The Economic Recession: Early Impacts on Health Care Safety Net Providers

HSC Research Brief No. 15

January 2010

Laurie E. Felland, Peter J. Cunningham, Genna R. Cohen, Elizabeth A. November, Brian C. Quinn

While the recession increased demands on the health care safety net as Americans

lost jobs and health insurance, the impact on safety net providers has been

mixed and less severe—at least initially—than expected in some cases,

according to a new study of five metropolitan communities by the Center for

Studying Health System Change (HSC). Even before the recession, many safety

net providers reported treating more uninsured patients and facing tighter state

and local funding. Federal expansion grants for community health centers during

the past decade, however, have increased capacity at many health centers. And,

programs to help direct people to primary care providers may have helped stem

the expected surge in emergency department use by the uninsured during the downturn.

Federal stimulus funding—the 2009 American Recovery and Reinvestment Act—has

assisted hospitals and health centers in weathering the economic storm, helping

to offset reductions in state, local and private funding. And, the economic

downturn has generated some potential benefits, including lower rents and broader

employee applicant pools. While safety net providers have adopted strategies

to stay financially viable, many believe they have not yet felt the full impact

of the deepest recession since the Great Depression.

- Federal Stimulus Aid Helps Offset State and Local Safety Net Budget Cuts

- Patient Demand Increases

- Impact of Federal Stimulus Funding on the Safety Net

- Other Reductions Diminish Stimulus Funding Gains

- Safety Net Provider Strategies to Stay Viable

- Policy Implications

- Notes

- Data Source and Funding Acknowledgement

Federal Stimulus Aid Helps Offset State and Local Safety Net Budget Cuts

![]() he recession that began in December 2007 has been more

severe than any economic downturn since the Great Depression. Unemployment has

topped 10 percent, causing a loss of employer-based health insurance and leaving

many people either uninsured or eligible for Medicaid or other public coverage.

At the same time, decreases in tax revenues have created significant gaps in

state and local government budgets, leaving fewer resources to pay for increased

Medicaid enrollment or grants to providers to support the costs of uncompensated

care.1 Despite the recent return to economic growth, high

levels of unemployment are expected to continue for the foreseeable future.

he recession that began in December 2007 has been more

severe than any economic downturn since the Great Depression. Unemployment has

topped 10 percent, causing a loss of employer-based health insurance and leaving

many people either uninsured or eligible for Medicaid or other public coverage.

At the same time, decreases in tax revenues have created significant gaps in

state and local government budgets, leaving fewer resources to pay for increased

Medicaid enrollment or grants to providers to support the costs of uncompensated

care.1 Despite the recent return to economic growth, high

levels of unemployment are expected to continue for the foreseeable future.

The recession’s severity was expected to place even greater pressure on safety net providers—including community health centers (CHCs), free clinics, public hospitals and nonprofit hospitals that treat many low-income patients—than they usually experience during economic downturns, as more people sought free or reduced-cost care. However, the federal government provided some relief to states and safety net providers through stimulus legislation. Enacted in February 2009, the American Recovery and Reinvestment Act (ARRA) included higher matching funds for state Medicaid programs, increased funding to support hospitals serving disproportionate numbers of low-income, uninsured and Medicaid patients, and additional grants to federally qualified health centers (FQHCs).2

This study explores the recession’s effect on safety net providers and the extent to which ARRA funding has helped shelter the safety net from the downturn’s fallout in five Community Tracking Study communities—Cleveland; Greenville, S.C.; northern New Jersey; Phoenix; and Seattle—between July 2008 and July 2009 (see Data Source). These five communities vary in population size, geographic region and uninsured rates. The safety nets in these communities have become relatively well established—including at least one major hospital and a network of CHCs and clinics that serve a safety net role.3

Before the recession, the state budget situation in 2007 was either strong or improving for three of the five communities—Greenville, Phoenix and Seattle—and state governments in South Carolina, New Jersey and Washington were either restoring Medicaid cuts made during the previous recession or were attempting to expand public programs.4 By 2009, all five states had significant budget shortfalls.

