Community Report No. 7

March 2011

Ha T. Tu, Grace Anglin, Dori A. Cross, Laurie E. Felland, Joy M. Grossman, Lucy B. Stark

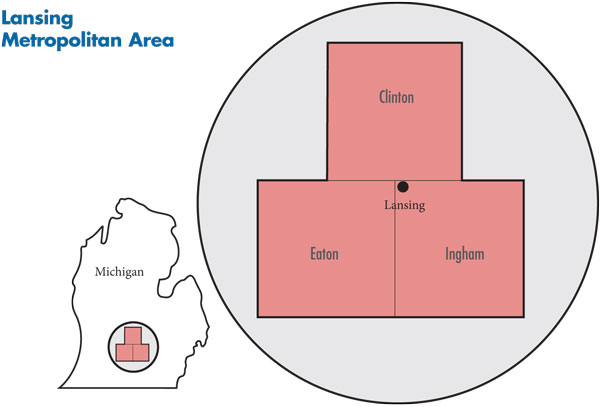

In August 2010, a team of researchers from the Center for Studying Health System Change (HSC), as part of the Community Tracking Study (CTS), visited the Lansing metropolitan area to study how health care is organized, financed and delivered in that community. Researchers interviewed more than 40 health care leaders, including representatives of major hospital systems, physician groups, insurers, employers, benefits consultants, community health centers, state and local health agencies, and others. The Lansing metropolitan area encompasses Clinton, Eaton and Ingham counties.

Located in geographically isolated mid-Michigan, the Lansing metropolitan area is a highly insular health care market, resistant to entry by outsiders. Most specialty referrals remain in the market, although some subspecialty care—such as transplants and complex cancer care—is sought outside the market, most often in Ann Arbor or Detroit. Lansing’s hospital sector continues to be highly concentrated, with two major systems, Sparrow Health System and Ingham Regional Medical Center (IRMC). While Sparrow has always been the larger system, IRMC has successfully pursued profitable specialty-service lines. In recent years, however, IRMC has faced financial difficulties and made cost-cutting moves that reportedly sparked discontent among some physicians, nurses and patients—causing some to leave IRMC for Sparrow.

Lansing’s health plan market is even more highly concentrated than the hospital sector, with Blue Cross Blue Shield of Michigan (BCBSM) increasing an already-commanding position in recent years. While that dominance has allowed BCBSM to keep provider payment rates relatively low, the plan has focused on, and largely succeeded in, keeping provider relationships—especially hospital contracting—non-adversarial.

Key developments include:

- Recession Less Severe than Elsewhere in Michigan

- Sparrow Gains Strength

- Uptick in Physician Consolidation

- BCBSM Draws Regulatory Scrutiny

- P4P Enhances Low Physician Payment Rates

- Weak Economy Pares Rich Benefits

- Safety Net Expands to Meet Demand

- Medicaid Growth Strains State Budget

- Anticipating Health Reform

- Issues to Track

- Background Data

Recession Less Severe than Elsewhere in Michigan

![]() reater Lansing (see map on page 2) is a relatively small metropolitan area of approximately 450,000 people. Lansing’s population—like that of Michigan—has declined slightly in recent years, in contrast to growth in metropolitan areas nationwide. On average, Lansing residents are less racially and ethnically diverse, have slightly lower incomes and have better health status than residents of other metropolitan areas.

reater Lansing (see map on page 2) is a relatively small metropolitan area of approximately 450,000 people. Lansing’s population—like that of Michigan—has declined slightly in recent years, in contrast to growth in metropolitan areas nationwide. On average, Lansing residents are less racially and ethnically diverse, have slightly lower incomes and have better health status than residents of other metropolitan areas.

Lansing’s position as the state capital has helped shield the community somewhat from the most severe effects of the recession. While Lansing’s economy was weakened, with unemployment increasing to levels slightly higher than the national average, respondents were quick to note that the community has fared significantly better than the rest of Michigan—a state extremely hard-hit by the recession. For example, statewide unemployment peaked at 14.9 percent in early 2010, compared to a peak of 11.7 percent in Lansing. Along with state government, which employs more than 14,000 people, another large employer that has helped buffer the local economy is Michigan State University (MSU), which employs roughly 11,000. With unions playing an important role in collective bargaining in both public and private sectors, health benefits in Lansing historically have been comprehensive.

The proportion of Lansing residents lacking health insurance has been low (9.1% in 2008). While Lansing’s uninsurance rate grew significantly as a result of the recession, it is still substantially lower than the average for large metropolitan areas (10.8% vs. 15.1% in 2009). Ingham County—where Lansing is located—has a relatively strong, stable and well-organized safety net anchored by the Ingham County Health Department (ICHD). Clinton and Eaton counties, which are more rural, have less-developed safety nets that refer many low-income patients to Ingham County.

