Issue Brief No. 52

May 2002

Joy M. Grossman, Bradley C. Strunk, Robert E. Hurley

![]() rivate health plans’ participation in Medicare was envisioned as a way to save

taxpayers money and offer Medicare beneficiaries more choices and benefits. As

enrollment grew, there were concerns about overpayments to some private health

plans and wide geographic variation in plan payments. The Balanced Budget Act of

1997 (BBA) introduced significant payment changes and regulatory requirements

for plans participating in the newly named Medicare+Choice (M+C) program.

Since January 1999, scores of plans have reduced or ended their participation,

disrupting coverage for more than two million seniors. While the BBA often is

blamed for this turnabout, research by the Center for Studying Health System

Change (HSC) indicates private market forces also played a key role in M+C’s

growing instability.

rivate health plans’ participation in Medicare was envisioned as a way to save

taxpayers money and offer Medicare beneficiaries more choices and benefits. As

enrollment grew, there were concerns about overpayments to some private health

plans and wide geographic variation in plan payments. The Balanced Budget Act of

1997 (BBA) introduced significant payment changes and regulatory requirements

for plans participating in the newly named Medicare+Choice (M+C) program.

Since January 1999, scores of plans have reduced or ended their participation,

disrupting coverage for more than two million seniors. While the BBA often is

blamed for this turnabout, research by the Center for Studying Health System

Change (HSC) indicates private market forces also played a key role in M+C’s

growing instability.

![]() eginning in 1985, Medicare has allowed beneficiaries to

enroll voluntarily in private managed care health plans, usually health maintenance

organizations, which receive a fixed monthly payment for each beneficiary. Since

1996, HSC has tracked developments in Medicare managed care through site visits

every two years in 12 nationally representative U.S. communities (see

Data Source).

eginning in 1985, Medicare has allowed beneficiaries to

enroll voluntarily in private managed care health plans, usually health maintenance

organizations, which receive a fixed monthly payment for each beneficiary. Since

1996, HSC has tracked developments in Medicare managed care through site visits

every two years in 12 nationally representative U.S. communities (see

Data Source).

In 1996-97, at the time of HSC’s first round of site visits, most private health

plans described Medicare as a particularly attractive line of business, and

plan participation and enrollment were increasing in most of the 12 markets.

Many observers predicted continued program growth, but by 2000-01, momentum

had stalled in almost every market. The percentage of Medicare beneficiaries

enrolled in managed care plans nationally grew from 11 percent in December 1996

to 16.1 percent in December 1998, but then fell to 14.5 percent in December

2001. Plan participation followed a similar pattern nationally and in most HSC

markets.

Many of M+C’s trials and tribulations were attributed to the BBA—particularly

changes that slowed the growth of plan payments and imposed new reporting and

quality requirements. Less attention has been paid to the role of private market

developments in plan withdrawals. Positive market conditions before the BBA’s

passage helped to spur Medicare managed care’s growth, while declining market

conditions, especially rising health care costs, intensified the impact of BBA

policy changes. This collision of public policy and private market forces, rather

than policy changes alone, brought M+C growth to a halt.

Three market factors stand out as major contributors to M+C’s initial rise and eventual fall:

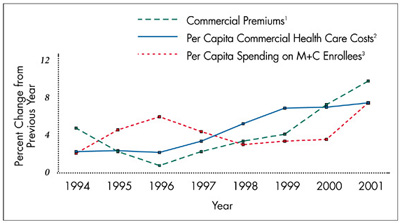

![]() ealth care costs grew slowly in the mid-1990s (see

Figure 1), thanks, in part, to the growth in managed care.1

Cost trends accelerated in the latter part of the decade, especially spending

on prescription drugs. Yet M+C payment trends followed the opposite pattern—rising

quickly in the mid-1990s, when cost growth was low, and slowing significantly

just as the rate of cost growth was increasing.

ealth care costs grew slowly in the mid-1990s (see

Figure 1), thanks, in part, to the growth in managed care.1

Cost trends accelerated in the latter part of the decade, especially spending

on prescription drugs. Yet M+C payment trends followed the opposite pattern—rising

quickly in the mid-1990s, when cost growth was low, and slowing significantly

just as the rate of cost growth was increasing.

Under Medicare’s administered pricing system, M+C payment growth for individual US counties is determined by a formula that ties annual payment rate increases to increases in spending in the traditional fee-for-service Medicare program.2 In the late 1990s, for example, large reductions in the rate of growth of provider payments under the BBA and a crackdown on Medicare fraud and abuse slowed trends in traditional program spending, which, in turn, reduced increases in M+C payment rates. Since 1998, plans in the counties with the greatest number of M+C enrollees typically have received annual increases well below cost trends.3

M+C payment rate increases also failed to account for rapidly rising spending for outpatient prescription drugs in the late 1990s. While traditional Medicare does not cover most outpatient drugs—thus, those costs are not figured into its annual growth estimates—many M+C plans offered outpatient drug coverage to attract enrollees.