Back to Top

Patient Demand Increases

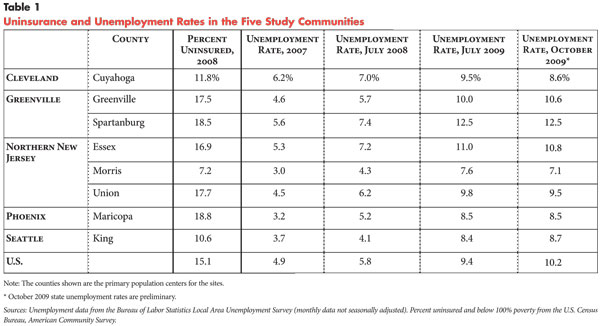

![]() onsistent with national trends, all five communities experienced

sharp increases in unemployment rates between 2007 and July 2009—with rates

increasing 50 percent in Cuyahoga County (Cleveland) and more than doubling

in the other four communities (see Table 1). Consequently,

safety net providers reported increased demand for services from uninsured people,

including many who were newly uninsured because of losing their jobs. Moreover,

many of the newly uninsured patients were people traditionally less reliant

on safety net providers, including those from more affluent areas with higher

incomes. An exception was Phoenix, a community with many Latino immigrants,

where safety net providers’ uninsured patient volume held steady or declined

as immigrants left the state in search of jobs or to escape the authorities’

increased scrutiny of undocumented immigrants.5

onsistent with national trends, all five communities experienced

sharp increases in unemployment rates between 2007 and July 2009—with rates

increasing 50 percent in Cuyahoga County (Cleveland) and more than doubling

in the other four communities (see Table 1). Consequently,

safety net providers reported increased demand for services from uninsured people,

including many who were newly uninsured because of losing their jobs. Moreover,

many of the newly uninsured patients were people traditionally less reliant

on safety net providers, including those from more affluent areas with higher

incomes. An exception was Phoenix, a community with many Latino immigrants,

where safety net providers’ uninsured patient volume held steady or declined

as immigrants left the state in search of jobs or to escape the authorities’

increased scrutiny of undocumented immigrants.5

However, given the recession’s severity, the impact of higher demand on safety net providers was not as great as might be expected in the five communities. To some extent, this reflects that safety net providers were experiencing increasing demand for care before the recession in the face of declining employer-sponsored coverage and other providers’ growing reluctance to treat uninsured and Medicaid patients. For example, Newark area respondents suggested that the recession has exacerbated stresses that have existed for years because of high numbers of poor, unemployed and uninsured people. As one Newark hospital executive said about the recession, “It’s business as usual. for this community.”

A rise in the rate of uninsured patients in a community is often reflected in higher use of hospital emergency departments (EDs), which by law must provide at least stabilizing care to all patients regardless of ability to pay. While safety net hospitals reported increased ED visits, many respondents reported that these increases were not as great as expected. This may reflect, in part, a longer lag time between when individuals lose coverage and when they begin to show up in EDs in large numbers. However, some respondents noted efforts that were underway before the recession to divert uninsured and low-income patients with nonurgent health needs away from EDs to primary-care settings, especially CHCs.6 Such efforts may have helped to prevent a surge in ED use, at least in the near term.

Most CHC respondents reported an increase in patients and the number of services they were providing. According to a recent national survey, CHCs’ total visits increased 14 percent between June 2008 and 2009—more than double the increase the prior year—while visits by uninsured patients increased 21 percent.7 The national increase is generally consistent with what many health center respondents in the five communities reported, although there was variation across health centers and communities. For example, a New Jersey health center reported that its patient volume had doubled since the recession began, some of which was caused by nearby hospitals closing since 2007. Other health centers reported smaller or no increases in patient volume because of insufficient capacity to see additional patients.

To some extent, increases in health center use reflect capacity expansions to meet higher demand before the recession. Federal initiatives over the last decade have increased the number of federally funded health centers from about 750 centers in 2000 to almost 1,100 by 2008.

Also, the rise in uninsured patients may not have been as large as expected because of temporary federal subsidies for continuation coverage for laid-off workers—so-called COBRA coverage. ARRA included a provision to pay 65 percent of the cost of employer coverage for recently laid-off workers. COBRA enrollment increased from 19 percent to 39 percent of laid-off workers in the six months after the ARRA subsidy was enacted.8 Many safety net respondents reported benefiting from the COBRA subsidies, which helped existing patients maintain coverage.

Increased uncompensated care was the most common concern among safety net hospitals in the five study communities, which is consistent with what public hospitals have reported nationally.9 At the same time, several safety net hospitals in the study communities reported declines in inpatient volume because of people delaying elective procedures, which results in a loss of revenue for safety net hospitals because these patients are more likely to be insured.

