Community Report No. 12

December 2011

Aaron Katz, Grace Anglin, Emily Carrier, Marisa K. Dowling, Lucy B. Stark, Tracy Yee

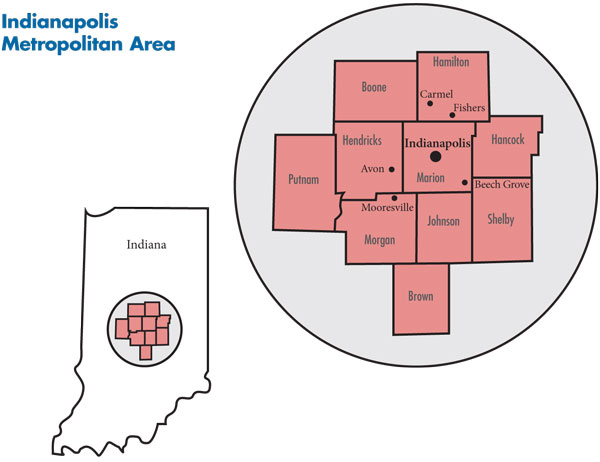

In September 2010, a team of researchers from the Center for Studying Health System Change (HSC), as part of the Community Tracking Study (CTS), visited Indianapolis to study how health care is organized, financed and delivered in that community. Researchers interviewed more than 50 health care leaders, including representatives of major hospital systems, physician groups, insurers, employers, benefits consultants, community health centers, state and local health agencies, and others. The Indianapolis metropolitan area encompasses Boone, Brown, Hamilton, Hancock, Hendricks, Johnson, Marion, Morgan, Putnam and Shelby counties.

Unlike many other communities, the Indianapolis metropolitan area emerged relatively unscathed from the Great Recession. The region has experienced above-average population growth and lower-than-average unemployment and uninsurance rates in recent years. The good financial health of some local businesses—notably those in the health care and life-sciences industries—likely contributed to this relatively strong local economic picture. Still, the recession took a toll, with unemployment rising more recently. And, in an effort to contain health benefit costs, employer interest in consumer-driven health plans (CDHPs)—high-deductible plans tied to a tax-advantaged savings account—remains strong.

The area’s major hospital systems continue to encroach on each other’s traditional territories, engaging in a battle of bricks and mortar in suburban areas as they compete for well-insured patients. The hospital systems also are continuing to build stronger relationships with physicians, and while employment of primary care physicians is well established, employment of specialists is picking up momentum. Despite challenges brought by the recession and resulting state budget and program cuts, safety net providers have expanded capacity and services.

Key developments include:

- Robust Health Care Industry Buffers Recession Fallout

- Hospitals Expand in Suburban Areas

- Hospitals and Physicians Grow Closer

- High-Deductible Plans Take Hold

- Health Plan Competition Weakens

- Safety Net Capacity Expands

- Public Insurance Programs’ Future Uncertain

- Mixed Views on Health Reform

- Issues to Track

- Background Data and Funding Acknowledgement

Robust Health Care Industry Buffers Recession Fallout

![]() he sprawling Indianapolis metropolitan area encompasses 10 counties and is home to about 1.8 million people (see map). The area saw population growth of 7.4 percent between 2004 and 2009, much faster than most other large metropolitan areas. While unemployment rose from 5.1 percent in 2008 to 8.7 percent by September 2010—compared to 9.4 percent for metropolitan areas—the presence of strong health care and life-sciences sectors appears to have buffered the local economy to some degree. Indeed, the region has a relatively large number of health care resources, with more hospital beds and physicians than the average metropolitan area, and longer hospital stays.

he sprawling Indianapolis metropolitan area encompasses 10 counties and is home to about 1.8 million people (see map). The area saw population growth of 7.4 percent between 2004 and 2009, much faster than most other large metropolitan areas. While unemployment rose from 5.1 percent in 2008 to 8.7 percent by September 2010—compared to 9.4 percent for metropolitan areas—the presence of strong health care and life-sciences sectors appears to have buffered the local economy to some degree. Indeed, the region has a relatively large number of health care resources, with more hospital beds and physicians than the average metropolitan area, and longer hospital stays.

Although Indianapolis residents are slightly younger on average, they tend to be sicker than residents of other large metropolitan areas, with higher rates of smoking, heart disease, asthma, weight problems and diabetes. Compared with other metropolitan areas, Indianapolis is less ethnically and racially diverse, with relatively small proportions of Latino and Asian residents.

