Issue Brief No. 96

June 2005

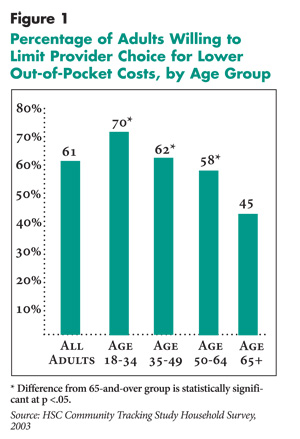

Ha T. Tu

Elderly Americans are much less willing than working-age Americans to limit their choice of physicians and hospitals to save on out-of-pocket medical costs, according to a new national study by the Center for Studying Health System Change (HSC). Only 44 percent of seniors 65 and older were willing to trade broad provider choice to save money, compared with more than 70 percent of people aged 18 through 34. Among seniors, those enrolled in Medicare health maintenance organizations (HMOs) were the most willing to limit choice of providers in return for lower out-of-pocket costs, while Medicare seniors with supplemental coverage were the least willing. Seniors with supplemental coverage account for nearly six in 10 Medicare seniors, and with nearly two-thirds of these seniors opposing provider choice restrictions, policy makers seeking to expand enrollment in Medicare Advantage managed care plans may face challenges.

![]() he willingness to limit choice of health care providers

to save on out-of-pocket expenses declines substantially as people get older,

according to HSC’s Community Tracking Study (CTS) Household Survey (see Data

Source).

he willingness to limit choice of health care providers

to save on out-of-pocket expenses declines substantially as people get older,

according to HSC’s Community Tracking Study (CTS) Household Survey (see Data

Source).

In 2003, only 44 percent of Americans aged 65 and older agreed with the statement, “I would be willing to accept a limited choice of physicians and hospitals if I could save money on my out-of-pocket costs for health care,” as compared with seven in 10 Americans aged 18 through 34 (see Figure 1).

In fact, elderly Americans represent the only age group where a majority does not favor giving up provider choice to save on out-of-pocket costs. The pattern of older consumers being less willing to sacrifice choice to save on costs has remained remarkably consistent over time (see Table 1).

Between 2001 and 2003, every age group except the elderly reported a significant increase in willingness to trade provider choice for lower costs, likely as a result of increased patient cost sharing for working-age people covered by employer sponsored insurance.

There are several possible explanations for older Americans’ lower willingness to limit broad provider choice for lower out-of- pocket costs.

First, people develop more health conditions and rely more on medical care as they age. About three out of 10 seniors, for example, say they are in fair or poor health, compared with one in 10 people 18 to 34 years old. And three in four seniors live with chronic health conditions, compared with one in five people in the 18-to-34 age group. It is hardly surprising, then, that maintaining broad choice of health providers would be a higher priority for the elderly, and this finding is consistent with previous research showing that people with chronic conditions are somewhat less willing to sacrifice provider choice.1

In addition, elderly people may be more likely to have long-term relationships with their doctors, making them more reluctant accept the restricted choice of providers commonly found in HMOs. And, compared with working-age people, seniors tend to have less experience with managed care. In addition, traditional fee-for-service Medicare provides a subsidized way for seniors to receive care from any provider accepting Medicare patients, and so insulates seniors to a large extent from having to make trade-offs between provider choice and out-of-pocket costs.

|

Table 1

|

||||

|

Somewhat or Strongly Willing to Limit Choice of Hospitals

and Physicians to Save on Out-of-Pocket Costs

|

||||

|

1997

|

1999

|

2001

|

2003

|

|

| All Adults |

57.7%

|

57.5%

|

56.9%

|

60.9%*

|

| Age 18-34 |

66.7

|

66.8

|

65.5

|

70.3*

|

| Age 35-49 |

59.1

|

58.3

|

57.7

|

61.8*

|

| Age 50-64 |

52.9

|

52.3

|

53.1

|

57.9*

|

| Age > 65 |

42.4

|

42.3

|

43.3

|

44.8

|

| * Change from previous survey is statistically

significant at p <.05. Note: All differences across age groups statistically significant at p <.05. Source: Community Tracking Study Household Survey |