Back to Top

Impact of Federal Stimulus Funding on the Safety Net

![]() n addition to COBRA subsidies, federal stimulus funding benefited the safety net in three ways:

n addition to COBRA subsidies, federal stimulus funding benefited the safety net in three ways:

- An increase in the federal medical assistance percentage (FMAP) for state Medicaid programs.

- An increase in Medicaid disproportionate share hospital (DSH) payments to hospitals that serve a high percentage of low-income and Medicaid patients.

- An increase in grant funding to FQHCs.

FMAP adjustments raised the federal share of Medicaid costs by about 6.2 percentage points on average, providing an additional $87 billion to all states between 2008 and 2010.10 With these increases, the federal matching rates for the five states in this study range from 59 percent in New Jersey to 79 percent in South Carolina.11 Also, Medicaid DSH payments increased by 2.5 percent in 2009 and will rise another 2.5 percent in 2010. To receive the additional FMAP and DSH funds, states must maintain Medicaid eligibility standards at July 1, 2008, levels; they are not, however, required to maintain optional services, such as dental care for adults.12

For the most part, the FMAP and DSH increases have not directly benefited safety net providers, except to shelter them from additional state budget cuts. Respondents reported that most of the additional federal funding stayed with the state governments—for example by applying the extra funds to their budget deficits. As a Cleveland hospital respondent explained, “. at best [ARRA is] a wash; if it keeps the budget balanced and helps in total, it’s a good thing, but it was never a direct pass-through [of funds] for us.” Only a few hospitals noted receiving modest DSH funding increases since ARRA. However, respondents from several communities indicated that the FMAP increase helped indirectly by enabling their states to maintain Medicaid provider payment rates or reduce the magnitude of reductions.

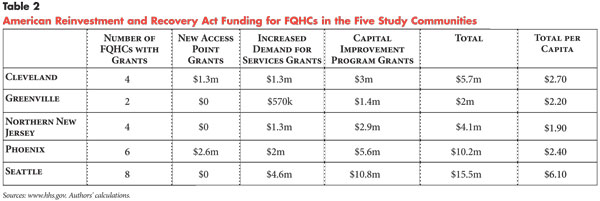

ARRA appears to have had a larger impact on FQHC capacity, both by helping FQHCs avoid expected cuts and expand services. In March 2009, 23 FQHCs in the five study communities started receiving $37.5 million in ARRA funding through three types of grants that allow health centers to maintain or expand capacity in a number of ways (see Table 2).

Increased Demand for Services (IDS) grants help cover the operational expenses of treating additional patients. Respondents commonly used the grants to hire clinical and administrative staff, especially to address increased primary care, mental health and dental needs. For example, IDS funds helped one Cleveland health center hire a full-time nurse, a clerical person and a half-time physician. The addition of a part-time dentist and a full-time dental assistant at another Cleveland health center was expected to provide capacity for more than 1,000 new patients over two years.

New Access Point (NAP) grants have allowed more community clinics to attain FQHC designation and allowed existing FQHCs to add sites. Nonprofit public and private clinics can become FQHCs if they provide comprehensive primary care and other supportive services to medically underserved insured and uninsured people and are governed by a community board, among other requirements. NAP grants converted health centers in both Cleveland and Phoenix to FQHCs, which also earns the health centers enhanced Medicaid reimbursement. NAP grants enabled a Cleveland health center to decrease patient fees and increase the number of uninsured patients treated. One of the Phoenix centers receiving a NAP grant planned to triple exam rooms and clinical staff.

Capital Improvement Program (CIP) grants provide funds for construction, infrastructure repairs and equipment purchases, including information technology (IT). Health center directors commonly reported using these funds to implement electronic health records systems or upgrade outdated IT systems. For others, CIP grants helped with facility expansions and improvements that do not directly impact clinical care. For example, a Phoenix health center used a CIP grant to renovate its facility. As an FQHC director in northern New Jersey reported, “The stimulus package was a godsend in the sense that it allowed us to get at least a good portion of those items from our ‘if only we had dollars we could repave the parking lot or redo our roof list.’” As of August 2009, FQHCs also could compete for another capital grant program—Facility Improvement Grants.

