Tracking Report No. 28

December 2011

Anna Sommers, Peter J. Cunningham

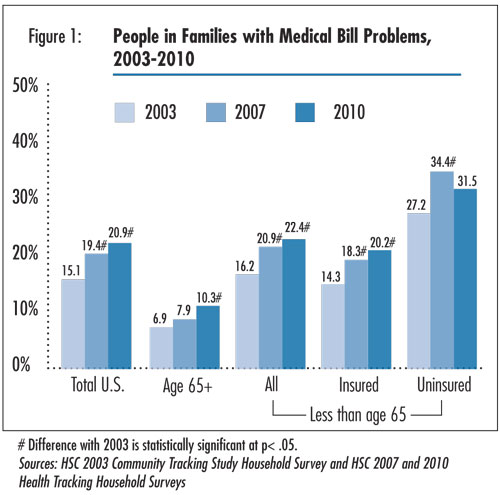

More than one in five Americans were in families reporting problems paying medical bills in 2010—about the same proportion as in 2007, according to a new national study by the Center for Studying Health System Change (HSC). Given the severe 2007-09 recession, the sluggish economic recovery and health care costs continuing to increase faster than incomes, it is somewhat surprising that the rate of medical bill problems did not increase between 2007 and 2010. The steady rate of medical bill problems may be a byproduct of decreased use of medical care—both by people who lost jobs and health insurance during the recession and others who cut back on medical care in the face of uncertain economic times. While problems paying medical bills stabilized in recent years, the proportion of Americans in families with medical bill problems remained significantly higher in 2010 compared with 2003—20.9 percent vs. 15.1 percent. And, in 2010, many people in families with problems paying medical bills continued to experience severe financial consequences, with about two-thirds reporting problems paying for other necessities and a quarter considering bankruptcy.

![]() n the wake of the deep 2007-09 recession and sluggish economic recovery, the number of uninsured Americans increased from 42.8 million in 2007 to 51.7 million in 2010.1 At the same time, Americans cut back on their use of medical care.2 And, the proportion of Americans—one in five—in families with problems paying medical bills remained stable between 2007 and 2010, according to HSC’s 2010 Health Tracking Household Survey (see Data Source and Figure 1). However, since 2003, the proportion of people in families with problems paying medical bills has increased by more than a third, rising from 15.1 percent to 20.9 percent in 2010. This reflects the continuation of a long-term decline in the affordability of medical care, as health care spending growth continues to outpace growth in the economy and real income for American households.3

n the wake of the deep 2007-09 recession and sluggish economic recovery, the number of uninsured Americans increased from 42.8 million in 2007 to 51.7 million in 2010.1 At the same time, Americans cut back on their use of medical care.2 And, the proportion of Americans—one in five—in families with problems paying medical bills remained stable between 2007 and 2010, according to HSC’s 2010 Health Tracking Household Survey (see Data Source and Figure 1). However, since 2003, the proportion of people in families with problems paying medical bills has increased by more than a third, rising from 15.1 percent to 20.9 percent in 2010. This reflects the continuation of a long-term decline in the affordability of medical care, as health care spending growth continues to outpace growth in the economy and real income for American households.3

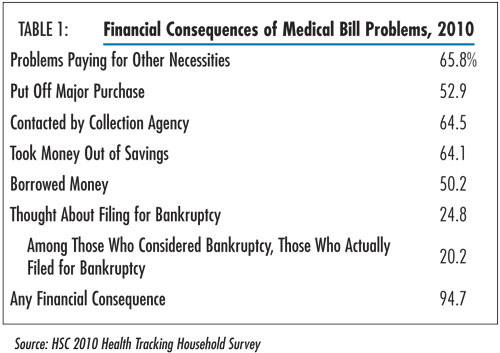

Almost all people in families with medical bill problems reported serious financial consequences. For example, two-thirds reported problems paying for other necessities, such as food, clothing or housing (see Table 1). And, almost two-thirds were contacted by a collection agency, which can tarnish a family’s credit rating.

Filing for bankruptcy is an extreme financial consequence of medical bill problems. One in four people in 2010 with medical bill problems considered filing for bankruptcy because of their medical debt—about the same proportion as in 2007.4 Of those who considered filing for bankruptcy, about one in five actually did so—or about 5 percent of all people in families with medical bill problems.

