Rising Costs Pressure Employers, Consumers in Northern New Jersey Health Care Market

Community Report No. 4

Winter 2003

Debra A. Draper, John F. Hoadley, Jessica Mittler, Sylvia Kuo, Gloria J. Bazzoli, Peter J. Cunningham, Len M. Nichols

Rapidly rising health care costs continue to permeate the northern New Jersey health care market, driven largely by escalating hospital payment rates, increasing utilization of health care services and rising pharmaceutical costs. Confounding these problems is a new medical malpractice insurance crisis that has prompted physicians to seek higher payment rates from health plans to offset financial pressure from rising malpractice premiums. Meanwhile, as health plans have fewer options to control costs, employers are confronting steep health insurance premium increases, but a strong union influence and employee preferences for less restrictive insurance products has limited their response.

Other notable developments are::- Hospitals’ financial health improved considerably over the past two years, although urban safety net hospitals remain financially fragile.

- Health plans are challenged to control rising utilization, but they also are moving back toward fee-for-service payment arrangements for primary care physicians, which threatens to weaken provider financial incentives to control service use.

- Unprecedented demand has halted growth in public insurance coverage, and a $5 billion state budget deficit may prompt rollbacks.

- Hospitals’ Financial Health

- Malpractice Crisis Puts Pressure on Physicians

- Health Plans Challenged to Control Costs

- Employers Seek Relief, but See Few Options

- Safety Net Support Remains Strong Despite Budget Woes

- Issues to Track

- Northern New Jersey Consumers’ Access to Care, 2001

- Background and Observations

Hospitals’ Financial Health Shows Dramatic Improvement

![]() fter several years of red ink, efforts by New Jersey hospitals

to bolster their bottom lines have paid off. The New Jersey Hospital Association

reports combined earnings of $320 million for 2000 and 2001 for all hospitals

in the state, a sharp contrast to the collective loss of $429 million reported

for 1998 and 1999. Hospitals in northern New Jersey report similar financial

improvement. The market’s two largest hospital systems—predominantly suburban

St. Barnabas Health System (nine hospitals) and Atlantic Health System (four

hospitals)—each incurred losses in 1998 and 1999, but reported profits

in 2000 and 2001.

fter several years of red ink, efforts by New Jersey hospitals

to bolster their bottom lines have paid off. The New Jersey Hospital Association

reports combined earnings of $320 million for 2000 and 2001 for all hospitals

in the state, a sharp contrast to the collective loss of $429 million reported

for 1998 and 1999. Hospitals in northern New Jersey report similar financial

improvement. The market’s two largest hospital systems—predominantly suburban

St. Barnabas Health System (nine hospitals) and Atlantic Health System (four

hospitals)—each incurred losses in 1998 and 1999, but reported profits

in 2000 and 2001.

While the financial health of urban safety net hospitals also improved, it continues to be comparatively more fragile than that of suburban hospitals. Two large urban safety net hospitals in Newark, state-owned University Hospital and Cathedral Health System, report improved financial performance. University Hospital, for example, reports moving from operating losses in 2000 to profitability in 2001 and 2002, aided in part by increased state funding for charity care services and more patients with Medicaid reimbursement. Cathedral Health System also reports improved financial performance. There are concerns, however, that the state’s budget crisis may lead to cuts that would jeopardize these gains, particularly as the recent economic downturn threatens to increase demand for safety net services.

Consolidation—and resulting gains in negotiating leverage—has been an important factor contributing to improved financial performance for northern New Jersey’s suburban hospitals. Notably, systems leveraged the must-have status of flagship hospitals, such as St. Barnabas Medical Center (St. Barnabas Health System) and Morristown Memorial Hospital (Atlantic Health System), to secure payment rate increases for all of the hospitals in their respective systems. In addition, prominent local hospitals continue to threaten contract termination to negotiate favorable terms. Two years ago, they successfully used this tactic to secure higher payment rates and, in turn, signed multiyear contracts that promised health plans and consumers greater network stability. More recently, several northern New Jersey hospitals have notified plans that they intend to terminate these contracts when the current multiyear contract period expires in 2004 or beyond, so they can force negotiations with plans to begin well in advance of this date.