But while many FQHCs have benefited from both the recent ARRA funding and federal expansion grants over the past 10 years, many free clinics without FQHC status were facing more serious financial strains than safety net hospitals and FQHCs. Free clinics do not receive enhanced Medicaid reimbursements like FQHCs and other community health centers deemed federal “look-alikes,” and they are not eligible for ARRA and other federal health center grants. Free clinics treat mostly uninsured patients, relying primarily on private philanthropy and volunteer physicians. Free clinics usually do not charge uninsured patients for services, in contrast to FQHCs and FQHC look-alikes that charge uninsured patients on a sliding fee scale depending on income. In some communities—such as Cleveland and Greenville—free clinics are major providers of primary care to uninsured people but have languished while FQHCs have expanded and often thrived because of increased federal support. Free clinic directors noted that many funders, policy makers and the public are unaware that they are ineligible for federal stimulus funds. As one FQHC executive said, “FQHCs got money, and free clinics are worried about keeping their doors open. The FQHCs have money to go forward with an electronic medical record and the [free clinics are] laying off staff. There’s a big haves and have-nots disparity.”

Other Reductions Diminish Stimulus Funding Gains

![]() s state and local officials grappled with large budget deficits, safety net hospitals and CHCs were facing funding cuts that would offset gains from federal stimulus funding. All five states reduced or proposed reductions in optional Medicaid services for adults—including dental, vision, mental health, podiatry and prescription drug coverage. One Seattle FQHC director described the additional federal funding as “a trickle” compared to the “torrent” of state and local cuts. In the absence of ARRA funding and the requirement for states to maintain Medicaid eligibility criteria, it is likely that more cuts to eligibility and services would have occurred.

s state and local officials grappled with large budget deficits, safety net hospitals and CHCs were facing funding cuts that would offset gains from federal stimulus funding. All five states reduced or proposed reductions in optional Medicaid services for adults—including dental, vision, mental health, podiatry and prescription drug coverage. One Seattle FQHC director described the additional federal funding as “a trickle” compared to the “torrent” of state and local cuts. In the absence of ARRA funding and the requirement for states to maintain Medicaid eligibility criteria, it is likely that more cuts to eligibility and services would have occurred.

Four of the five states also have made significant funding cuts to other programs that assist safety net providers; South Carolina was the exception because it has not funded such initiatives in the past. Washington almost halved funding for the state’s Basic Health Plan—a subsidized insurance program for low-income people—which safety net providers expected would eliminate coverage for many of their patients. As of November 2009, the plan covered approximately 78,000 people, down from more than 100,000 six months before (approximately 10% of the uninsured statewide) and enrollment was expected to decline by approximately another 15,000 people by early 2010.13

Further, three of the five states reduced funding to support primary care: Ohio and Arizona cut tobacco tax revenues dedicated to primary care at hospitals and clinics, and New Jersey eliminated a $5 million pool to build health center capacity. Other funding pools that support the costs of providing uncompensated care in New Jersey—$40 million for health centers and $605 million for hospitals—remained intact but have not increased to match rising uncompensated care costs.

Local budgets have become increasingly strained as well, with some effects on safety net providers. Three of the communities—Cleveland, Phoenix and Seattle—have county hospitals supported by local revenues. Despite increased strain on local budgets, large-scale funding cuts for these hospitals had not yet occurred, although the county hospital in Phoenix experienced some decline in funding. Unlike the other communities, Seattle historically has provided financial support to local health centers, but these county and city funds have declined during the recession. Some safety net providers also expected to see additional demand for public health services, such as mental health, maternal and child health, and immunizations as state and local health departments cut back services in the face of budget shortfalls.

At the same time, other revenue for many safety net providers has declined. Many private safety net hospitals reported significant investment losses, while public providers typically have fewer, more stable investments.

Both public and private safety net providers reported reduced support from charitable foundations, whose investment portfolio values also declined. For example, a free clinic in Greenville reported a 20-percent reduction in foundation funding. Overall, however, losses in donations were reportedly not as great as many respondents feared, in some cases because of multi-year grants that were issued before the recession hit and because donors often were “stepping up” to sustain or, in a few cases, increase their level of giving.

As a result of recession-related financial concerns, many safety net hospitals have delayed capital projects and reduced some services. For instance, a Newark hospital limited the availability of some outpatient specialty services for low-income people, and the public hospital in Cleveland cut specialty pediatric services. More commonly, safety net providers have tried to preserve clinical services at the expense of administrative and support functions.