||||

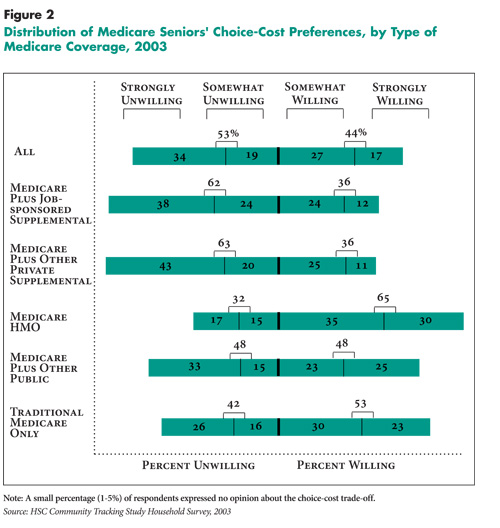

![]() lthough the choice-cost preferences of elderly Americans—like

those of working-age Americans—vary by income and chronic conditions (see

Table 2), the largest variations in seniors’ choice-cost

attitudes are seen across different types of Medicare coverage. Medicare seniors

enrolled in HMOs are those most inclined to favor out-of-pocket savings over

broad provider choice (see Figure 2).

lthough the choice-cost preferences of elderly Americans—like

those of working-age Americans—vary by income and chronic conditions (see

Table 2), the largest variations in seniors’ choice-cost

attitudes are seen across different types of Medicare coverage. Medicare seniors

enrolled in HMOs are those most inclined to favor out-of-pocket savings over

broad provider choice (see Figure 2).

Given that enrollment in HMOs is entirely voluntary for Medicare beneficiaries, it makes sense that seniors who have chosen to enroll in HMOs would be those most willing to sacrifice provider choice to save money. And, HMO Medicare enrollees who find that restrictions are more of a problem than they had expected can easily return to traditional Medicare, so the seniors who do remain in HMOs tend to be those most willing to sacrifice provider choice. In 2006 a “lock-in” will be introduced, allowing enrollees to disenroll or change plans only once a year.2

The Medicare beneficiaries least willing to sacrifice provider choice to save on costs are those with supplemental coverage: Among seniors with either retiree or Medigap supplemental coverage, almost two-thirds are unwilling to limit provider choice and about four in 10 are strongly unwilling to do so. If strong willingness to sacrifice choice is indicative of readiness to switch insurance plans to save on costs, then only about one in nine seniors with supplemental coverage seems prepared to make the change.

In between the preferences of costconscious Medicare HMO enrollees and those of choice-favoring seniors with supplemental coverage lie the preferences of seniors with dual Medicare-Medicaid eligibility and seniors with traditional Medicare coverage only. About half of the seniors in these groups are willing to sacrifice choice to save on costs and about a quarter are strongly willing to do so. It is somewhat surprising that among seniors who have no coverage in addition to traditional Medicare, there are not more people willing to sacrifice provider choice to save on out-of-pocket costs.

Table 2

|

|

|

Somewhat or Strongly Willing to Limit Choice of Hospitals

and Physicians to Save on Out-of-Pocket Costs

|

|

| Family Income | |

| Below 200% Federal Poverty Level |

53.1%

|

| 200-399% |

43.3

|

| 400+% |

37.5

|

| Number of Chronic Conditions | |

| None |

48.0

|

| One |

43.8

|

| Two or More |

42.9

|

| Note: All differences across income groups and across categories

of chronic conditions are statistically significant at p <.05. Source: Community Tracking Study Household Survey |

|

|

![]() he Department of Health and Human

Services (HHS) has projected that, by

2013, the enrollment share of Medicare

Advantage plans will increase to 30 percent

from its current level of 12 percent,

while the Congressional Budget Office has

estimated a more modest increase to 16

percent.3

he Department of Health and Human

Services (HHS) has projected that, by

2013, the enrollment share of Medicare

Advantage plans will increase to 30 percent

from its current level of 12 percent,

while the Congressional Budget Office has

estimated a more modest increase to 16

percent.3

To make the large enrollment gains projected by HHS, Medicare Advantage plans will need to attract a large number of seniors who currently have supplemental coverage, because these seniors account for nearly six out of every 10 noninstitutionalized elderly beneficiaries. Getting large numbers of seniors with retiree or Medigap coverage to switch to Medicare Advantage plans will likely present a major challenge because they strongly resist limiting provider choice to save on costs.

Given widespread beneficiary concerns about restricted provider choice, it appears that Medicare Advantage plans will need to offer broad provider networks, along with richer benefit packages or lower out-ofpocket costs, to attract enough seniors from traditional Medicare to boost enrollment significantly. During the current period when Medicare Advantage payments are exceeding traditional Medicare payments, plans may not have much trouble enhancing benefits and keeping out-of-pocket costs low, but they are likely to find this approach unsustainable in the face of future budget pressures that may force the government to slow payment increases.