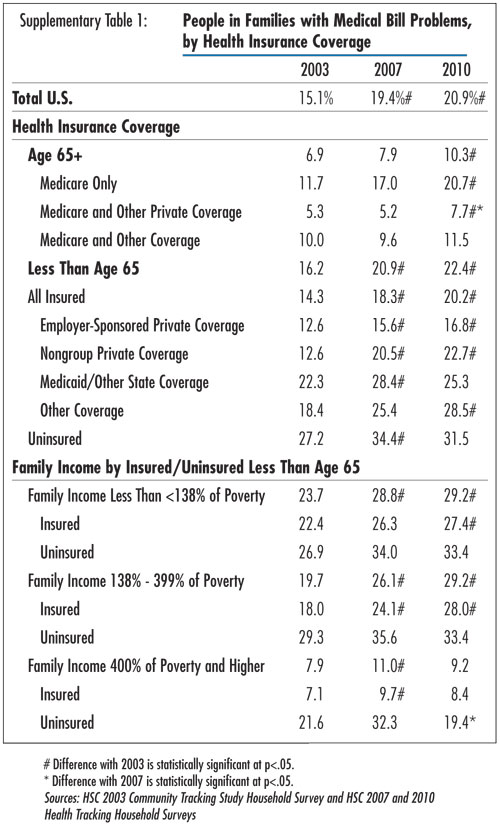

![]() he proportion of children and working-age adults (aged 0-64) in families with medical bill problems remained level between 2007 and 2010. However, the proportion of nonelderly people with medical bill problems has increased significantly from 16.2 percent in 2003 to 22.4 percent in 2010.

he proportion of children and working-age adults (aged 0-64) in families with medical bill problems remained level between 2007 and 2010. However, the proportion of nonelderly people with medical bill problems has increased significantly from 16.2 percent in 2003 to 22.4 percent in 2010.

A similar scenario occurred for insured children and working-age adults—the proportion in families with medical bill problems leveled off between 2007 and 2010 but increased significantly between 2003 (14.3%) and 2010 (20.2%). Along with the severe 2007-09 recession prompting economic worries, employers during this period continued to shift health care costs to workers through increased patient cost sharing5—for example, through higher deductibles, coinsurance and copayments—placing pressure on people to change the way they use health care. Following a surge in health care utilization between 2003 and 2007, nonelderly insured people’s utilization leveled off between 2007 and 2010.6

Underscoring uninsured people’s lack of financial protection from health care expenses, uninsured children and working-age adults in 2010 were more likely to have medical bill problems (31.5%) than their insured counterparts (20.2%). The proportion of uninsured children and working-age adults with medical bill problems increased significantly between 2003 and 2007 and then leveled off in 2010 at 31.5 percent.

Between 2007 and 2010, uninsured nonelderly people cut back on their use of health care, primarily by visiting office-based physicians less often.7 Also, many of those who lost health insurance between 2007 and 2010 had fewer health problems compared to those already uninsured. Thus, the lack of an increase in medical bill problems for the nonelderly uninsured population may partially reflect that uninsured people on average were healthier and had fewer medical expenses in 2010 compared to 2007.8

![]() ompared with younger people, medical bill problems typically have been much lower among people aged 65 and older,9 despite higher out-of-pocket spending because of elderly people’s greater health care needs.10 Marking a significant upward trend, the proportion of elderly people with medical bill problems rose from 6.9 percent in 2003 to 10.3 percent in 2010.

ompared with younger people, medical bill problems typically have been much lower among people aged 65 and older,9 despite higher out-of-pocket spending because of elderly people’s greater health care needs.10 Marking a significant upward trend, the proportion of elderly people with medical bill problems rose from 6.9 percent in 2003 to 10.3 percent in 2010.

The proportion of seniors covered just by Medicare with medical bill problems almost doubled between 2003 and 2007, increasing from 11.7 percent to 20.7 percent (see Supplementary Table 1). Similarly, the proportion of seniors with Medicare and supplemental private coverage—typically Medigap or employer-sponsored retiree coverage—with medical bill problems increased from 5.3 percent in 2003 to 7.7 percent in 2010.

