200% of Federal Poverty Level1 | 20.4%# | 26.3% |

| Household Income more than $50,0001 | 64.8% | 56.1% |

| Recipients of Income Assistance and/or Food Stamps1 | 7.3% | 7.7% |

| Persons Without Health Insurance1 | 11.0% | 14.9% |

| Unemployment Rate, 20082 | 4.8% | 5.7% |

| Unemployment Rate, 20093 | 8.5% | 9.2% |

| Unemployment Rate, March 20104 | 8.0% | 9.6% |

# Indicates a 12-site low. Sources: |

||

| Health Status1 | ||

|---|---|---|

| Seattle Metropolitan Area | Metropolitan Areas 400,000+ Population | |

| Chronic Conditions | ||

| Asthma | 15.2% | 13.4% |

| Diabetes | 6.7% | 8.2% |

| Angina or Coronary Heart Disease |

2.7%# | 4.1% |

| Other | ||

| Overweight or Obese | 58.3% | 60.2% |

| Adult Smoker | 12.0% | 18.3% |

| Self-Reported Health Status Fair or Poor |

11.0% | 14.1% |

# Indicates a 12-site low. Sources:1 Centers for Disease Control and Prevention, Behavioral Risk Factor Surveillance System, 2008 |

||

| Health System Characteristics | ||

|---|---|---|

| Seattle Metropolitan Area |

Metropolitan Areas 400,000+ Population | |

| Hospitals1 | ||

| Staffed Hospital Beds per 1,000 Population | 1.8# | 2.5 |

| Average Length of Hospital Stay (Days) | 4.6 | 5.3 |

| Health Professional Supply | ||

| Physicians per 100,000 Population2 | 272 | 233 |

| Primary Care Physicians per 100,000 Poplulation2 | 101 | 83 |

| Specialist Physicians per 100,000 Population2 | 171 | 150 |

| Dentists per 100,000 Population2 | 83 | 62 |

Average monthly per-capita reimbursement for beneficiaries enrolled in fee-for-service Medicare3 |

$614 | $713 |

# Indicates a 12-site low. Sources:1 American Hospital Association, 2008 2 Area Resource File, 2008 (includes nonfederal, patient care physicians) 3 HSC analysis of 2008 county per capita Medicare fee-for-service expenditures, Part A and Part B aged and disabled, weighted by enrollment and demographic and risk factors. See www.cms.gov/MedicareAdvtgSpecRateStats/05_FFS_Data.asp. |

||

Community Reports are published by the Center for Studying

Health System Change:

600 Maryland Avenue, SW, Suite 550

Washington, DC 20024-2512

Tel: (202) 484-5261

Fax: (202) 484-9258

www.hschange.org

President: Paul B. Ginsburg