To strengthen their market position further, hospitals are refurbishing existing facilities and, in some cases, bringing new capacity online to establish themselves as the preferred choice of patients. Although the northern New Jersey market has long had excess capacity, demand for more suburban services has created pockets of constrained capacity and has spurred this higher-than-normal expansion activity. St. Barnabas Health System has rebuilt and expanded eight of its nine emergency departments and plans to rebuild the ninth in the near future. In addition, it has expanded selected services such as obstetrics in some of its facilities. Atlantic Health System has added capacity as well in three of its four emergency departments and has expanded ambulatory surgery and pediatric and cardiac services capacity at Morristown Memorial Hospital.

Despite capacity expansions, hospitals continue to face a shortage of health care personnel, particularly nurses. In addition to raising salaries, they are addressing the shortage by expanding the use of nurse extenders, offering nursing scholarships and recruitment programs, relying on visiting and agency nurses and hiring foreign nurses. However, these staffing alternatives are more expensive than in-house staff.

Malpractice Crisis Puts Pressure on Physicians

![]() hysicians have faced mounting financial pressure from an emerging medical malpractice insurance crisis in New Jersey.

hysicians have faced mounting financial pressure from an emerging medical malpractice insurance crisis in New Jersey.

Malpractice premiums have risen rapidly over the past year, increasing 30 percent or more,with some specialists facing even higher increases. The crisis has been prompted in large part by the insolvency of a large insurer, Medical Inter-Insurer Exchange (MIIX), which insured nearly 40 percent of the state’s practicing physicians. Financial problems arose when MIIX, which originally operated only in New Jersey, expanded rapidly to include approximately 20 other states, most of which were unprofitable. MIIX is now attempting to resurrect itself in part by assessing large premium increases.

Meanwhile, other insurers also raised their rates. For example, Princeton Insurance Company, which insures about a third of the state’s practicing physicians, increased its rates by comparable levels. Angered by the rise in malpractice insurance rates, physicians recently staged a work stoppage and are canceling some routine visits and tests to prod state policy makers to address the issue. Hospitals are responding to the work stoppage by allocating additional staff to their emergency rooms to care for affected patients.

Growing pressure from rapidly rising malpractice premiums is driving local physicians to seek higher payment rates from health plans, a situation also fueled by recent Medicare payment cuts. However, the northern New Jersey physician market remains highly fragmented, with the majority of physicians continuing to practice solo or in small practice groups (two or three physicians). As a result, they have not had the same level of clout as hospitals, and their recent efforts to gain higher payment rates have met with limited success.

In other efforts to shore up their revenue, some physicians are investing in specialty facilities, such as ambulatory surgery centers (ASCs), that allow them to supplement standard professional fees with profits from facility fees. Often, these activities are in direct competition with hospitals, and physician-hospital relationships have become increasingly contentious as a result. For example, surgeons from Atlantic Health System’s Overlook Hospital opened an ASC two miles from the hospital, placing it in direct competition with a similar hospital-owned center. The hospital’s relationship with these surgeons has been strained as both compete for patients, nursing staff and referrals.

Atlantic Health System averted a similar situation at Morristown Memorial Hospital by selling surgeons a 50 percent ownership share of an existing hospital-owned, freestanding ASC. Hospitals are increasingly concerned about the financial impact of physician-owned specialty facilities because these facilities tend to pull out hospitals’ more profitable services and limit their ability to cross-subsidize other services, such as charity care.