Generally, Lansing’s main health care providers—with the important exception of IRMC, whose financial difficulties predated the 2007-09 recession—have fared reasonably well during the economic downturn, with neither patient volume decreasing nor uncompensated care increasing significantly.

Sparrow Gains Strength

![]() he Lansing hospital market has long been characterized by vigorous competition between Sparrow Health System and Ingham Regional Medical Center, despite the size disparity between the two systems. Sparrow’s main hospital, at 676 beds, has more than twice the licensed beds of IRMC’s main hospital, and Sparrow accounts for more than 60 percent of hospital admissions, compared to IRMC’s 30-plus percent.

he Lansing hospital market has long been characterized by vigorous competition between Sparrow Health System and Ingham Regional Medical Center, despite the size disparity between the two systems. Sparrow’s main hospital, at 676 beds, has more than twice the licensed beds of IRMC’s main hospital, and Sparrow accounts for more than 60 percent of hospital admissions, compared to IRMC’s 30-plus percent.

IRMC has been a more substantial competitor than its relative size would suggest because of a longstanding focus on certain profitable specialty-service lines—notably orthopedic surgery and cardiology. In the past few years, Sparrow has continued to compete vigorously with IRMC for these lucrative services and has become the go-to place for other key services. For example, Sparrow was described by several respondents as the only provider of obstetric and pediatric care in the Lansing market, even though IRMC still offers these services and continues to staff and recruit for these departments.

In addition to their main hospitals, Sparrow has a smaller specialty hospital and IRMC has an orthopedic hospital, all in Lansing. Both systems also maintain relationships with rural critical access hospitals in the tri-county area surrounding Lansing.

IRMC, owned by Flint, Mich.-based McLaren Health Corp., was widely reported to have struggled financially in recent years. Several respondents suggested that IRMC’s competitive position has been hampered by lack of support from its corporate parent, McLaren—which is viewed within the insular Lansing community as an outsider.

Despite the opening of a new heart center in 2007, some observers suggested that McLaren has not invested sufficient capital to upgrade IRMC’s physical plant. Also, corporate expectations about financial performance reportedly caused IRMC to adopt cost-cutting measures that may have helped stabilize finances but were unpopular with clinical staff and patients. For example, layoffs of physicians and nurses—including psychiatrists at IRMC’s highly regarded inpatient psychiatric consultation service—left some departments understaffed and contributed to the migration of clinicians and patients to Sparrow. In early 2010, rumors circulated that IRMC was up for sale, but McLaren publicly dismissed these rumors and announced that IRMC’s finances were improving.

In contrast to IRMC, Sparrow’s financial performance has improved substantially in recent years. A modest positive profit margin in 2007 and breakeven performance in 2008 were followed by more sizable margins in 2009 and 2010. Constraints on capacity in the first half of the last decade, combined with the need to replace and upgrade older facilities and the desire to expand market share, led Sparrow to increase inpatient and emergency department (ED) capacity. In 2008, Sparrow opened a new 10-story tower, with six built-out floors and a new ED that doubled the capacity of the old space. These capacity expansions, however, have been insufficient to handle Sparrow’s increased volume. And, Sparrow’s increasing dominance in recent years is exacerbating the system’s longstanding challenges of dealing with ED and inpatient capacity constraints and controlling lengths of stay.

Unlike IRMC, Sparrow continues to pursue a strategy of expanding into a larger eight- to 12-county market surrounding Lansing, by seeking affiliations with—or outright ownership of—hospitals and physician practices in outlying areas. Until now, greater Lansing has continued to be a closed hospital market, with Sparrow able to expand its dominance. However, some respondents suggested that Lansing might become a contested market in the relatively near future, as other, larger Michigan systems—such as Grand Rapids-based Spectrum Health and Ann Arbor-based University of Michigan Health System—pursue their own growth strategies. In particular, some observers speculated that Sparrow might find itself targeted by one of these large systems, which would likely find Sparrow a more attractive acquisition than IRMC.

Uptick in Physician Consolidation

![]() ansing’s physician market has a handful of moderately large groups amid many smaller practices. In recent years, the larger practices have grown somewhat, mostly by acquiring previously independent small practices or recruiting individual physicians. The larger groups tend to be amalgamations of smaller practices that leverage economies on such dimensions as shared office space, administrative support and electronic medical records (EMRs). In many cases, these larger groups are attempting to integrate more fully but have yet to attain a high degree of either clinical or financial integration.

ansing’s physician market has a handful of moderately large groups amid many smaller practices. In recent years, the larger practices have grown somewhat, mostly by acquiring previously independent small practices or recruiting individual physicians. The larger groups tend to be amalgamations of smaller practices that leverage economies on such dimensions as shared office space, administrative support and electronic medical records (EMRs). In many cases, these larger groups are attempting to integrate more fully but have yet to attain a high degree of either clinical or financial integration.