Hospitals Expand in Suburban Areas

![]() our hospital systems serve the market, each with a flagship hospital in or near downtown Indianapolis, along with other hospitals and clinics in surrounding counties and, in some cases, elsewhere in the state. Indiana University Health (IU Health), formerly Clarian Health, is the largest system in the market, with almost 30 percent of inpatient admissions across six hospitals. IU Health also owns more than a dozen hospitals elsewhere in Indiana. The second largest system is St. Vincent Health, part of Ascension Health, the largest Catholic health system in the nation. St. Vincent owns seven hospitals in the market and 10 more around the state. Community Health Network, with five general hospitals and one specialty heart hospital, and Franciscan St. Francis Health System with three hospitals in the market, are the next largest systems. In addition to the four systems, Suburban Health Organization operates a network of seven independent hospitals ringing downtown Indianapolis. And, county-owned Wishard Health Services serves as the main safety net provider and regional provider of Level 1 trauma and burn services.

our hospital systems serve the market, each with a flagship hospital in or near downtown Indianapolis, along with other hospitals and clinics in surrounding counties and, in some cases, elsewhere in the state. Indiana University Health (IU Health), formerly Clarian Health, is the largest system in the market, with almost 30 percent of inpatient admissions across six hospitals. IU Health also owns more than a dozen hospitals elsewhere in Indiana. The second largest system is St. Vincent Health, part of Ascension Health, the largest Catholic health system in the nation. St. Vincent owns seven hospitals in the market and 10 more around the state. Community Health Network, with five general hospitals and one specialty heart hospital, and Franciscan St. Francis Health System with three hospitals in the market, are the next largest systems. In addition to the four systems, Suburban Health Organization operates a network of seven independent hospitals ringing downtown Indianapolis. And, county-owned Wishard Health Services serves as the main safety net provider and regional provider of Level 1 trauma and burn services.

Historically, each hospital system occupied a separate quadrant of the metropolitan area: IU Health in the central and western part of the market, including the affluent suburb of Avon; St. Vincent in the prosperous northern area of the market, including Carmel and Fishers; Community in the east; and both Community and St. Francis in relatively less-affluent southern areas, including Beech Grove and Mooresville. Because they operate hospitals in lower-income areas, Community Health Network and St. Francis have faced more financial challenges than the other systems.

However, hospitals’ geographic service areas have blurred in the last decade as the four hospital systems expand beyond central Indianapolis and encroach on one another’s market niches. The systems’ growth follows the migration of well-insured patients to growing, affluent suburban communities. At the same time, the four major systems have stepped up competition in areas historically dominated by independent community hospitals.

“It used to be that the hospital systems wouldn’t build near the other hospitals—there was an unspoken rule—but now they are right in each other’s backyards, and they are all vying for patients and are buying up smaller community hospitals,” one market observer said.

Hospitals have been free to build and renovate hospitals since the 1995 repeal of Indiana’s certificate-of-need law. According to a January 2010 Indiana Business Journal article, the Indianapolis area has added more than 900 staffed inpatient beds since 2000, a 17 percent increase. For example, as part of a $120-million expansion, Community completed a new inpatient tower at South Hospital and a several hundred-million-dollar renovation of Community North Hospital.

Competition is especially evident in areas where more than one hospital system is building new facilities. In the Fishers area, north of the city, for example, three competing systems have or are building facilities. Described by some observers as the “Exit 10 strategy,” referring to the construction proliferation near Interstate 69 in Fishers, Community has built a new ambulatory center, St. Vincent has a freestanding emergency department (ED) and IU Health is set to open Saxony Hospital, a replacement facility, in December 2011.

Construction slowed briefly during the 2007-09 recession but has bounced back to pre-recession levels. For example, IU Health restarted construction on Saxony Hospital after a pause, and St. Vincent added 100 inpatient beds and a new maternity ward to its Carmel facility and reportedly is planning to add two to four more freestanding EDs. After a delay, St. Francis resumed a $265-million replacement inpatient tower on its far south-side campus and is expanding its Mooresville campus to include a new ED, new orthopedics and medical-surgical beds, new operating rooms, and more space for staff cardiologists. In addition, St. Francis is planning to expand to Carmel with construction of a new short-stay medical center.

