Data Bulletin No. 22

September 2002

Bradley C. Strunk, Paul B. Ginsburg, Jon R. Gabel

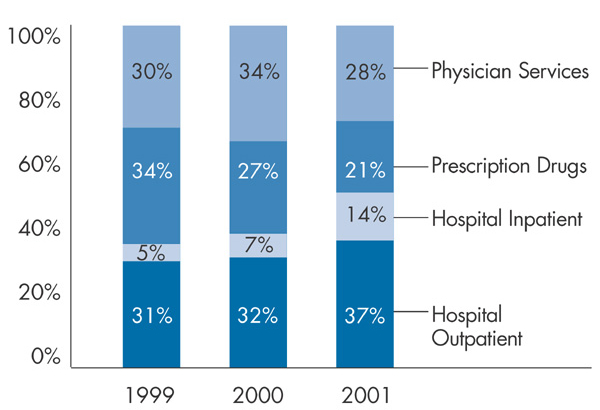

Spending on outpatient hospital care grew 16.3 percent in 2001, accounting for 37 percent of the overall spending increase. Outpatient care surpassed prescription drugs as the fastest-growing component of overall health spending. For the second year in a row, the rate of growth in prescription drug spending slowed. The 13.8 percent increase in drug spending contributed 21 percent to the overall spending increase.

Figure 1

Note:Data reflect the August 2002 revision by Milliman USA. As a result of this revision by Milliman USA, some estimates for 1999-2000 changed from previous reports.

Source: Milliman USA Health Cost Index ($0 deductible)

![]() ore use of inpatient and outpatient hospital services, coupled

with higher prices, increased overall hospital spending by 12 percent in 2001.

Growing use of hospital services accounted for two-thirds of increased hospital

spending, reflecting the loosening of health plan restrictions on care. Higher

prices also played a role as hospitals used their increased bargaining power to

win higher payment rates from health plans.

ore use of inpatient and outpatient hospital services, coupled

with higher prices, increased overall hospital spending by 12 percent in 2001.

Growing use of hospital services accounted for two-thirds of increased hospital

spending, reflecting the loosening of health plan restrictions on care. Higher

prices also played a role as hospitals used their increased bargaining power to

win higher payment rates from health plans.

Spending for inpatient hospital care jumped 7.1 percent in 2001, accounting for 14 percent of the overall health spending increase. Growing at almost three times the 2000 rate, inpatient spending continued a dramatic reversal from 1997, when inpatient spending decreased 5.3 percent.

Hospital payroll costs grew 8.6 per-cent in 2001—more than double the 3.7 percent increase in 2000—due to increases in wages and hours worked.

The average hourly hospital wage grew 6.1 percent in 2001—nearly double the 2000 pace—providing evidence of the financial fallout due to the severe shortage of nurses and other skilled hospital workers. Total hours worked by hospital employees in 2001 grew 2.4 percent, up from 0.4 percent in 2000. The sharp climb in hours worked reflects increased use of hospital services.

Unlike hospital services, no clear trend for prices or use of physician services has emerged. Spending on physician services in 2001 increased 6.7 percent, accounting for 28 percent of the overall spending increase.

![]() ather than increasing workers’ share of premium contributions,

employers are shifting more costs to workers, primarily through higher deductibles

and higher drug copayments. They envision consumers avoiding some of the financial

consequences of increased cost sharing by using fewer services.

ather than increasing workers’ share of premium contributions,

employers are shifting more costs to workers, primarily through higher deductibles

and higher drug copayments. They envision consumers avoiding some of the financial

consequences of increased cost sharing by using fewer services.

Early evidence indicates that cost trends are slowing in 2002, setting the stage for more moderate premium growth. The easing of cost trends may reflect the effects of increased cost sharing and the likelihood that much of the increased use of services is probably a one-time consequence of the retreat from tightly managed care. The recent national economic slowdown also will ease the rate of cost growth, although the influence will be spread over time.

Moreover, the inevitable turn in the health insurance underwriting cycle—the interdependent pattern of profitability and pricing in the insurance industry—eventually will slow pre-mi um growth. In recent years, insurers have restored profitability by raising premiums more than underlying costs and exiting unprofitable markets. With much of the industry now on sounder financial footing, insurers may soon switch gears to grow market share through fierce price competition, leading to slower premium growth.

This Data Bulletin is based on data from the Milliman USA Health Cost Index ($0 deductible), which is designed to reflect claims increases faced by private insurers; the Kaiser Family Foundation/Health Research and Educational Trust survey of employer-based health plans for 1999- 2002; the KPMG survey of employer-based plans for 1991-98; and the U.S. Bureau of Labor Statistics Employment, Hours and Earnings series to track payroll costs and Hospital Producer Price Index to track hospital prices. It is adapted from “Tracking Health Care Costs: Growth Accelerates Again in 2001” by Bradley C. Strunk, Paul B. Ginsburg and Jon R. Gabel, Health Affairs,Web-exclusive publication, Sept. 25, 2002, www.healthaffairs.org.

Data Bulletins are published by the Center for Studying Health System Change (HSC)