Back to Top

Safety Net Provider Strategies to Stay Viable

![]() ven as they are able to expand in some areas, safety net

providers reported more financial strain in 2008-09 than previous years. They

have pursued a variety of strategies to increase revenues and reduce costs to

maintain services and remain financially viable. Providers were redoubling efforts

to earn more for each patient visit by increasing identification and enrollment

of uninsured patients eligible for Medicaid or other public insurance and by

improving collections from public and private insurers. Some providers also

were trying to collect more through patient fees and donations. For instance,

a Newark hospital added a $25-$50 fee per dental visit. Even a free clinic in

Phoenix—which normally doesn’t charge for services—has become more

proactive in asking for patient donations—typically $10.

ven as they are able to expand in some areas, safety net

providers reported more financial strain in 2008-09 than previous years. They

have pursued a variety of strategies to increase revenues and reduce costs to

maintain services and remain financially viable. Providers were redoubling efforts

to earn more for each patient visit by increasing identification and enrollment

of uninsured patients eligible for Medicaid or other public insurance and by

improving collections from public and private insurers. Some providers also

were trying to collect more through patient fees and donations. For instance,

a Newark hospital added a $25-$50 fee per dental visit. Even a free clinic in

Phoenix—which normally doesn’t charge for services—has become more

proactive in asking for patient donations—typically $10.

Many providers were also trying to become more efficient. Some providers have identified or negotiated savings in supply costs. Safety net providers in Phoenix reported that the recession has spurred commercial real estate vacancies, bringing rental prices down. As one CHC director said, “There are some great deals out there, and we’re trying to take advantage of those as our leases come up [for renewal].”

Most providers reported trying to control labor costs, a significant portion of their operating budgets. Varied degrees of layoffs or reductions through attrition were reported in all of the communities, especially at safety net hospitals and free clinics, although wage freezes were more common. Some staffing reductions have been significant—for example the county hospital in Cleveland cut more than 300 positions, mainly administrative employees, in the course of a year. Some safety net hospitals reported significantly reducing or eliminating overtime for nurses and the use of agency nurses, which offered staffing flexibility but are relatively expensive. Some of those slots have been replaced with regular full- or part-time nursing staff.

The recession has produced some benefits for providers that are retaining or increasing staff—especially FQHCs as they expand their service areas. Providers typically have found larger, more qualified applicant pools for financial and administrative positions, which they attribute to job losses in other sectors. Also, employees were more likely to stay in their positions than risk going elsewhere, which reduces providers’ recruiting and training costs and helps maintain a strong workforce. As one FQHC director described the benefits of employment for physicians compared with running a private practice, “It’s guaranteed work and salary. That seems to be satisfying to [physicians] right now, so our turnover costs are lower.”

Policy Implications

![]() lthough safety net providers in the five communities so far have weathered the economic recession, the downturn has placed additional strain on already-limited capacity and tenuous financial situations. Despite expansions over the past decade, many health centers were at full capacity, limiting their ability to accept new patients and causing longer waits for care. Further, the effects of the recession are highly localized, and some safety net hospitals outside the five communities have encountered significant financial problems and service cutbacks.

lthough safety net providers in the five communities so far have weathered the economic recession, the downturn has placed additional strain on already-limited capacity and tenuous financial situations. Despite expansions over the past decade, many health centers were at full capacity, limiting their ability to accept new patients and causing longer waits for care. Further, the effects of the recession are highly localized, and some safety net hospitals outside the five communities have encountered significant financial problems and service cutbacks.

The safety nets studied have been helped by federal stimulus funding, organizational strategies to reduce costs, and some unexpected benefits related to cost savings and staff recruiting and retention. Without funding assistance through ARRA, many people likely would have lost Medicaid coverage as states reduced eligibility to balance their budgets, and both safety net hospitals and health centers would have had more difficulty meeting increased demand as people lost their jobs and health insurance. Yet, states that tried to expand coverage beyond Medicaid—such as Washington—or at least provide some funding for safety net services have lost ground as they struggle with ongoing deficits.

Also, safety net providers were concerned that they have not yet felt the full impact of the recession. Unemployment and uninsured rates will likely remain high for some time despite some signs of an economic recovery at the end of 2009. These greater demands on safety net providers may persist even as federal stimulus funding ends. While Congress recently extended COBRA coverage subsidies from nine to 15 months, ARRA provisions for increased FMAP, DSH funding and health center grants will end at various points in 2010 and 2011. State and local budgets are unlikely to fully recover by then to offset the loss of federal subsidies, and many state governments will have other spending priorities. Moreover, the timing of multi-year grant cycles may be such that some providers begin to experience reductions in private grants and donations in the next year or two to a greater extent.