The major hospital systems also are moving into the market’s southwest quadrant through mergers and affiliations with existing facilities. For example, IU Health recently acquired Morgan Hospital and Medical Center, a county facility. The growing geographic competition between systems extends beyond the immediate market area, with St. Vincent prevailing over IU Health to merge with Dunn Memorial Hospital in Bedford. Community’s recently secured affiliation with Johnson Memorial Hospital in the southern Indianapolis suburbs was described in media reports as a victory over IU Health and other competitors. A merger with Westview Hospital on Indianapolis’s west side also will give Community a foothold in that part of the city.

As a result of new building, inpatient capacity across the market has increased, particularly in well-insured, suburban communities. Several observers suggested that the increased capacity is leading to rising utilization as hospitals seek to recoup investments by ensuring new facilities are running near capacity. For example, St. Vincent, which recently acquired a stake in The Care Group, an independent group of about 130 cardiologists, is promoting $49 computed tomography, or CT, scans on its website to screen patients for coronary artery disease; patients who screen positive would likely receive follow-up care from a St. Vincent-affiliated cardiologist.

Some observers believed the community as a whole is now overbuilt, with new growth aimed mainly at winning the allegiance of well-insured patients by providing greater convenience and amenities, such as private rooms.

Hospitals and Physicians Grow Closer

![]() any Indianapolis physicians—primary care and specialists—have long been employed by a hospital system or affiliated group, with relatively few independent physicians compared to other markets. IU Health is affiliated with Indiana University, which has the only medical school in the area—an osteopathic school is scheduled to open in 2012—and the more than 500-member physician group, IU Health Physicians. Indeed, IU Health’s name change from Clarian Health in January 2011 reportedly was an effort to rebrand the system as it moves toward more service integration and physician employment.

any Indianapolis physicians—primary care and specialists—have long been employed by a hospital system or affiliated group, with relatively few independent physicians compared to other markets. IU Health is affiliated with Indiana University, which has the only medical school in the area—an osteopathic school is scheduled to open in 2012—and the more than 500-member physician group, IU Health Physicians. Indeed, IU Health’s name change from Clarian Health in January 2011 reportedly was an effort to rebrand the system as it moves toward more service integration and physician employment.

Hospital systems in Indianapolis didn’t spin off owned primary care practices during the 1990s to the extent that many hospitals did around the country. Community Health Network is known for its long-established group of employed primary care physicians, Community Physicians of Indiana, which has about 180 physicians in 70 locations. St. Vincent owns a medical group of nearly 600 employed physicians across Indiana—one-third of them in primary care. While hospital employment of physicians is not new in the Indianapolis market, as in other markets, it has been increasing as physicians and hospitals face growing incentives to align.

Market observers reported that many physicians are seeking shelter from the financial pressures and uncertainties of independent practice through employment in large physician-owned practices or hospital-owned groups. In particular, smaller practices suffer from their inability to negotiate favorable payment rates from insurers and face the daunting costs of implementing electronic health records (see box on page 5 for more about health information technology development in the market). As a result, the number of independent solo- and two-physician practices in Indianapolis continues to fall, while a few slightly larger physician-owned, single-specialty groups—orthopedics, for example—have grown.

Hospitals look to employment of physicians as a way to strengthen referral networks through closer relationships with primary care and specialist physicians, particularly as the hospitals expand their geographic reach. St. Vincent recently acquired ownership stakes in The Care Group and OrthoIndy. Lacking the robust specialty networks of IU Health and St. Vincent and the large clinic network of Community, St. Francis plans to purchase several physician practices.

Still, hospitals and physicians expressed some concerns about becoming increasingly interdependent. Some physicians worried that the generous offers hospitals wooed them with will prove unsustainable, and they will have little leverage with their employers. At the same time, hospitals may fear that competition for physicians among the major health care systems could lead some physicians to leave for competitor hospitals. “Physicians can be fickle; without the latest technology, they could leave,” one respondent said.