IRMC’s relationships with physicians were declining, while Sparrow’s appeared to be improving—at least in comparison to IRMC’s problems, according to market observers. Sparrow, which was already expanding physician employment before passage of federal health reform, reportedly has stepped up employment in anticipation of the formation of accountable care organizations (ACOs). Sparrow has been ramping up specialist employment in particular, as the system perceived its total number of employed primary care physicians to be sufficient. Approximately 130 physicians are now employed by the system through the Sparrow Medical Group (SMG)—up from an estimated 80-90 in 2007.

Early in 2010, Sparrow scored a coup in acquiring Thoracic Cardiovascular Institute (TCI), which had been the largest independent specialty practice in the market and historically had a close affiliation with IRMC. Although the full impact on Sparrow’s market share and bottom line was not expected to be felt for several more years, respondents generally viewed this development as a market changer in that other specialty groups—to the extent that they viewed the acquisition as a success—may become more willing to consider acquisition by a hospital, especially Sparrow.

IRMC, which reportedly laid off some physicians over the last three years and employed substantially fewer physicians than Sparrow as of 2010, reacted to TCI’s defection with aggressive acquisitions of its own. By the beginning of 2011, the system had acquired three small cardiology practices from Lansing and outlying areas, boosting its staff of employed cardiologists to 15—still smaller than TCI’s 26, but an important signal to the market that IRMC was not prepared to cede one of its longstanding strengths and profitable service lines to Sparrow.

Competition between Sparrow and IRMC over physician practices is likely to heat up, as more physicians consider hospital employment. Respondents indicated that discussions were already underway between hospitals and some larger practices—and in more high-revenue specialties—about future relationships. While independent physicians appeared to face some financial pressures to align with a system, most reportedly were ambivalent about giving up autonomy and clinical control.

One of Lansing’s large practices, the MSU Health Team—the faculty practice for MSU’s two medical schools—one allopathic, the other osteopathic—occupies an important niche in the market. The practice employs about 200 faculty physicians and mid-level clinicians and reportedly intends to grow by another 50 percent in the next five years. The MSU Health Team provides significant amounts of care in specialty pediatrics, radiology, neurology and surgery and serves a safety net role in caring for Medicaid and uninsured patients. Because MSU has no academic medical center, both medical schools maintain residency programs at each hospital system, with the allopathic program more closely aligned with Sparrow, while the osteopathic program has tighter alignment with IRMC.

The hospitals and MSU have expressed interest in developing closer ties, formalized for the first time in agreements with both hospitals to help clarify and enhance affiliations around clinical practice, research and education, as well as joint recruitment of needed specialists. What this means practically has yet to play out, and these developments may be affected by the changing alignments among hospitals and other physician groups.

BCBSM Draws Regulatory Scrutiny

![]() here continues to be little competition in Lansing’s health plan market, with BCBSM holding a commercial market share of about 70 percent. Combined with its health maintenance organization (HMO) subsidiary, Blue Care Network (BCN), the Blue plan’s market share hovers at about 80 percent.

here continues to be little competition in Lansing’s health plan market, with BCBSM holding a commercial market share of about 70 percent. Combined with its health maintenance organization (HMO) subsidiary, Blue Care Network (BCN), the Blue plan’s market share hovers at about 80 percent.

Competition, already weak, declined as a result of the attempted BCN acquisition of Physicians Health Plan of Mid-Michigan (PHP), a local HMO owned by Sparrow. Although the sale ultimately fell through in March 2010 because of state and federal antitrust objections, uncertainty during the months of the proposed acquisition weakened PHP’s competitive position and eroded its market share.

In expectation of the takeover, many of PHP’s longstanding employer accounts—including its largest account, MSU—dropped the plan. As a result, PHP’s commercial market share reportedly declined from 15 percent to 8 percent, with nearly all the lost enrollment going to BCBSM or BCN, further consolidating the Blue plan’s dominant market position. McLaren Health Plan, owned by the same parent company as IRMC, raised expectations for increased competition when it entered the Lansing commercial market in 2007 but has managed to gain “just a sliver” of market share since then.

For several years, Grand Rapids-based Priority Health—seeking to build a statewide provider network—has tried without success to enter the Lansing health plan market. A nonprofit HMO owned by Spectrum Health, Priority Health is regarded by some market observers as more innovative in product design and care management and more aggressive in pricing than many plans in Michigan. As a result, many observers have looked forward to Priority Health boosting plan competition by establishing a Lansing presence. However, the plan’s efforts to enter the market continued to be stymied by its inability to reach a network agreement with Sparrow.