These out-of-sync cost and payment trends suggest substantial variation in the profitability of M+C plans. In 1996-97, when Medicare payment growth was outstripping underlying cost growth, plans in the 12 communities studied reported M+C was attractive because of the potential for profits as payment rates grew and more Medicare beneficiaries moved into private plans. By 2000-01, however, nearly all plans in the 12 sites had seen M+C profitability decline dramatically, and some plans reported losing money.

![]() ommercial insurance premium trends

tend to be higher than health care cost

trends for several years and then lower than

cost trends for several years, following a

predictable cyclical pattern known as the

insurance underwriting cycle. As profits

rise and competition heats up, plans try to

increase market share by holding down

premium increases, often causing profits

to shrink. Plans then raise premiums to

restore profitability. A new phase of the

commercial insurance underwriting cycle

began in the early 1990s, when health costs

increased more slowly than expected,

improving profitability and attracting new

plans. By 1996-97, as competition in the

commercial market intensified, many

plans in HSC markets shifted their focus

to expanding market share, and some

plans reported setting premiums below

expected costs to capture new business.

ommercial insurance premium trends

tend to be higher than health care cost

trends for several years and then lower than

cost trends for several years, following a

predictable cyclical pattern known as the

insurance underwriting cycle. As profits

rise and competition heats up, plans try to

increase market share by holding down

premium increases, often causing profits

to shrink. Plans then raise premiums to

restore profitability. A new phase of the

commercial insurance underwriting cycle

began in the early 1990s, when health costs

increased more slowly than expected,

improving profitability and attracting new

plans. By 1996-97, as competition in the

commercial market intensified, many

plans in HSC markets shifted their focus

to expanding market share, and some

plans reported setting premiums below

expected costs to capture new business.

Many plans viewed M+C participation as an attractive strategy to grow market share. In the three HSC markets with the highest M+C penetration (see Table 1), plans reported they were able to offset declining profit margins on their commercial lines of business with comfortable M+C profit margins. While M+C plans typically had offered lower beneficiary cost sharing than traditional Medicare, many plans in these markets offered additional benefits, such as outpatient prescription drug coverage, for little or no extra premium, which also attracted more enrollees.

Even in communities where plans viewed M+C products as less profitable at the time and M+C penetration was lower, Medicare represented an untapped opportunity to expand market share. Opportunities for expansion and the prospect of rapidly growing M+C payment rates helped to drive both national and local plans to enter M+C in the moderate penetration sites. National plans introduced zero-premium products with enhanced benefits in these markets. Meanwhile, local plans in most of the limited and minimal penetration sites were poised to begin offering M+C products, in part to thwart anticipated entry by national plans.

By 1999, with the BBA changes fully implemented, the health plan industry’s overall financial condition had weakened. Many plans had suffered several years of significant losses as fierce price competition in the commercial market kept premium growth below newly accelerating cost trends. To address ailing profit margins, plans switched their focus from growing market share to restoring profitability across their entire range of products. In the commercial market, plans raised premiums—aided by employers’ willingness to absorb most of these increases for their employees—reduced benefits, closed unprofitable product lines and exited certain markets.

Since plans had no control over M+C payments and believed they were limited in what they could charge beneficiaries and remain competitive, they were more constrained in their ability to address declining M+C profits. Many plans in the moderate and limited penetration markets froze enrollment, retreated from selected counties or left the program altogether. In Seattle, for example, four of six plans left M+C as of Jan. 1, 2001. Some of the moderate and limited penetration markets did receive higher payments under provisions of the Benefits Improvement and Protection Act of 2000 (BIPA), but those increases did not prevent the remaining plans in Lansing and Little Rock from withdrawing from M+C in 2002. Meanwhile, in the three markets with minimal M+C penetration, the higher payments provided by Congress under BIPA have not yet attracted new plans.

Plans that continued to offer M+C products scaled back extra benefits, particularly outpatient prescription drug coverage. They also raised premiums, although some plans chose to trim benefits to shed some less-healthy enrollees rather than raise premiums and risk losing healthier members.

In 2002, plans began to alter the last major feature that had distinguished M+C from traditional Medicare: the absence of significant cost sharing. Plans now are imposing cost sharing on basic Medicare benefits at levels that approach those of traditional Medicare. In HSC’s 12 sites, only plans in Miami—where M+C payment rates remain high—have continued to offer more generous benefits.