Indianapolis in Vanguard of Health Information Technology Stemming from the market’s robust life-sciences industry, Indianapolis was an early pioneer in health information technology (HIT). The Indiana Health Information Exchange (IHIE) is cited by market observers as the key example of progress in HIT integration among providers. Created in 2004, the IHIE allows the sharing of patient information, such as test results, across providers through their electronic health records (EHRs), with a goal of improving care coordination, reducing duplicative services and reducing costs. IHIE was founded by the major Indianapolis hospital systems in collaboration with the Regenstrief Institute, an academically affiliated medical informatics organization, and has achieved wide participation by hospitals, health plans, community health centers and the county health department. A key IHIE initiative is the Quality Health First (QHF) Program, a physician quality measurement and reporting program launched in 2008 by the Employers’ Forum of Indiana—a coalition of large public and private employers, physicians, hospitals, public officials, and health plans. With the clinical data from IHIE, plus claims data from major public and private payers, QHF provides performance reports based on 10 primary care measures to physicians and health plans; these reports are not publicly available. Insurers can use these measures as the basis of pay-for-performance (P4P) programs, although Anthem is the only plan to do so to date. Reportedly approximately 1,200 primary care physicians (PCPs) in Indianapolis (about 80% of the PCPs in the market) participate in the Anthem program and receive bonuses of up to 10 percent above regular payment rates based on improvements in the measures. Anthem reportedly is developing similar P4P programs for cardiology and orthopedics. IHIE has expanded outside of the Indianapolis area and received a federal grant to aid adoption in other regions but continues to face challenges. Several respondents noted difficulties accessing other systems’ data and loading some data into providers’ EHRs, and the significant task of educating providers to use the system. To help sustain the system, in 2011, IHIE began charging a subscription fee to hospitals for access to IHIE’s clinical repository and clinical messaging services. Many observers expected that hospitals will continue to participate but may more closely scrutinize the value of the service. |

High-Deductible Plans Take Hold

![]() nthem Blue Cross and Blue Shield has long been the dominant health plan in Indianapolis, reportedly increasing its market share in the last five years. Anthem is followed in market share by UnitedHealth Group and ADVANTAGE Health Solutions.

nthem Blue Cross and Blue Shield has long been the dominant health plan in Indianapolis, reportedly increasing its market share in the last five years. Anthem is followed in market share by UnitedHealth Group and ADVANTAGE Health Solutions.

Consumer-driven health plans continue to grow in Indianapolis. Major private employers—notably Eli Lilly and Marsh Supermarkets—offer CDHPs exclusively. Also, public employers, including the state of Indiana and city of Indianapolis, have introduced CDHPs as an option. Approximately 85 percent of state employees are in a CDHP, while few public employers in other markets even offer CDHPs. Between 25 percent and 30 percent of Anthem’s commercial enrollees are in CDHPs paired with either a health savings account or a health reimbursement account, compared to the national average of 13 percent in 2010, according to the Kaiser Family Foundation and Health Research and Educational Trust 2010 Annual Survey of Employer Benefits.

The growth of CDHPs is a response to rising health benefit costs. In part because of limited union presence and leverage in the market, benefits provided by large and small employers historically have been less comprehensive than in other areas. Faced with increasing premiums and economic pressures from the recession, employers have shifted even more costs to employees through higher deductibles, coinsurance rates and a greater share of employee premium contributions.

In addition, large employers that offer coverage for pre-Medicare retirees are cutting their contributions to premiums, often to zero, and small employers are reducing their premium contributions for dependents of active employees and eliminating coverage for vision and dental care. Even with these cost shifts and benefit cuts, health care benefits appear to be less and less affordable for many small businesses.

Health plans have instituted some benefit innovations in recent years, mostly aimed at meeting demands from small employers for lower premiums. For example, Anthem and UnitedHealth Group have introduced the Essential plan and the Multi-Choice plan, respectively. Both high-deductible products aim to keep key characteristics of traditional benefit plans while lowering premiums for employers by, for example, offering four office visits with $25 copayments before the deductible and coinsurance take effect. Launched in 2007, United’s Multi-Choice plan allows small businesses to offer workers between two and 25 different product designs with varying levels of patient cost sharing. Also, in 2011, IU Health started a narrow-network product called IU Health Quality Partners Exclusive Provider Medical Plan.