Medicare reformers have focused on preferred provider organizations (PPOs), which typically offer broad provider networks and the opportunity to go to out-ofnetwork providers for higher out-of-pocket costs, as an option that they believe will attract many more seniors than HMOs have in the past. Citing the popularity of PPOs among working-age, privately insured Americans, proponents would like to replicate the PPO model in Medicare. However, PPOs in the commercial sector appeal to employers and consumers on the basis of providing broader provider choice and fewer access restrictions than HMOs. In contrast, most seniors will assess the new Medicare Advantage PPOs against traditional Medicare, which offers the greatest breadth possible in provider choice.

PPO plans likely will face considerable hurdles in assembling networks and negotiating price discounts with providers, given that traditional Medicare will remain an option for both beneficiaries and providers, so providers may not feel they have to join a network to continue seeing their current Medicare patients.4 If PPOs can only get providers to join their networks by offering generous payment rates, the drain on plan finances will make it hard to offer the rich benefits and lower costs needed to attract new enrollees. Conversely, if PPOs adopt a hard-nosed bargaining strategy with providers, the resulting networks may be too narrow to attract many seniors.

With Medicare PPOs needing to use strategies other than restricting choice, an area of potential opportunity for plans lies in the coordination of care for enrollees. Care fragmentation has long been a problem in particular for the Medicare population, which has a large proportion of people living with multiple and complex health conditions. Plans that can provide effective disease management and case management, and can make a convincing case to potential enrollees that an organized system can provide better care to them, may be the plans best positioned for growth and success. Efforts to attract seniors with care coordination are likely to be boosted by the new prescription drug benefit, Medicare Part D, which enables plans to include and market a subsidized drug benefit as part of a care integration package.

However, the model of using care coordination to simultaneously increase enrollment and contain costs is still an unproven one. And, while the prescription drug benefit may attract new enrollees to Medicare Advantage plans, it also may cause some current enrollees to leave: Those enrollees who were leery of provider choice restrictions, yet joined managed care plans to obtain a drug benefit, will now have the option of returning to traditional Medicare and receiving their Part D benefit through a stand-alone prescription drug plan.

Although most seniors—especially those with supplemental coverage—currently are reluctant to sacrifice provider choice for cost savings, some recent developments, if they continue, may cause a shift in seniors’ choice-cost attitudes. Multiple years of double-digit premium increases for Medicare Part B may cause some seniors to reassess the trade-off between unfettered choice of health care providers and lower out-of-pocket costs. Also, with some former employers steeply raising retirees’ premiums and out-of-pocket costs, and other companies dropping retiree coverage altogether, many seniors who can no longer obtain or afford such coverage may have to begin considering insurance alternatives that place more restrictions on provider choice.

If escalating costs and eroding private coverage cause seniors to reassess their choice-cost preferences, that development would echo a trend that has already started taking hold among working-age Americans.

1. |

Tu, Ha T., More Americans Willing to Limit Physician-Hospital Choice for Lower Medical Costs, Issue Brief No. 94, Center for Studying Health System Change, Washington, D.C. (March 2005). |

2. |

Henry J. Kaiser Family Foundation, Medicare Advantage Fact Sheet, April 2005. |

3. |

Ibid. |

4. |

Hurley, Robert E., Bradley C. Strunk and Joy M. Grossman, Preferred Provider Organizations and Medicare: Is There an Advantage?, Issue Brief No. 81, Center for Studying Health System Change, Washington, D.C. (April 2004). |

The findings reported in this Issue Brief are based on an analysis of the Community Tracking Study (CTS) Household Survey, a nationally representative survey conducted in 1996-97, 1998-99, 2000-01 and 2003. For discussion and presentation, we refer to a single calendar year for the first three surveys (1997, 1999 and 2001). The first three rounds of the survey contain information on more than 45,000 adults, including 6,300 to 7,300 adults aged 65 and older; the 2003 survey contains responses from about 36,000 adults, including 6,700 aged 65 and older.

To determine whether people had chronic conditions, the survey asked adult respondents whether they had been diagnosed with one of more than 10 chronic conditions and whether they had seen a doctor in the past two years for the condition. The list of chronic conditions includes asthma, arthritis, diabetes, chronic obstructive pulmonary disease, heart disease, hypertension, cancer, benign prostate enlargement, abnormal uterine bleeding and depression. Because the CTS list of conditions is not exhaustive, the estimate of the prevalence of chronic conditions is likely conservative.

ISSUE BRIEFS are published by the

Center for Studying Health System Change.

600 Maryland Avenue, SW, Suite 550

Washington, DC 20024-2512

Tel: (202) 484-5261

Fax: (202) 484-9258

www.hschange.org