![]() nder health reform, many people with incomes below 400 percent of poverty—or $88,200 for a family of four in 2010—will have additional options to obtain more-affordable health coverage. Starting in 2014, Medicaid eligibility will be extended to almost all people with incomes less than 138 percent of poverty—or $30,429 for a family of four in 2010. And, people with incomes between 138 percent and 400 percent of poverty in 2014 without access to employer coverage will be eligible for premium subsidies to purchase private coverage through state health insurance exchanges. People in this income group enrolled in exchange plans also will be eligible for cost-sharing subsidies to help lower their out-of-pocket costs for care. The targeting of low- to middle-income people reflects the high and increasing financial burden of medical care, even among those with health insurance.

nder health reform, many people with incomes below 400 percent of poverty—or $88,200 for a family of four in 2010—will have additional options to obtain more-affordable health coverage. Starting in 2014, Medicaid eligibility will be extended to almost all people with incomes less than 138 percent of poverty—or $30,429 for a family of four in 2010. And, people with incomes between 138 percent and 400 percent of poverty in 2014 without access to employer coverage will be eligible for premium subsidies to purchase private coverage through state health insurance exchanges. People in this income group enrolled in exchange plans also will be eligible for cost-sharing subsidies to help lower their out-of-pocket costs for care. The targeting of low- to middle-income people reflects the high and increasing financial burden of medical care, even among those with health insurance.

The proportion of children and working-age adults in low-income families—those below 138 percent of poverty—with medical bill problems grew significantly between 2003 and 2010 from 23.7 percent to 29.2 percent. A similar trend occurred for nonelderly people in families with incomes between 138 percent and 400 percent of poverty, with the proportion with medical bill problems growing from 19.7 percent in 2003 to 29.2 percent in 2010.

In contrast, the proportion of children and working-age adults in higher-income families—those with incomes at or above 400 percent of poverty—is much lower and was about the same in 2003 and 2010 (7.9% vs. 9.2%).

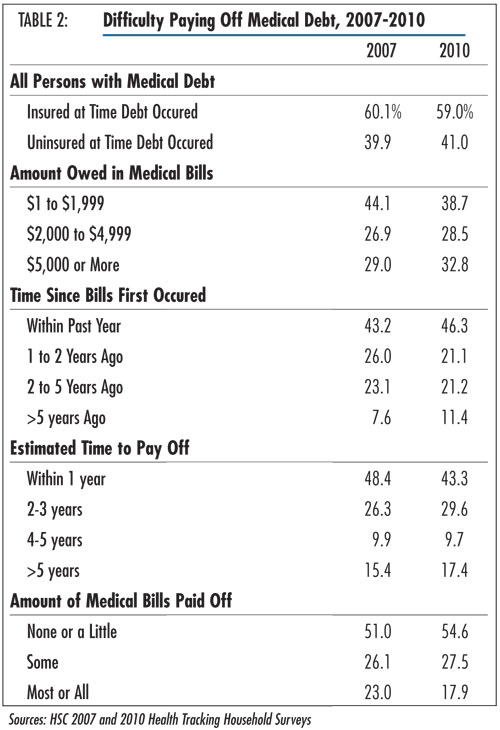

![]() or those reporting problems paying medical bills, average medical debt for the family was $6,500 in 2010 (findings not shown). One-third of Americans with medical debt owed more than $5,000 in medical bills in 2010, and about 60 percent owed $2,000 or more (see Table 2). There were no statistically significant changes in debt amounts between 2007 and 2010.

or those reporting problems paying medical bills, average medical debt for the family was $6,500 in 2010 (findings not shown). One-third of Americans with medical debt owed more than $5,000 in medical bills in 2010, and about 60 percent owed $2,000 or more (see Table 2). There were no statistically significant changes in debt amounts between 2007 and 2010.

In addition, more than half of people with medical debt had paid off “none or a little” of the debt. And, more than half of people with medical debt expected that it would take more than a year to pay off the bills, while 17.4 percent expected it would take longer than five years.