Health Plan Competition Weakens

![]() ith little health plan competition historically, the Indianapolis commercial health insurance market has become more concentrated as plans have left the market. Notable exits include M Plan—primarily owned by IU Health—in 2008 and Principal—which exited the industry nationally—in 2010, as well as Humana, which still offers Medicare Advantage product. M Plan endorsed Anthem as its replacement carrier, with Anthem gaining the bulk of the exiting plan’s enrollment.

ith little health plan competition historically, the Indianapolis commercial health insurance market has become more concentrated as plans have left the market. Notable exits include M Plan—primarily owned by IU Health—in 2008 and Principal—which exited the industry nationally—in 2010, as well as Humana, which still offers Medicare Advantage product. M Plan endorsed Anthem as its replacement carrier, with Anthem gaining the bulk of the exiting plan’s enrollment.

Some observers indicated that Anthem’s size gives the plan more leverage to negotiate discounts with hospitals and physicians, giving Anthem a competitive edge over other health plans. This has remained true despite a 2007 state law banning so-called “most-favored-nation” clauses in health plan contracts. Anthem previously used such contracting clauses to require providers to guarantee Anthem the lowest rates charged to any payer. However, market observers reported the law has not stemmed Anthem’s ability to obtain the steepest discounts.

Although remaining a distant second to Anthem in market share, UnitedHealth Group has grown enrollment at a moderate pace in recent years, particularly among small groups. United also acquired additional business through the exit of smaller carriers. In response to recent plan exits, providers reportedly are offering United better discounts than in the past as a strategy to retain some health plan competition in the market.

Owned by St. Francis and St. Vincent, Advantage Health Solutions primarily offers health maintenance organization (HMO) products. In a turnaround from 2007, the plan has doubled its market share, though it still accounts for just 5 percent of the commercial market. With the exit of M Plan, Advantage was able to pick up business from employers that still wanted to offer an HMO product.

Safety Net Capacity Expands

![]() ishard Health Services and other Indianapolis safety net providers have remained relatively strong financially, allowing them to expand capacity to meet increased need for free or reduced-cost care. Wishard, part of the Health and Hospital Corporation of Marion County, which also operates the county health department, comprises a 313-bed hospital, 13 outpatient clinics and Midtown Community Mental Health Center, the area’s major outpatient mental health provider.

ishard Health Services and other Indianapolis safety net providers have remained relatively strong financially, allowing them to expand capacity to meet increased need for free or reduced-cost care. Wishard, part of the Health and Hospital Corporation of Marion County, which also operates the county health department, comprises a 313-bed hospital, 13 outpatient clinics and Midtown Community Mental Health Center, the area’s major outpatient mental health provider.

Following an aggressive campaign in 2009, Wishard received overwhelming public support for a $754-million bond issue to replace its aging hospital. The new hospital is expected to open by late 2013 and, in honor of a couple that donated $40 million, both the new hospital (in 2013) and entire Wishard system (in 2014) will be renamed after Sidney and Lois Eskenazi.

The new hospital will have about the same number of inpatient beds as the existing one, but with about a third less square footage. The plan for a smaller hospital is based on Wishard’s strategy to move services—especially primary and mental health care—from the system’s main campus into the community. Since 2007, the system has converted clinics into hospital outpatient clinics to reportedly gain higher Medicaid payment rates, allowing the system to expand to additional sites.

HealthNet, a federally qualified health center, provides a significant amount of primary care services. The health center used federal American Recovery and Reinvestment Act funds to expand to additional sites. HealthNet also participates in local initiatives to reduce hospital utilization and improve quality. For example, HealthNet is in discussions with IU Health and Wishard to start a medical-home pilot and help the hospital systems redirect patients from emergency departments.

Several other providers play important safety net roles as well: IU Health’s Methodist and Riley Children’s hospitals also treat large numbers of uninsured and Medicaid patients. After Wishard, Methodist is a main provider of inpatient services for low-income people within Indianapolis. Gennesaret Free Clinics, the area’s largest free clinic, provides care primarily to homeless people at several clinic sites as well as mobile clinics that visit shelters and food pantries. And, the Indianapolis market has an extensive network of about 90 school-based clinics.

Still, despite a relatively strong safety net, observers noted significant, ongoing access problems for low-income people. Access to dental care is poor in Indianapolis, though reportedly better than in other areas of the state where fewer dentists accept Medicaid patients. Specialty medical care is also a problem for low-income patients. One community strategy to address the problem is Project Health, which provides access to specialists who volunteer to provide some care to patients. Access to mental health care continues to be a huge unmet need, although initiatives by Wishard and HealthNet to integrate mental health care into primary care clinics hold promise.