Table 1| Degree of M+C Penetration/HSC Site |

Percent of Medicare Beneficiaries Enrolled in an M+C Plan | |||

| 1996 |

1998 |

2000 |

2001 |

|

| High Penetration | ||||

| Orange Co.1 | 41.7% |

43.1% |

42.5% |

40.9% |

| Phoenix | 38.1 |

43.4 |

43.9 |

41.5 |

| Miami | 37.2 |

43.4 |

45.5 |

45.8 |

| Moderate Pentration | ||||

| Seattle | 30.5 |

33.4 |

32.5 |

25.3 |

| Boston1 | 15.5 |

23.0 |

23.7 |

21.4 |

| Cleveland | 11.6 |

22.2 |

22.4 |

18.7 |

| Limited Penetration | ||||

| Lansing | 8.7 |

12.1 |

12.4 |

11.6 |

| Little Rock | 4.6 |

9.9 |

8.9 |

7.3 |

| Northern N.J. | 4.1 |

10.0 |

8.9 |

7.5 |

| Minimal Penetration | ||||

| Indianapolis1 | 4.0 |

6.2 |

6.4 |

4.1 |

| Greenville | 0.2 |

0 |

0 |

0 |

| Syracuse | 0 |

1.1 |

1.7 |

0 |

| National | 11.0 |

16.1 |

16.5 |

14.5 |

| 1 Includes cost and demonstration plans with at least 1,000

beneficiaries. In Indianapolis, one cost plan has most of the enrollment. Note: Data are for December of each year. Enrollment is in coordinated care plans unless otherwise noted. Source: Centers for Medicare and Medicaid Services, Quarterly State/County Market Penetration Data File |

||||

![]() roviders’ willingness to participate in M+C plans also

made an about-face in the late 1990s. In 1996-97, providers were eager to join

Medicare managed care networks to ensure they did not lose patients or revenue

as beneficiaries moved into managed care. Plan and provider interest in risk-contracting

arrangements increased, and these arrangements were more likely to cover Medicare

beneficiaries than those who were privately insured. By 2000-01, however, some

plans had a hard time forming and sustaining M+C provider networks. In most

markets, providers said they no longer felt pressure to accept contracts for

M+C enrollees as fewer beneficiaries enrolled in the program. Some providers,

primarily dominant hospital systems and specialist groups, found their negotiating

clout strengthened, thus fueling provider pushback against plans.

roviders’ willingness to participate in M+C plans also

made an about-face in the late 1990s. In 1996-97, providers were eager to join

Medicare managed care networks to ensure they did not lose patients or revenue

as beneficiaries moved into managed care. Plan and provider interest in risk-contracting

arrangements increased, and these arrangements were more likely to cover Medicare

beneficiaries than those who were privately insured. By 2000-01, however, some

plans had a hard time forming and sustaining M+C provider networks. In most

markets, providers said they no longer felt pressure to accept contracts for

M+C enrollees as fewer beneficiaries enrolled in the program. Some providers,

primarily dominant hospital systems and specialist groups, found their negotiating

clout strengthened, thus fueling provider pushback against plans.

To keep providers, many plans were forced to pay higher rates. Stung by several years of flat payments and rising costs, many providers who had managed care risk contracts with plans were particularly eager to renegotiate terms or end contracts for both M+C and commercial enrollees. With providers demanding higher payments and better contract terms, some plans—including those in Cleveland, Indianapolis and Seattle—struggled to keep M+C networks intact while maintaining profitability.

The near-term outlook for Medicare’s ability to retain and attract plans appears bleak with the 2003 M+C payment increase set at 2 percent for virtually all US counties and no sign of a slowdown in cost growth.4

Calls for stabilization of M+C come from many sources and include proposals for short-term measures to increase plan payments through so-called givebacks. If policy makers wish to preserve Medicare’s relationship with private health plans over the longer term, however, they need to consider reforms that would make M+C payment rates more responsive to changing marketplace conditions to ensure that beneficiaries have stable and affordable choices.

Long-term M+C reform proposals include:

Under any of the options, policy makers would need to protect Medicare beneficiaries from undesirable fluctuations in costs, benefits and provider networks as private plans respond to changes in payments in the context of broader market forces. Even with more stable plan participation, some plans still would decide to exit the program, and safeguards would be needed to reduce beneficiary disruptions.

![]() SC interviews community leaders

about how the health system is

changing in the following 12 sites:

Boston; Cleveland; Greenville, S.C.;

Indianapolis; Lansing, Mich.; Little

Rock, Ark.; Miami; northern New

Jersey; Orange County, Calif.;

Phoenix; Seattle; and Syracuse, N.Y.

Site visits were conducted in 1996-97,

1998-99 and 2000-01.

SC interviews community leaders

about how the health system is

changing in the following 12 sites:

Boston; Cleveland; Greenville, S.C.;

Indianapolis; Lansing, Mich.; Little

Rock, Ark.; Miami; northern New

Jersey; Orange County, Calif.;

Phoenix; Seattle; and Syracuse, N.Y.

Site visits were conducted in 1996-97,

1998-99 and 2000-01.

ISSUE BRIEFS are published by the Center for Studying Health System Change.

President: Paul B. Ginsburg

Director of Public Affairs: Richard Sorian

Editor: The Stein Group

For additional copies or to be added

to the mailing list, contact HSC at:

600 Maryland Avenue, SW

Suite 550

Washington, DC 20024-2512

Tel: (202) 554-7549

(for publication information)

Tel: (202) 484-5261

(for general HSC information)

Fax: (202) 484-9258

www.hschange.org