Health Plans Challenged to Control Costs

![]() s their bargaining power with providers weakens, northern New Jersey’s health plans

are increasingly limited in their capacity to control health care costs. Demand for broad networks and less restrictive products

constrains health plans’ ability to control provider payment rates. At the same time, provider leverage and changes in product

offerings have further reduced what little capitation had been in the market, and plans that still have capitated primary

care physician payment arrangements are increasingly moving back to fee-for-service.

s their bargaining power with providers weakens, northern New Jersey’s health plans

are increasingly limited in their capacity to control health care costs. Demand for broad networks and less restrictive products

constrains health plans’ ability to control provider payment rates. At the same time, provider leverage and changes in product

offerings have further reduced what little capitation had been in the market, and plans that still have capitated primary

care physician payment arrangements are increasingly moving back to fee-for-service.

Hospitals also are beginning to push for and receive payment arrangements based on percent of charges instead of per diems. Preferred provider organizations (PPOs), in particular, noted this trend, adding that hospitals also are increasing their charges significantly, which is driving up costs. It is unclear whether the move to percent of charges and fee-for-service payment is influencing practice patterns or service use in the market, even though these payment methodologies change incentives for providers.

With diminishing influence over provider payment, plans increasingly are turning to utilization and care management efforts to control costs. Although there was some movement away from more aggressive utilization management activities, such as preauthorization, two years ago, plans are reinstating these requirements selectively for services where utilization trends are escalating rapidly, such as for physical therapy and chiropractic services.

Plans also are intensifying care management efforts that focus on the small percentage of enrollees who account for the majority of costs. These efforts provide more intensive intervention through case management and disease management activities. In some instances, northern New Jersey plans are launching these initiatives under contracts with specialty pharmacy vendors who offer disease-specific clinical expertise and deeper discounts than those available through plans’ pharmacy benefit management companies.

In addition to these cost-control efforts, plans are pursuing other strategies to improve profitability. On the commercial side, plans report more aggressive underwriting of high-risk business by raising premiums significantly. Plans also continue to assess the financial viability of their participation in public sector programs such as Medicare. Although five plans continue to participate in Medicare+Choice in the state, they often limit their participation, sometimes to a single county. Horizon Blue Cross and Blue Shield and Aetna remain the two largest participating plans and, as of January 2003, both introduced Medicare PPO products under the new federal demonstration project aimed at increasing enrollment in Medicare managed care options.

In Medicaid, changes in plan ownership dominated the landscape. In 2002, United Healthcare acquired AmeriChoice, and Centene acquired University Health Plans. Statewide, nearly 250,000 Medicaid and State Children’s Health Insurance Program (SCHIP) beneficiaries saw their plans change ownership as a result of these acquisitions, representing nearly half of those enrolled in Medicaid managed care. In early 2003, Horizon Blue Cross and Blue Shield acquired full ownership of Horizon/Mercy, the largest Medicaid managed care plan in the state with more than 280,000 enrollees, by buying out its 50 percent joint venture partner,Mercy Health Plan. However, because these ownership changes did not affect provider networks, they did not cause enrollees significant disruptions in care.

Finally, passage of legislation clearing the way for Horizon Blue Cross and Blue Shield to convert to for-profit status promises more change to come for New Jersey health plans and the health care market as a whole. The conversion, which is expected to occur sometime during 2003, will leave only for-profit health plans operating in the northern New Jersey market, including some of the nation’s largest plans, such as United and Aetna. Some anticipate that Horizon will become an acquisition target for multistate Blues plans, such as Wellpoint or Anthem, which may diminish local leadership and potentially pave the way for more aggressive negotiations with providers.

Also the subject of much controversy is the $1.5 billion to $2 billion conversion fund. Some worry that this fund will be used to offset potential state budget cuts in health-related programs, thus forgoing the opportunity to create a private foundation that might support access initiatives over the long term.