Because of its ownership of PHP, Sparrow reportedly was reluctant to contract with a competing health plan seeking to enter the market. During the proposed sale of PHP to BCN, Sparrow reportedly agreed to negotiate with Priority Health once it divested itself of PHP. With that transaction ultimately falling through, however, one observer noted that “the status quo hasn’t changed. [Priority Health] still is making no headway getting Sparrow into their network. and you can’t offer a viable product if Sparrow doesn’t participate.”

Large, for-profit national health plans have a modest—and, in some cases, declining—presence in Lansing and in Michigan. By late 2010, Aetna had exited the small-group market and Humana had exited the group market for 100 lives or more—both citing the inability to negotiate competitive discounts with providers as a key factor. In addition to the fact that hospitals do not give national plans the same discounts given to BCBSM or to provider-sponsored local plans, respondents noted that the largest Lansing employers—all headquartered locally or within the state—prefer to do business with BCBSM. This stands in contrast to markets where the largest employers have regional or national operations and prefer to deal with national health plans.

While BCBSM is able to obtain discounts that some respondents estimated are at least 20 percent lower than those received by national plans, both of Lansing’s hospital systems have some negotiating power, even with BCBSM, because both systems are widely considered must-have providers for plan networks. A hospital executive characterized the negotiating environment with BCBSM as “fair, non-adversarial,” and a market observer noted “the deep and abiding truce” between the Blue plan and the hospitals. Since 2003, when BCBSM and Sparrow engaged in a contentious, much-publicized contract showdown, relations between the health plan and the hospital systems have improved steadily.

The process used by BCBSM for contracting with hospitals in Michigan is an unusual one: A standard contract is first negotiated with the state hospital association; then individual contracts are negotiated with each hospital. Under the standard contract, hospitals receive periodic prepayments for their services, with reconciliation occurring annually. The prepayments are used as at least partial justification for the discounts. While the contracts have features limiting hospital profits, they also are designed to cover hospital financial needs, such as a portion of bad debt and charity care. Statewide, a typical recent hospital rate increase from BCBSM was reportedly 2 percent to 3 percent per year—smaller increases from a lower base than what other plans are able to negotiate with hospitals.

In October 2010, the U.S. Department of Justice (DOJ) and the Michigan attorney general filed an antitrust lawsuit against BCBSM, alleging the company’s hospital contracting practices discouraged competition. Reportedly, the scrutiny of the BCN-PHP merger helped provide information that federal and state authorities needed to pursue this case. The lawsuit focuses on the “most-favored nation” (MFN) clauses that started appearing in BCBSM contracts with hospitals in 2007, when BCBSM began seeking MFN stipulations in exchange for agreeing to rate increases higher than the statewide average of 2 percent to 3 percent. Two kinds of MFN clauses appear in contracts: an “equal-to MFN,” which requires a hospital to charge other commercial insurers at least as much as it charges BCBSM; and an “MFN-plus,” which requires the hospital to charge other commercial insurers more than it charges BCBSM.

In the Lansing market, BCBSM has an MFN-plus contract with Sparrow, requiring the latter to charge other commercial insurers at least 12.5 percent more than it charges BCBSM. In return, BCBSM raised its rates to Sparrow by $5 million a year compared to the standard contract with similar hospitals, according to the lawsuit. BCBSM has equal-to-MFN contracts with the Lansing market’s three critical access hospitals—Eaton Rapids Medical Center, Hayes Green Beach Memorial Hospital and Sparrow Clinton Hospital. IRMC and its parent company, McLaren, are not mentioned in the lawsuit as having any MFN agreements with BCBSM.

While most-favored-nation agreements are not illegal per se under federal law, the lawsuit detailed DOJ’s view that the use of MFNs by a dominant insurer, such as BCBSM, has the impact of raising hospital prices, in turn increasing barriers to health plan entry and competition, and harming consumers. These views, while supported by some market observers, were not universally held. Others suggested that BCBSM has been able to keep hospital rates relatively low and questioned whether a more fragmented and vigorously competitive health plan market would result in lower hospital rates, given the high degree of hospital consolidation. BCBSM, contending that the suit failed to prove that its MFNs resulted in economic harm to consumers, asked a federal court in December 2010 to dismiss the case, which is still pending.

P4P Enhances Low Physician Payment Rates

![]() n contrast to hospitals, which exercise some leverage in health plan negotiations, Lansing physicians—even in larger practices—reported having to accept “take-it or leave-it” contracts from BCBSM. Larger physician groups reportedly can obtain more favorable rates from national health plans, but those contracts represent a small share of practice revenues. Physician commercial payment rates were reported to be 110 percent to 115 percent of Medicare, with relatively static annual rate increases of 1 percent to 2 percent allowing practices to keep pace with cost trends only by pursuing greater efficiencies.

n contrast to hospitals, which exercise some leverage in health plan negotiations, Lansing physicians—even in larger practices—reported having to accept “take-it or leave-it” contracts from BCBSM. Larger physician groups reportedly can obtain more favorable rates from national health plans, but those contracts represent a small share of practice revenues. Physician commercial payment rates were reported to be 110 percent to 115 percent of Medicare, with relatively static annual rate increases of 1 percent to 2 percent allowing practices to keep pace with cost trends only by pursuing greater efficiencies.