Public Insurance Programs’ Future Uncertain

![]() oosier Healthwise is Indiana’s Medicaid and Children’s Health Insurance Program (CHIP) managed care program for children, pregnant women and low-income families. Hoosier Healthwise enrollment has grown about 10 percent annually in recent years, according to the Family and Social Services Administration (FSSA), the state Medicaid and CHIP agency. In 2008, the state Legislature expanded eligibility for children to 250 percent of the federal poverty level—$55,125 for a family of four in 2010.

oosier Healthwise is Indiana’s Medicaid and Children’s Health Insurance Program (CHIP) managed care program for children, pregnant women and low-income families. Hoosier Healthwise enrollment has grown about 10 percent annually in recent years, according to the Family and Social Services Administration (FSSA), the state Medicaid and CHIP agency. In 2008, the state Legislature expanded eligibility for children to 250 percent of the federal poverty level—$55,125 for a family of four in 2010.

A new state program, the Healthy Indiana Plan (HIP), is operated through a Medicaid Section 1115 waiver and funded by revenue from a cigarette tax increase and disproportionate share hospital (DSH) funds, which formerly went to hospitals to help cover the costs of caring for low-income people. The program provides high-deductible coverage to adults with incomes up to 200 percent of the poverty level who are ineligible for Medicaid. HIP includes an $1,100 health savings account (HSA) and $500 of free preventive care, as well as free mammograms and flu shots. Enrollees must contribute between 2 percent and 5 percent of their monthly gross income to the HSA. The state’s original enrollment goal for HIP was 140,000, but higher than expected costs have limited it to about 50,000 enrollees. Safety net hospitals reported that additional revenue from more insured patients has not matched their loss of DSH funds.

FSSA contracts with three managed care plans to serve Hoosier Healthwise and HIP enrollees: MDwise, Managed Health Services (MHS) Indiana and Anthem. Anthem is the newest player, entering the Medicaid market in 2007, and remains the smallest with about 170,000 enrollees statewide; MHS has about 212,000 and MDwise about 270,000. A rebidding of these contracts required plans to serve enrollees of both programs in an effort to better coordinate benefits for children and parents in the same family.

Like many states, Indiana’s budget is under pressure from declining revenues and rising spending, particularly for state health programs. In response, the state cut Medicaid hospital payment rates by five percent in November 2009, held payments to Medicaid and CHIP plans at previous levels through June 2011, and cut payments to its enrollment broker, MAXIMUS, reportedly by 10 percent to 15 percent. In addition, the state in 2010 reduced the scope of services and eligibility for Care Select, Indiana’s care management program for its Medicaid aged, blind and disabled population (exclusive of dual eligibles and the nursing home population), leading to a significant drop in enrollment from about 73,000 to 32,000 people.

Mixed Views on Health Reform

![]() espite Gov. Mitch Daniels’ opposition to federal health reform, FSSA is preparing for implementation of some aspects of the Patient Protection and Affordable Care Act (PPACA). Notably, the state is considering HIP as a possible vehicle for coverage expansions and planning for needed upgrades to Medicaid information systems. In addition, an FSSA task force is looking at changes needed in eligibility and claims payment systems, as well as design of a health insurance exchange.

espite Gov. Mitch Daniels’ opposition to federal health reform, FSSA is preparing for implementation of some aspects of the Patient Protection and Affordable Care Act (PPACA). Notably, the state is considering HIP as a possible vehicle for coverage expansions and planning for needed upgrades to Medicaid information systems. In addition, an FSSA task force is looking at changes needed in eligibility and claims payment systems, as well as design of a health insurance exchange.

Overall, respondents in Indianapolis voiced optimism about health care reform, especially the benefits of expanded coverage, but also concern that the health care system and state budget won’t be able to meet the increased demands. Safety net providers generally saw expanded coverage as a plus, as the care of more of their patients would be paid for. Some, however, worried that many of their uninsured patients would go to other providers when they became covered.

The largest health plans were educating employers and assessing how to comply with the health reform law. Concern was particularly high among health plans over how medical-loss ratios—the proportion of each premium dollar that must be spent on medical care—will be calculated under the federal reform law.

Health care reform also appears to have spurred discussions and actions concerning accountable care organizations (ACOs). One observer said IU Health’s group of nearly 600 physicians has a head start in moving toward this type of clinical integration and that this would force other physicians “to choose sides” among hospital systems. The respondent suggested that independent physicians—those “living on an island”—will find it increasingly difficult to remain independent. Anthem also is considering offers from hospitals to develop ACO pilots.