Employers Seek Relief, but See Few Options

![]() acing declining profits in a weak economy, northern New

Jersey employers are frustrated by rising premiums and the limited ability of

plans to control provider payment rates and utilization. However, strong union

influence in the area has limited employers’ options to respond. Nearly 20 percent

of northern New Jersey’s workforce is unionized, and unions historically have

negotiated rich benefit packages with very low cost-sharing requirements. Moreover,many

unionized workers are covered under multiyear contracts that limit how frequently

employers can change their health benefits. Finally, while the labor market

has softened over the past two years, employers remain attentive to general

consumer preferences for broad networks and less restrictive insurance products,

which further constrains their response to premium increases.

acing declining profits in a weak economy, northern New

Jersey employers are frustrated by rising premiums and the limited ability of

plans to control provider payment rates and utilization. However, strong union

influence in the area has limited employers’ options to respond. Nearly 20 percent

of northern New Jersey’s workforce is unionized, and unions historically have

negotiated rich benefit packages with very low cost-sharing requirements. Moreover,many

unionized workers are covered under multiyear contracts that limit how frequently

employers can change their health benefits. Finally, while the labor market

has softened over the past two years, employers remain attentive to general

consumer preferences for broad networks and less restrictive insurance products,

which further constrains their response to premium increases.

Although cost-sharing requirements are increasing, they remain very low in comparison to other markets. For example, while employers elsewhere have generally adopted a three-tier pharmacy benefit design, which typically involves progressively higher cost-sharing requirements for preferred brand and nonpreferred brand drugs, take-up rates have been lower among northern New Jersey employers.

In part because of the difficulty of shifting more financial burden onto their employees, northern New Jersey employers have shown little interest in alternative product offerings, such as consumer directed products, that promise to make consumers more cost conscious in their use of health care services. Although employers believe these products, which generally have a high front-end deductible with a personal spending account, would offer them greater predictability in their health care spending, they are not optimistic that employees would accept them or have the information available to make choices about cost and quality of care that would be necessary under this benefit design.

Safety Net Support Remains Strong Despite Budget Woes

![]() ew Jersey has expanded eligibility for public insurance programs extensively over

the past few years, but the state’s budget crisis jeopardizes many of these gains. Following a series of expansions, eligibility

levels under New Jersey’s Medicaid and FamilyCare (as SCHIP is now called there) programs are among the most generous

nationally, with approximately 800,000 people covered:

ew Jersey has expanded eligibility for public insurance programs extensively over

the past few years, but the state’s budget crisis jeopardizes many of these gains. Following a series of expansions, eligibility

levels under New Jersey’s Medicaid and FamilyCare (as SCHIP is now called there) programs are among the most generous

nationally, with approximately 800,000 people covered:

- Between 1998 and 2000, the state expanded SCHIP eligibility for children up to 200 percent and then 350 percent of the federal poverty level, extending coverage to children in families of four, for example,with annual incomes of up to nearly $62,000.

- In January 2001, the state received a federal waiver to add coverage for parents of SCHIP children up to 200 percent of the federal poverty level, reaching adults in families of four, for example, with annual incomes of up slightly more than $35,000.

- The state also expanded FamilyCare coverage to include childless adults up to 100 percent of the federal poverty level, using state funds, including tobacco settlement monies, to finance the initiative.

The state’s ambitious plans were not realized entirely, however. New Jersey experienced unprecedented demand for coverage when it expanded the FamilyCare program to adults, reaching its initial target of 125,000 new enrollees in just nine months. In response, the state froze new enrollment for adults and, faced with a $5 billion state budget deficit, is now trying to fend off further erosion of its expansion efforts. It filed a Medicaid waiver under federal Health Insurance Flexibility and Accountability demonstration guidelines, which was recently approved. The waiver proposes reducing benefits for adults enrolled in FamilyCare to a level comparable to the largest commercial managed care plan in the state. This would result in lower or no coverage for dental services, medical supplies, durable medical equipment and home health services as well as higher premiums. In return, the state proposes to process the SCHIP applications for adults that were in the queue—approximately 12,000 people—when enrollment was frozen.

Meanwhile, as the state confronts a significant budget deficit, there are concerns that funding cuts could jeopardize other recent improvements in northern New Jersey’s safety net. Providers and state policy makers note that New Jersey’s coverage expansions have led to a decline in demand for charity care services. The state hospital association reports hospital charity care claims dropped by 7 percent statewide—decreasing from $624 million in 2000 to $580 million in 2001—and are expected to drop again in 2002. In addition, a $61 million increase to the state’s now $381 million charity care pool, funded in part by a cigarette tax increase, helped to improve reimbursement for this care.