While there is physician discontent with payment rates overall, BCBSM’s statewide pay-for-performance (P4P) program, the Physician Group Incentive Program (PGIP), appears to have gained broad-based physician support. Introduced in 2005 and subsequently expanded, PGIP is widely regarded as an important means for physician practices to supplement relatively low base reimbursement rates.

The program has one component rewarding physicians for achieving quality and cost/utilization benchmarks and another component providing additional rewards to physician groups designated as patient-centered medical homes (PCMHs). Most of the larger physician groups in Lansing had either achieved PCMH designation or were working toward it. But practices noted the intensive effort required to document PCMH adherence, particularly in practices lacking sophisticated health information technology (HIT) tools. Practices not yet designated as medical homes can still receive payments for making certain investments in PCMH infrastructure—for example, after-hours care and patient registries to identify and track patients with chronic conditions.

PGIP’s financial incentives—totaling $80 million statewide for the year beginning July 2010 and financed by a 3.7 percent withhold on physician fees—appear sizable enough to motivate practice changes, although these changes have been mostly process oriented to date. It is widely expected that PGIP rewards will come to constitute an increasing share of physician reimbursement over time. PGIP activities, along with federal stimulus HIT incentives and expectation of federal payment reform, have accelerated physician adoption of HIT. This stands in contrast to hospital adoption of inpatient electronic medical records, which continues to lag.

Weak Economy Pares Rich Benefits

![]() espite the weak economy, health benefits continue to be comprehensive in Lansing compared to other markets, in part reflecting the strong influence of unions in both public and private sectors. Market observers noted that, historically, employers with non-unionized workforces have looked to the benefits provided by the three largest employers—the state of Michigan, Michigan State University and General Motors—as benchmarks for their own coverage.

espite the weak economy, health benefits continue to be comprehensive in Lansing compared to other markets, in part reflecting the strong influence of unions in both public and private sectors. Market observers noted that, historically, employers with non-unionized workforces have looked to the benefits provided by the three largest employers—the state of Michigan, Michigan State University and General Motors—as benchmarks for their own coverage.

Until recently, it was common for large employers to pay the entire premium and require minimal out-of-pocket cost sharing for care. Only recently have large public employers, including the state of Michigan and the city of Lansing, started requiring employees to make modest premium contributions—for example, 5 percent—and adopting benefit cost-sharing designs already prevalent in other markets, such as three-tier prescription drug plans.

While small employers have increased premium contributions and out-of-pocket cost sharing more than large employers, their benefits also continue to be more generous than in many other markets. Consumer-driven health plans (CDHPs)—which include larger deductibles and typically are paired with a health savings account or health reimbursement arrangement—have grown in popularity among small employers because they offer substantially lower premiums than traditional products.

However, employers switching to CDHPs often implement wraparound arrangements to reimburse employees for out-of-pocket spending within the deductible portion of coverage. Respondents observed that many employers in this market purchase CDHPs not to promote consumerism or cost-consciousness but simply to obtain lower premiums. Health plans were struggling with the employer practice of wrapping CDHP deductibles, noting that the CDHP premiums had been priced under the assumption that enrollees would be exposed to the full deductible, motivating them to consider value in seeking care. Similar to health plans in some other markets, BCBSM has introduced tiered pricing for its CDHP products, reserving the lowest-priced products for employers willing to sign affidavits stating that wraparound arrangements will not be used.

Safety Net Expands to Meet Demand

![]() ngham County’s historically strong, stable and well-organized safety net has expanded in an effort to keep pace with growing demand for free or discounted health services as a result of the poor economy and the loss of employer-sponsored coverage. Safety net respondents noted particular growth in demand from middle-class patients—for example, in East Lansing, once a fairly affluent area—and patients seeking treatment for behavioral health issues. However, while safety net demand has grown because of the economy, safety net providers reported feeling fortunate that the Lansing community has not suffered nearly as severe an economic downturn as the rest of Michigan.

ngham County’s historically strong, stable and well-organized safety net has expanded in an effort to keep pace with growing demand for free or discounted health services as a result of the poor economy and the loss of employer-sponsored coverage. Safety net respondents noted particular growth in demand from middle-class patients—for example, in East Lansing, once a fairly affluent area—and patients seeking treatment for behavioral health issues. However, while safety net demand has grown because of the economy, safety net providers reported feeling fortunate that the Lansing community has not suffered nearly as severe an economic downturn as the rest of Michigan.