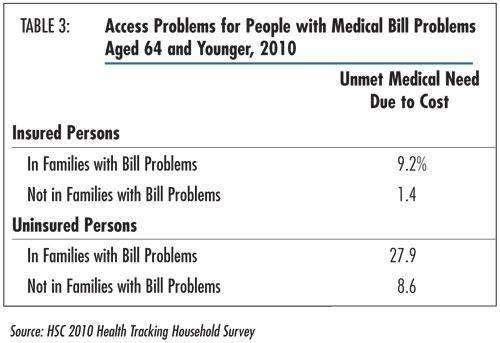

![]() roblems paying medical bills can create financial barriers to needed medical care. People with medical bill problems—both insured and uninsured—have much higher levels of unmet medical needs because of cost concerns compared to people without medical bill problems (see Table 3).

roblems paying medical bills can create financial barriers to needed medical care. People with medical bill problems—both insured and uninsured—have much higher levels of unmet medical needs because of cost concerns compared to people without medical bill problems (see Table 3).

Among insured people, 9.2 percent of those with medical bill problems reported unmet medical needs because of cost concerns in 2010, compared to 1.4 percent of those with no medical bill problems. Among uninsured people, 27.9 percent of those with medical bill problems reported unmet needs, compared to 8.6 percent of uninsured people with no medical bill problems.

![]() fter a sharp increase between 2003 and 2007, the proportion of Americans in families with problems paying medical bills remained steady between 2007 and 2010.

fter a sharp increase between 2003 and 2007, the proportion of Americans in families with problems paying medical bills remained steady between 2007 and 2010.

Provisions in the 2010 Patient Protection and Affordable Care Act (PPACA) are likely to reduce—but not eliminate—financial pressures related to paying medical bills for families with incomes below 400 percent of poverty. In 2014, almost all people with incomes less than 138 percent of poverty will be eligible for Medicaid. Likewise, federal subsidies to purchase private coverage through state health insurance exchanges will be available in 2014 for people with incomes between 138 percent and 399 percent of poverty without access to employer coverage. People in this income bracket who are uninsured or who buy nongroup insurance may be able to purchase more affordable coverage through the exchanges, and cost-sharing subsidies that limit out-of-pocket spending on services will help reduce the financial burden of medical care. But, the majority of people in this income group already has employer coverage and will be ineligible to purchase subsidized coverage in the exchanges unless their premiums exceed 9.5 percent of income.

Other factors will affect whether Americans experience fewer medical bill problems in the future, with the most important being the underlying growth in health care spending. If wages continue to stagnate and health care costs continue to grow faster than real income, the financial burden of health care likely will grow more acute.

This Tracking Report presents findings from the HSC 2010 and 2007 Health Tracking Household Surveys and the 2003 Community Tracking Study Household Survey. All three telephone surveys used nationally representative samples of the civilian, noninstitutionalized population. For the first time, the 2010 survey included a cell phone sample because of declining percentages of households with landline phones. Sample sizes include about 47,000 people for the 2003 survey, about 18,000 people for the 2007 and about 17,000 people for the 2010 survey. Response rates for the surveys were 57 percent in 2003, 43 percent in 2007, and 46 and 29 percent, respectively, for the landline and cell phone samples in 2010. Population weights adjust for probability of selection and differences in nonresponse based on age, sex, race or ethnicity, and education. The weights also adjust for the increased probability of selection in cases of households using both landline and cell phones. Although all three surveys are nationally representative, the sample for the 2003 survey was largely clustered in 60 representative communities, while the 2007 and 2010 surveys were based on a stratified random sample of the nation. Standard errors account for the complex sample design of the surveys. Questionnaire design, survey administration and the question wording of all measures in this study were similar across the three surveys.

Estimates of medical bill problems were based on the question, “During the past 12 months have you or your family had any problems paying medical bills?” This report takes the perspective that it is more appropriate to observe medical bill problems at the family level because decisions on major expenses and finances—including medical care—are usually made at the family level. This also implies that the negative effects of medical bill problems in the family will affect all family members, rather than just the individual(s) within the family who incurred the medical bills. For this reason, the response to the question on medical bill problems—asked only once per family—are applied to all persons in the family. The estimates reflect the percent of persons in families with medical bill problems.

This research was funded by the Robert Wood Johnson Foundation (RWJF). The HSC 2007 and 2010 Health Tracking Household Surveys and the HSC 2003 Community Tracking Study Household Survey used for the analysis also were funded by RWJF.

TRACKING REPORTS are published by the

Center for Studying Health System Change.

1100 1st Street, NE, 12th Floor

Washington, DC 20002

Tel: (202) 484-5261

Fax: (202) 863-1763

www.hschange.org