University Hospital, a key safety net hospital in Newark, reports improvements in its charity care accounting and reporting system, which helped it to secure increased reimbursement from the state pool in 2002. Some hospitals in northern New Jersey, however, saw decreases in charity care funding during this same year as a result of reporting changes by other hospitals and the resulting impact on the funding formula. Despite the state’s past financial commitment to the safety net, budget woes now threaten to erode the level of this support, leaving the long-term fiscal health of the safety net tenuous in light of the increased demand expected for these services.

Issues to Track

![]() apid growth in health care costs continues to shape northern

New Jersey’s health care system. Hospitals are increasingly pushing for—and

winning—payment rate increases and other changes in payment methodologies

that are leaving plans with fewer options to manage costs. Meanwhile, as physicians

experience financial pressure from rapidly rising malpractice premiums and Medicare

payment cuts, they are pursuing more new business ventures that put them in

direct competition with hospitals for key specialty services, that threaten

to limit hospitals’ ability to cross-subsidize less profitable services. Employers

face large premium increases, but union contracts and sustained consumer demand

for limited cost sharing and less restrictive products limit how they can respond.

All of this comes at a time when the state faces severe budget constraints that

eventually may force a retreat from generous coverage expansions and recently

increased financial support for the safety net.

apid growth in health care costs continues to shape northern

New Jersey’s health care system. Hospitals are increasingly pushing for—and

winning—payment rate increases and other changes in payment methodologies

that are leaving plans with fewer options to manage costs. Meanwhile, as physicians

experience financial pressure from rapidly rising malpractice premiums and Medicare

payment cuts, they are pursuing more new business ventures that put them in

direct competition with hospitals for key specialty services, that threaten

to limit hospitals’ ability to cross-subsidize less profitable services. Employers

face large premium increases, but union contracts and sustained consumer demand

for limited cost sharing and less restrictive products limit how they can respond.

All of this comes at a time when the state faces severe budget constraints that

eventually may force a retreat from generous coverage expansions and recently

increased financial support for the safety net.

Key issues include:

- Will hospitals maintain the upper hand in negotiations with health plans, or will plans regain some leverage as employers renegotiate their health benefits? What effect, if any, will the Horizon Blue Cross and Blue Shield conversion have on plans’ leverage in the local market?

- How will rising medical malpractice premiums and Medicare payment cuts ultimately affect physician supply and the stability of provider networks? How, if at all, will the state intervene in the medical malpractice crisis?

- Will employers succeed in getting employees to pay a higher share of costs in their next round of benefits negotiations? If so, will demand for more tightly managed or consumer-directed products increase?

- How will the state’s budget crisis play out? Will the state sustain support for the safety net and public insurance programs? Will it elect to use funds from the pending conversion of Horizon Blue Cross and Blue Shield to support its efforts?