The Ingham County Health Department fulfills the traditional public health functions of a county health department and serves as the major hub of safety net health services, most notably by providing primary care directly to low-income people and by partnering with the Ingham Health Plan (IHP). With seven clinics providing 83,000 patient visits annually, ICHD is Lansing’s largest primary care provider for low-income people. ICHD’s already-vital safety net role grew during the recession, as funding from the American Recovery and Reinvestment Act (ARRA) enabled ICHD to expand capacity. Previously a federally qualified health center (FQHC) look-alike—eligible for enhanced Medicaid payment rates but not federal grant funding—ICHD received full FQHC status for four of its seven clinics in 2009. Federal grants totaling $1.3 million enabled ICHD to hire more than 20 additional staff and extend clinic hours, although its physical capacity was not expanded.

In addition to ICHD, Lansing is served by two non-FQHC clinics: Care Free Medical and Dental Clinic on the southern end of Lansing and the Cristo Rey Family Health Clinic on the north side. Care Free, started by a retired physician in 2004 with a paid and volunteer staff, has more than doubled its capacity over the last few years and provides 12,000 medical visits annually (plus behavioral health visits). It provides comprehensive primary care and limited specialty care and has added dental care, optometry, behavioral health and substance abuse capacity over the last three years. Cristo Rey has a mix of paid and volunteer physicians and provides 11,000 visits annually, with the Hispanic population accounting for 40 percent of its patient base. The clinic offers comprehensive primary care and behavioral health services but not dental, optometry or medical specialty services.

Financially, these safety net providers have weathered the recession quite well and, indeed, are faring better than they were three years ago. In addition to ARRA grants, ICHD received an infusion of state dollars, enabling its two school-based clinics to remain open. The non-FQHC clinics have both gained more solid financial footing in the past few years, with public and private grants allowing Care Free to more than double its cash reserves and Cristo Rey to halve its usual deficit. Care Free also introduced modest, income-based patient cost sharing.

Although neither Care Free nor Cristo Rey is pursuing FQHC status, both clinics are working with ICHD on a potential affiliation that—if approved by the federal government—would allow them to obtain the same enhanced Medicaid reimbursement received by full FQHCs and FQHC look-alikes. While respondents agreed that these providers fared well during the recession overall, they also expressed concern about ICHD’s ability to maintain its expanded capacity once ARRA funding expires, as well as the state’s ability to preserve clinic funding, given severe budget deficits. Also, private funding may be on the decline; a recent media report indicates that Care Free’s grant funding and donations have dropped.

Hospital safety net responsibilities are shared by Sparrow and IRMC in proportions roughly equivalent to their market shares. IRMC historically has been considered the more proactive hospital in addressing the needs of low-income residents, but Sparrow has stepped up its role in recent years by expanding services and assisting community clinics. For example, Sparrow raised income eligibility for charity care to 250 percent of the federal poverty level ($55,125 for a family of four in 2010), is placing family practice residents at the Care Free clinic one day a week, and recently adopted a new compensation model that removes financial disincentives for its employed physicians to treat Medicaid or uninsured patients. Hospital uncompensated care has increased over the past few years but not to such an extent as to be cited by respondents as a major pressure on hospitals.

The Ingham Health Plan continues to be the key community initiative to improve access to care for uninsured people. Created in 1998, versions of IHP (referred to generally as “county plans”) have been replicated across most Michigan counties as a way to provide affordable outpatient care to enrollees and potentially reduce the need for ED or other costly hospital services. IHP’s eligibility requirements have remained relatively generous (up to 250% of poverty). Although demand for IHP enrollment increased as the economy soured, the number of IHP enrollees actually has declined over the last three years because of state and local budget constraints. Growing deficits have led the program to initiate an “active redetermination” process in lieu of cutting benefits or provider reimbursement. Enrollees who had not used the program in two years were removed, and all other enrollees must now provide annual proof of eligibility. Despite these restrictions trimming membership from 16,000 to 12,000 over the last three years, almost 40 percent of Lansing’s estimated uninsured population is now covered by IHP.

Most of IHP’s funding comes from Medicaid disproportionate share hospital (DSH) funds through Sparrow and IRMC—which are not reimbursed for treating IHP enrollees. Hospitals’ participation in the program is based on the expectation that providing affordable outpatient care to IHP enrollees would lead to lower ED use. However, reducing enrollees’ reliance on EDs has been a challenge, despite program staff working with enrollees to establish primary care relationships and educate them on where best to seek care depending on their condition. In a more recent effort to curb ED use more directly, ED staff notifies IHP about enrollees who have used the ED within the past day. IHP case managers then follow up with those enrollees to help direct them to providers and services more appropriate for their needs.