Thus, safety net providers are likely to continue to experience significant, and potentially increasing, financial pressures. Many safety net providers will successfully adapt to these circumstances as they have in the past, but it is unlikely that they will be able to expand capacity enough to meet the higher demand for care by the unemployed and uninsured that will linger even after the recession is technically over. Also, the creative strategies that safety net providers have used in the past to adapt to higher demand and financial constraints can only go so far. As a Seattle FQHC director explained, “We’re working hard every place we can see, in our intake system, in the way we triage folks, we’re doing our best to do more with less, but you can only do so much of that.”

Back to Top

Notes

| 1. | Holahan, John, and A. Bowen Garrett, Rising Unemployment, Medicaid and the Uninsured, Kaiser Commission on Medicaid and the Uninsured, Washington, D.C. (January 2009). |

| 2. | McNichol, Elizabeth, and Iris J. Lav, State Budget Troubles Worsen, Center on Budget and Policy Priorities (CBPP), Washington, D.C. (March 13, 2009); U.S. Congress, H.R. 1: American Recovery and Reinvestment Act of 2009, Washington, D.C. (February 2009). |

| 3. | Felland, Laurie E., et al., “The Resilience of the Health Care Safety Net 1996-2001,” Health Services Research, No. 38, Issue 1 (Part II)(February 2003). |

| 4. | Hurley, Robert E., Aaron Katz, and Laurie E. Felland, Relief, Restoration and Reform: Economic Upturn Yields Modest and Uneven Health Returns, Issue Brief No. 117, Center for Studying Health System Change, Washington, D.C. (January 2008). |

| 5. | “Still Going After Them: America’s Toughest Sheriff is Still Hunting Illegals,” The Economist (Oct. 24, 2009). |

| 6. | Felland, Laurie E., Robert E. Hurley and Nicole M. Kemper, Safety Net Hospital Emergency Departments: Creating Safety Valves for Nonurgent Care, Issue Brief No. 120, Center for Studying Health System Change, Washington, D.C. (May 2008). |

| 7. | National Association of Community Health Centers, Recession Brings More Patients to Community Health Centers, Fact Sheet No. 0209, Washington, D.C. (September 2009). |

| 8. | Hewitt Associates, “Hewitt Research Continues to Show High Rate of COBRA Enrollments Among Subsidy-Eligible Employees,” Press Release (Dec. 23, 2009). |

| 9. | National Association of Public Hospitals and Health Systems, Safety Net Health Systems: An Essential Resource During the Economic Recession, Washington, D.C. (August 2009). |

| 10. | National Governors Association, National Association of State Budget Officers, The Fiscal Survey of States, Washington, D.C. (December 2009); Lav, Iris J., et al., Recovery Act Provides Much-Needed, Targeted Medicaid Assistance to States, CBPP, Washington, D.C. (Feb. 13, 2009). |

| 11. | Kaiser Family Foundation, Federal Matching Rate (FMAP) for Medicaid with American Recovery and Reinvestment Act (ARRA) Adjustments, FY2009, www.statehealthfacts.gov (accessed Jan. 6, 2010). |

| 12. | Lav, Iris J., et al. (Feb. 13, 2009). |

| 13. | Ho, Vanessa, “Basic Health Wait List Will Soon Surpass Enrollees,” Seattle Post-Intelligencer (Nov. 17, 2009). |

Back to Top

Data Source

Five study communities—Cleveland; Greenville, S.C.; northern New Jersey; Phoenix; and Seattle—were selected from the 12 Community Tracking Study (CTS) sites for their geographic and economic diversity, which was assessed using such indicators as unemployment and size of the state FY 2009 budget gap. Between June and September 2009, a total of 45 telephone interviews were conducted with representatives of safety net hospitals, community health centers, free clinics and other knowledgeable observers in the five communities, as well as with national experts. Respondents were asked about the impact of the economic recession on safety net providers between July 2008 and July 2009. A two-person research team conducted each interview, and notes were transcribed and jointly reviewed for quality and validation purposes. The interview responses were coded and analyzed using Atlas.ti, a qualitative software tool.

Funding Acknowledgement:

This research was funded by the Robert Wood Johnson Foundation.

Back to Top

RESEARCH BRIEFS are published by the Center for Studying Health System

Change.

600 Maryland Avenue, SW, Suite 550

Washington, DC 20024-2512

Tel: (202) 484-5261

Fax: (202) 484-9258

www.hschange.org