Hospitals expressed concerns about lower Medicare payment rates and loss of Medicaid DSH funds under PPACA. The Indiana Hospital Association reportedly has informed members to plan for 15 percent cuts in reimbursement over the next four years. One insider suggested this prospect could lead hospitals to be more skittish about purchasing other hospitals.

Finally, another market observer wondered whether reduced profits expected under reform for the medical device and pharmaceutical industries, on which Indianapolis is highly dependent—“Most buildings in [IU] School of Medicine are named after Lilly”—might undercut the local economy.

Issues to Track

Background Data

| Indianapolis Demographics | ||

|---|---|---|

| Indianapolis Metropolitan Area |

Metropolitan Areas 400,000+ Population | |

| Population, 20091 | 1,743,658 | |

| Population Growth, 5-Year, 2004-20092 | 7.4% | 5.5% |

| Age3 | ||

| Under 18 | 26.6% | 24.8% |

| 18-64 | 62.7% | 63.3% |

| 65+ | 10.7% | 11.9% |

| Education3 | ||

| High School or Higher | 88.7% | 85.4% |

| Bachelor’s Degree or Higher | 31.8% | 31.0% |

| Race/Ethnicity4 | ||

| White | 77.4% | 59.9% |

| Black | 14.4% | 13.3% |

| Latino | 4.9% | 18.6% |

| Asian | 1.8% | 5.7% |

| Other Races or Multiple Races | 1.5% | 4.2% |

| Other3 | ||

| Limited/No English | 3.3% | 10.8% |

Sources: |

||

| Economic Indicators | ||

|---|---|---|

| Indianapolis Metropolitan Area |

Metropolitan Areas 400,000+ Population | |

| Individual Income less than 200% of Federal Poverty Level1 | 27.5% | 26.3% |

| Household Income more than $50,0001 | 53.9% | 56.1% |

| Recipients of Income Assistance and/or Food Stamps1 | 8.1% | 7.7% |

| Persons Without Health Insurance1 | 12.4% | 14.9% |

| Unemployment Rate, 20082 | 5.1% | 5.7% |

| Unemployment Rate, 20093 | 8.4% | 9.2% |

| Unemployment Rate, June 20104 | 8.7% | 9.4% |

Sources: |

||

| Health Status1 | ||

|---|---|---|

| Indianapolis Metropolitan Area |

Metropolitan Areas 400,000+ Population | |

| Chronic Conditions | ||

| Asthma | 15.6% | 13.4% |

| Diabetes | 10.9%* | 8.2% |

| Angina or Coronary Heart Disease |

4.4% | 4.1% |

| Other | ||

| Overweight or Obese | 65.3%* | 60.2% |

| Adult Smoker | 23.5%* | 18.3% |

| Self-Reported Health Status Fair or Poor |

16.6% | 14.1% |

* Indicates a 12-site high. |

||

| Health System Characteristics | ||

|---|---|---|

| Indianapolis Metropolitan Area |

Metropolitan Areas 400,000+ Population | |

| Hospitals1 | ||

| Staffed Hospital Beds per 1,000 Population |

3.1 | 2.5 |

| Average Length of Hospital Stay (Days) |

5.5 | 5.3 |

| Health Professional Supply | ||

| Physicians per 100,000 Population2 |

262 | 233 |

| Primary Care Physicians per 100,000 Poplulation2 |

86 | 83 |

| Specialist Physicians per 100,000 Population2 |

176 | 150 |

| Dentists per 100,000 Population2 |

56 | 62 |

| Average monthly per-capita reimbursement for beneficiaries enrolled in fee-for-service Medicare3 |

$702 | $713 |

Sources: |

||

Funding Acknowledgement

The 2010 Community Tracking Study and resulting Community Reports were funded jointly by the Robert Wood Johnson Foundation and the National Institute for Health Care Reform. Since 1996, HSC researchers have visited the 12 communities approximately every two to three years to conduct in-depth interviews with leaders of the local health system.

Community Reports are published by the Center for Studying

Health System Change:

1100 1st Street, NE, 12th Floor

Washington, DC 20002

Tel: (202) 484-5261

Fax: (202) 863-1763

www.hschange.org

President: Paul B. Ginsburg