Medicaid Growth Strains State Budget

![]() ichigan’s Medicaid enrollment has grown substantially over the last few years as a result of the poor economy. In Lansing, enrollment increased to a total of 72,000 people in 2010—an increase of 23 percent since 2007. This growth occurred despite the lack of state outreach or particular improvements in enrollment processes. In fact, challenges implementing two new data systems adopted by the state in 2008 and 2009 have made Medicaid enrollment more difficult, by delaying processing of applications and assigning enrollees to the wrong health plans, among other reported problems.

ichigan’s Medicaid enrollment has grown substantially over the last few years as a result of the poor economy. In Lansing, enrollment increased to a total of 72,000 people in 2010—an increase of 23 percent since 2007. This growth occurred despite the lack of state outreach or particular improvements in enrollment processes. In fact, challenges implementing two new data systems adopted by the state in 2008 and 2009 have made Medicaid enrollment more difficult, by delaying processing of applications and assigning enrollees to the wrong health plans, among other reported problems.

Michigan’s public insurance programs have eligibility levels that rank as middle-of-the-road in generosity compared to other states’ programs. Children with family incomes up to 150 percent of poverty are eligible for Medicaid (Healthy Kids), while those up to 200 percent of poverty qualify for the children’s health insurance program (CHIP), known as MI Child. Working parents with incomes up to 64 percent of poverty and pregnant women with incomes up to 185 percent of poverty are eligible for Medicaid. Despite severe state budget pressures over the last three years, eligibility levels have remained unchanged—which respondents attributed to former Gov. Jennifer Granholm’s protectiveness of these programs, as well as the federal stipulation that states must maintain Medicaid eligibility levels to receive stimulus funding.

While protecting eligibility, Michigan has sought Medicaid savings through elimination of optional benefits. Among the optional Medicaid benefits cut by the state in 2009 were adult dental care (and part of children’s dental care), hearing aids, vision, podiatry and chiropractic services. In October 2010, Granholm signed a fiscal year 2011 budget restoring dental, podiatry and vision services. Newly elected Gov. Rick Snyder’s proposed fiscal year 2012 budget would maintain Medicaid eligibility and optional benefits. While the proposal maintains Medicaid provider payment rates, it does recommend a reduction in state support for graduate medical education.

In 2009, Michigan reduced Medicaid reimbursement rates to providers across the board. The state’s Medicaid rates, already below the national average a few years ago, likely rank even lower since the cuts. Physicians and non-FQHC clinics are bearing the brunt of these cuts, as the hospital rate reductions reportedly are largely offset by an increase in the hospital tax, which draws down federal matching dollars and then is redistributed among hospitals based on their proportions of Medicaid revenue. Respondents indicated the cuts have decreased access to care by reducing the willingness of physicians in private practice to accept Medicaid patients.

Two-thirds of Medicaid enrollees in Michigan are in managed care, which is mandated for most groups, including aged, blind and disabled people and (since 2008) pregnant women. Dual eligibles—low-income seniors and younger people with disabilities enrolled in both Medicare and Medicaid—and children with special health care needs remain excluded from managed care. However, the governor’s 2012 budget proposal calls for moving dual eligibles into managed care.

Since 2009, a new entrant into Lansing’s Medicaid managed care market—Health Plan of Michigan (HPM)—has been competing with the two longstanding, hospital-owned plans, PHP and McLaren. By mid-2010, HPM had captured 15 percent of the market, reportedly gaining favor with providers for not passing on the state’s rate cuts and with enrollees for retaining some optional services eliminated by other plans. The significant financial incentives offered by HPM to providers and enrollees for, respectively, providing and obtaining preventive services also have proved popular. However, maintaining benefit and payment levels in the face of declining state payments has taken a toll on HPM financially, reducing its net profit margin.

Anticipating Health Reform

![]() ichigan was an enthusiastic early supporter of national health reform under the Granholm administration, despite some concerns about the need for implementation resources, given the state’s dire budget situation. By the summer of 2010, the state had selected PHP to administer the new federally funded high-risk pool and was writing a planning grant to develop an insurance exchange. Whether, and to what extent, the state will change course under the new governor is not yet clear.

ichigan was an enthusiastic early supporter of national health reform under the Granholm administration, despite some concerns about the need for implementation resources, given the state’s dire budget situation. By the summer of 2010, the state had selected PHP to administer the new federally funded high-risk pool and was writing a planning grant to develop an insurance exchange. Whether, and to what extent, the state will change course under the new governor is not yet clear.

In Lansing, safety net providers did not appear to be taking proactive steps to prepare for reform. This is likely, in part, because uninsurance is already relatively low compared to many metro areas nationwide, and the Ingham Health Plan already has brought a significant portion of the uninsured into the delivery system and provides reimbursement to outpatient providers. Many IHP enrollees are expected to become eligible for Medicaid when eligibility is expanded in 2014 to all adults up to 138 percent of poverty.