Northern New Jersey Consumers’ Access to Care, 2001

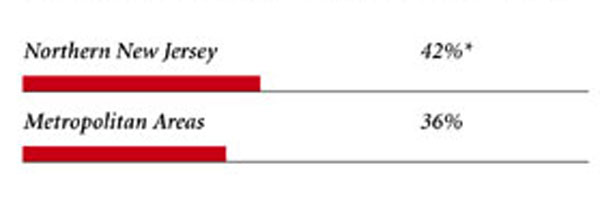

Northern New Jersey compared to metropolitan areas with over 200.000 population

| Unmet Need |

| PERSONS WHO DID NOT GET NEEDED MEDICAL CARE DURING THE LAST 12 MONTHS |

|

| Delayed Care |

| PERSONS WHO DELAYED GETTING NEEDED MEDICAL CARE DURING THE LAST 12 MONTHS |

|

| Out-of-Pocket Costs |

| PRIVATELY INSURED PEOPLE IN FAMILIES WITH ANNUAL OUT-OF-POCKET COSTS OF $500 OR MORE |

|

| Access to Physicians |

| PHYSICIANS WILLING TO ACCEPT ALL NEW PATIENTS WITH PRIVATE INSURANCE |

|

| PHYSICIANS WILLING TO ACCEPT ALL NEW MEDICARE PATIENTS |

|

| PHYSICIANS WILLING TO ACCEPT ALL NEW MEDICAID PATIENTS |

|

| PHYSICIANS PROVIDING CHARITY CARE |

|

| * Site value is significantly different from the mean for large metropolitan

areas over 200,000 population at p<.05. † Indicates a 12-site low. Source: HSC Community Tracking Study Household and Physician Surveys, 2000-01 Note: If a person reported both an unmet need and delayed care, that person is counted as having an unmet need only. Based on follow-up questions asking for reasons for unmet needs or delayed care, data include only responses where at least one of the reasons was related to the health care system. Responses related only to personal reasons were not considered as unmet need or delayed care. |

Background and Observations

| Northern New Jersey Demographics | |

| Northern New Jersey | Metropolitan areas 200,000+ population |

| Population1 2,041,824 |

|

| Persons Age 65 or Older2 | |

| 12% | 11% |

| Median Family Income2 | |

| $37,636 | $31,883 |

| Unemployment Rate3 | |

| 5.7% | 5.8% |

| Persons Living in Poverty2 | |

| 10% | 12% |

| Persons Without Health Insurance2 | |

| 12% | 13% |

| Age-Adjusted Mortality Rate per 1,000 Population4 | |

| 8.8 | 8.8* |

* National average. Sources: |

|

| Health Care Utilization | |

| Northern New Jersey | Metropolitan areas 200,000 population |

| Adjusted Inpatient Admissions per 1,000 Population 1 | |

| 203 | 180 |

| Persons with Any Emergency Room Visit in Past Year 2 | |

| 18% | 19% |

| Persons with Any Doctor Visit in Past Year 2 | |

| 81% | 78% |

| Average Number of Surgeries in Past Year per 100 Persons 2 | |

| 17 | 17 |

| Sources: 1. American Hospital Association, 2000 2. HSC Community Tracking Study Household Survey, 2000-01 |

|

| Health System Characteristics | |

| Northern New Jersey | Metropolitan areas 200,000+ population |

| Staffed Hospital Beds per 1,000 Population1 | |

| 4.0 | 2.5 |

| Physicians per 1,000 Population2 | |

| 2.2 | 1.9 |

| HMO Penetration, 19993 | |

| 25% | 38% |

| HMO Penetration, 20014 | |

| 31% | 37% |

| Medicare-Adjusted Average per Capita Cost (AAPCO) Rate, 20025 | |

| $608 | $575 |

| Sources: 1. American Hospital Association, 2000 2. Area Resource File, 2002 (includes nonfederal, patient care physicians, except radiologists, pathologists and anesthesiologists) 3. InterStudy Competitive Edge, 10.1 4. InterStudy Competitive Edge, 11.2 5. Centers for Medicare and Medicaid Services. Site estimate is payment rate for largest county in site; national estimate is national per capita spending on Medicare enrollees in Coordinated Care Plans in December 2002. |

|

Debra A. Draper,Mathematica Policy Research, Inc.; John F.Hoadley,

Georgetown University; Jessica Mittler,Mathematica Policy Research, Inc.;

Sylvia Kuo,Mathematica Policy Research, Inc.; Gloria J. Bazzoli,

Virginia Commonwealth University; Peter J. Cunningham, HSC; Len Nichols, HSC

President: Paul B. Ginsburg

Director of Site Visits: Cara S. Lesser

Director of Public Affairs: Richard Sorian

Editor: The Stein Group

600 Maryland Avenue SW, Suite 550, Washington, DC 20024-2512

Tel: (202) 554-7549 (for publication information)

Tel: (202) 484-5261 (for general HSC information)

Fax: (202) 484-9258

www.hschange.org