Most respondents believed that the current supply of primary care physicians will be adequate to handle the newly insured, but others suggested that if demand expanded substantially, capacity might prove inadequate, especially if Medicaid rates were to remain at very low levels. ED capacity might be further strained in that event.

Most of Lansing’s large provider organizations were exploring how they might participate in ACOs in the future. The consensus among respondents was that ACOs strengthened incentives for both hospitals and physicians to have hospitals acquire physician practices.

In the commercial insurance sector, respondents suggested that modifying products to make them compliant with the health reform law would not be as challenging for Lansing and Michigan plans compared to many other markets. The state already requires modified community rating in the small-group market, and most insurance products offer comprehensive benefits and contain many features mandated by the law. Respondents observed that many employers in this benefit-rich market would feel the impact of the excise tax on high-cost plans, the so-called Cadillac tax, in 2018. BCBSM executives, who believed their organization is disadvantaged under current Michigan requirements to serve as an insurer of last resort, looked forward to a “leveling of the playing field” in the insurance exchange. However, some observers suggested that once that playing field has been leveled, the justification for BCBSM’s tax-advantaged status would be diminished.

Issues to Track

Background Data

| Lansing Demographics | ||

|---|---|---|

| Lansing Metropolitan Area | Metropolitan Areas 400,000+ Population | |

| Population, 20091 | 453,603# | |

| Population Growth, 5-Year, 2004-20092 | -0.7% | 5.5% |

| Age3 | ||

| Under 18 | 22.4% | 24.8% |

| 18-64 | 66.5% | 63.3% |

| 65+ | 11.1% | 11.9% |

| Education3 | ||

| High School or Higher | 92.6%* | 85.4% |

| Bachelor’s Degree or Higher | 30.6% | 31.0% |

| Race/Ethnicity4 | ||

| White | 81.3% | 59.9% |

| Black | 8.1% | 13.3% |

| Latino | 5.0% | 18.6% |

| Asian | 3.2% | 5.7% |

| Other Races or Multiple Races | 2.4% | 4.2% |

| Other3 | ||

| Limited/No English | 3.3% | 10.8% |

# Indicates a 12-site low. |

||

| Economic Indicators | ||

|---|---|---|

| Lansing Metropolitan Area | Metropolitan Areas 400,000+ Population | |

| Individual Income less than 200% of Federal Poverty Level1 | 31.3% | 26.3% |

| Household Income more than $50,0001 | 49.6% | 56.1% |

| Recipients of Income Assistance and/or Food Stamps1 | 11.5% | 7.7% |

| Persons Without Health Insurance1 | 9.1% | 14.9% |

| Unemployment Rate, 20082 | 6.7% | 5.7% |

| Unemployment Rate, 20093 | 10.8% | 9.2% |

| Unemployment Rate, August 20104 | 10.1% | 9.8% |

Sources: |

||

| Health Status1 | ||

|---|---|---|

| Lansing Metropolitan Area | Metropolitan Areas 400,000+ Population | |

| Chronic Conditions | ||

| Asthma | 12.4% | 13.4% |

| Diabetes | 6.4% | 8.2% |

| Angina or Coronary Heart Disease |

3.9% | 4.1% |

| Other | ||

| Overweight or Obese | 58.9% | 60.2% |

| Adult Smoker | 18.9% | 18.3% |

| Self-Reported Health Status Fair or Poor |

10.9% | 14.1% |

Note: Lansing metropolitan area estimates are for Ingham County only. |

||

| Health System Characteristics | ||

|---|---|---|

| Lansing Metropolitan Area |

Metropolitan Areas 400,000+ Population | |

| Hospitals1 | ||

| Staffed Hospital Beds per 1,000 Population | 2.2 | 2.5 |

| Average Length of Hospital Stay (Days) | 4.4# | 5.3 |

| Health Professional Supply | ||

| Physicians per 100,000 Population2 | 190 | 233 |

| Primary Care Physicians per 100,000 Poplulation2 | 90 | 83 |

| Specialist Physicians per 100,000 Population2 | 100# | 150 |

| Dentists per 100,000 Population2 | 58 | 62 |

Average monthly per-capita reimbursement for beneficiaries enrolled in fee-for-service Medicare3 |

$725 | $713 |

# Indicates a 12-site low.. Sources:1 American Hospital Association, 2008 2 Area Resource File, 2008 (includes nonfederal, patient care physicians) 3 HSC analysis of 2008 county per capita Medicare fee-for-service expenditures, Part A and Part B aged and disabled, weighted by enrollment and demographic and risk factors. See www.cms.gov/MedicareAdvtgSpecRateStats/05_FFS_Data.asp. |

||